Networks

Bitcoin & the Internet: A comparison.

Understanding why, let alone predicting where economic activity will congregate, is hard.

It’s hard because people are blinded by their biases, their egos get in the way and instead of focusing on what can be built on top (where the real opportunity is) they’re focusing on owning the network or layer.

But here’s a revelation for you:

What made the internet special is that the phone companies didn’t “own” it.

The reason AOL failed was that it was the complex, managed, corporate solution, with all the bells & whistles, that assumed what people wanted in this new “information superhighway”.

They learnt the hard way, that no amount of market data or corporate experience & foresight can predict what a new communication modality (for the commons) would become – because just as free markets always trump centrally governed ones; open networks are a requirement for free speech & that’s exactly where all the innovation goes.

Now; AoL wasn’t the worst of them.

At least they were trying to reimagine how this new communication network might function – and the things it may enable us to do.

The phone companies – they were the funny ones.

They controlled all form of non-face to face communication at that point, and their question about the internet was:

“How many phone calls will this internet thing do?”

(sound familiar???)

They assumed what the internet was going to be used for (ie; phone calls & video conferencing), based upon their current biases & problem sets. This is low level skeuomorphic thinking and design.

The internet on the other hand assumed NOTHING, and it won because it had the basic, robust, open, building blocks upon which all the innovation actually occurred.

The same thing will happen with Bitcoin (or if I steal a term from Andreas – The Internet of Money**)

Why?

Because strong, simple, stable foundations will always work best.

That’s just physics.

Ghandi said it best:

“First they ignore you, then they laugh at you, then they fight you, then you win”

And if we look at the internet; the story is no different:

1. The phone companies first dismissed it, because they measured it’s capability through the same lens via which they measured themselves (# of phone calls; quality of phone call).

2. When they saw it taking off; they asked “How do we buy this internet thing”

3. When they realized they couldn’t do that, they tried to replicate it, they built AoL

4. And then the internet won…and here we are – those phone companies have merely become on-ramps & off-ramps for the internet – something that’s larger than all of them combined.

They wanted to own it & have it dependent on them; but they’re now dependent on it.

All of their services now run on the internet. So not only did the internet win, but an entire infrastructure inversion took place!

And if that wasn’t enough – this inversion paved the way for new innovation & new opportunities. Opportunities the phone companies could not capitalize on, and as a result; opened the door for new, global giants to emerge.

Giants, who built on the internet.

I don’t know about you, but there’s an eerie similarity to Bitcoin (as a money & monetary network) and the current financial institutions.

And whilst I know it sounds far-fetched to think that today’s financial institutions will one day be on-ramps for Bitcoin; remember that 30yrs ago it was also completely insane to think that the phone companies would merely be connection points for the internet.

This is happening – right now.

Whilst the silly people are trying to reinvent the wheel, The smart people are building on Bitcoin.

The Dorsey’s, Stark’s, Lopp’s, Rochard’s of the world get it.

This is the future.

Instant, unstoppable routing of value. Not just information.

Inversion & Opportunity

This kind of inversion happens once in a lifetime.

It’s like getting on the ground floor of Amazon in 1995. Bitcoin is the opportunity that everyone is looking for – and whilst it’s staring us right in the face, we’re all running around yelling “blockchain”, trying to fit circles into squares.

What you can’t replicate about Bitcoin is that it’s an uncensorable, unstoppable monetary network, who’s growth compounds with every unit of value that’s stored on there.

Bitcoin’s long term future doesn’t lie in it just being a “speculative asset”, but lies in its network being used as the common fabric upon which value transfer occurs.

If you can anchor into that fabric, the same way as we do with the internet for information packets to be routed, then you can get all the benefits of a decentralized, immutable, secure financial network, without all the downsides, eg; slow speed (and longer term; volatility).

This will all happen in layers – and the layers are where all the commercial opportunity exists. Not in trying to build and “sell” a new version of bitcoin.

That might last for a while, and because nobody really understands anything in this space, people will let their greed get the better of them, and buy into pointless narratives to make the “next bitcoin” or the next pot of gold.

Good luck with that. Good luck with your information superhighway, that nobody is going to use, and that you’ll need to maintain.

We’re building on the living, breathing, autonomous network which started off worth nothing, and is today securely storing almost $100bn worth.

The lindy effect will only continue to compound here, and its self-reinforcing effect will only get stronger. The result is more capital held, which in turn strengthens not only the trust in the network, but the incentive for more validators to expend real world cost to maintain & verify this ledger – which in turn makes it more robust, more decentralized, more secure & more immutable – and so it continues.

I scratch my head & wonder why one would want to compete with that? These not so intelligent, short sighted & non-creative people are all wasting time trying to reinvent the wheel, while the smart ones are out there building the car. They’re putting the wheel to use.

It’s the story of the internet all over again.

Whilst AOL set out to rebuild the internet in their eyes, Google & Hotmail took those building blocks, recognised it was the most robust network to build on, then created useful applications which in turn made the internet more useful – and in the process, changed the world.

Today, we have a monetary network that has all the ingredients upon which we can build a secure, modern, digital financial infrastructure.

The smart people, the true visionaries know that; and are doing just that.

The deluded / greedy / and those with a veneer of an understanding, who’ve bought into an ideology or concepts they don’t understand will run around getting money from people for a while, but it’s a game that’s losing steam.

The future is being built here, on Bitcoin, with Lightning.

Blockchains & DLTs are hub caps applied in vain by those trying to make a faster carriage.

Bitcoin is the motor vehicle.

And although the motor vehicle was initially used by crooks, was slow & really hard to use on roads built for horses; it ultimately drove the transformation of society and transport was built around it.

I could pull similarities, metaphors & analogies all day – I think you get the point.

Network Fundamentals

Networks are another inherently non-intuitive area for humans to grasp. Throughout history, we’ve been extraordinarily poor at predicting the growth of networks; especially those which become a public commons, such as electricity, the telephone, the internet & now Bitcoin.

Here are some more ‘famous’ examples:

“When the Paris Exhibition [of 1878] closes, electric light will close with it and no more will be heard of it.” – Oxford professor; Erasmus Wilson

“The Americans have need of the telephone, but we do not. We have plenty of messenger boys.” – Sir William Preece, Chief Engineer, British Post Office, 1878.

And my favorite:

“The growth of the Internet will slow drastically, as the flaw in ‘Metcalfe’s law’ becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.” – Paul Krugman, winner of the Nobel Prize in Economics, wrote in 1998.

Why?

How do the so-called “experts” get it so wrong?

There’s a number of reasons; a lot to do with biases, and a big one to do with how we’ve evolved. I delve deeper into this in my 2019 article, Homo Sapiens, Evolution, Money and Bitcoin, although the cliff notes are as follows:

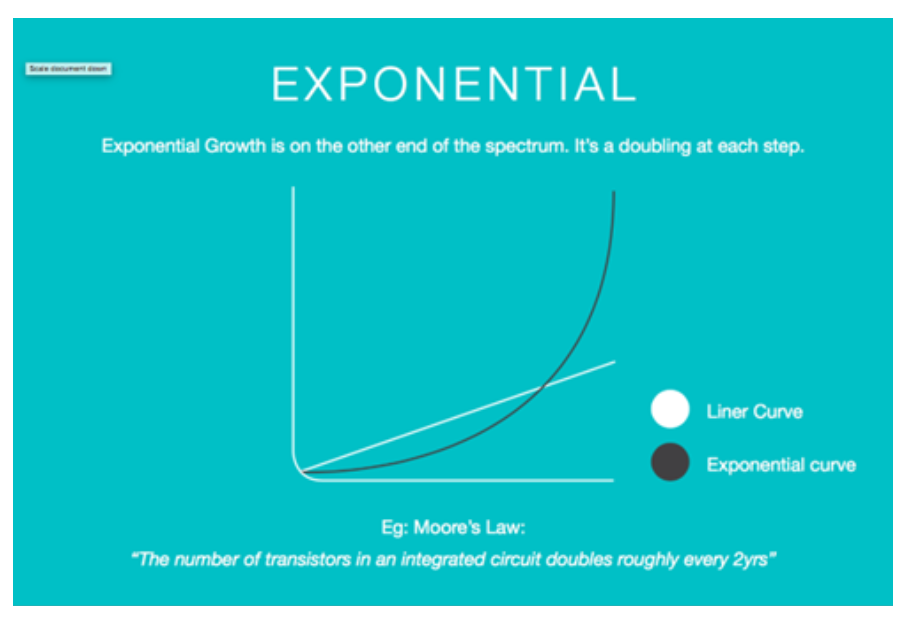

Humans evolved in a world defined by our more linear sensory perceptions.

Growing up in the Savanna; you had to know roughly how long it would take you to run x-distance in order to steal some food, protect your family or outrun a predator..

As a result, we’re great at estimating how far 30 linear steps will take us (roughly 30m).

30 exponential steps is a completely different story. That’s 1bn meters, which is a distance we can’t easily fathom – Peter Diamandis & Ray Kurzweil really popularized both this term, and the example.

When we encounter something that moves exponentially or via some network effect, we find it hard to make accurate, intuitive estimates. We generally project linearly, whether over or underestimating.

Note: network effects are similar in nature to exponential; just not as pronounced – the key takeaway is that in the early stages; their progress is imperceptible. Network growth seems to move slow as the initial base of connections is established. But..once it hits a critical mass (inflexion point); the momentum to continue is almost unstoppable; barring a catastrophic failure of the network itself.

This inflection point is probably not a “point”. It’s more like a period – and without hindsight; it’s impossible to measure and therefore forecast, but as a rule of thumb, or a heuristic; you could probably bet that it’s the point where people give up and think it’s not going to work (because of the lack of surface level results) that a functional network which has continued growing it’s node-base; takes off.

The graph above is not meant to be mathematically accurate, but designed to illustrate the following point:

– We overestimate in the short term (“Bitcoin will take over the world”)

– We underestimate in the long term (“Bitcoin is dead..it’s been 10yrs”)

Note: exponential & quadratic curves look similar in those earlier stages – but they are different.

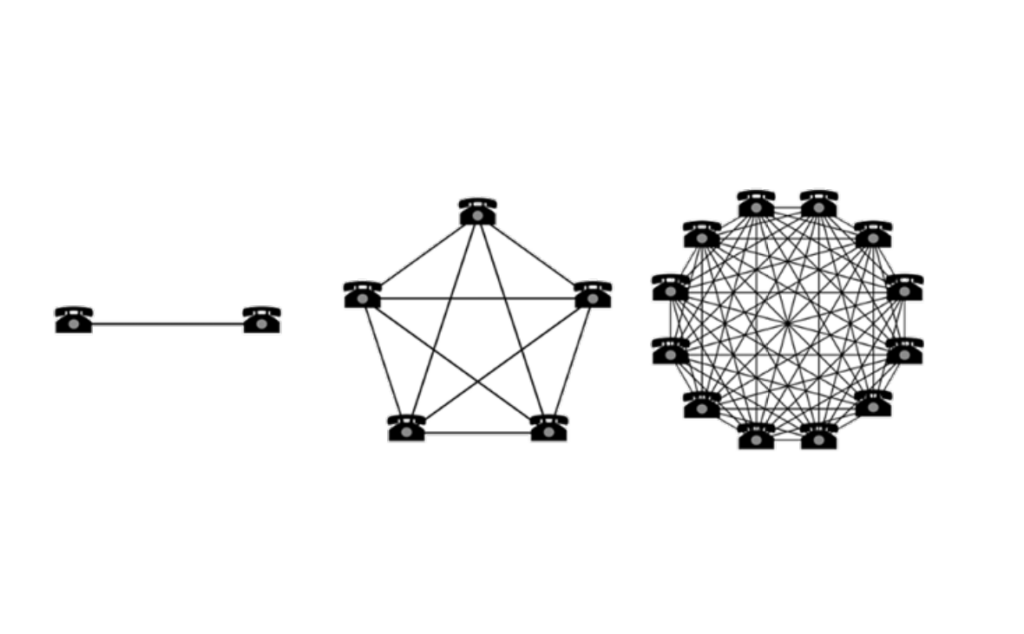

The following diagram and example will help you better understand how network (also known as quadratic growth) can really accelerate beyond a certain point:

Nodes & Connections

If we take the most basic quadratic formula, ie; x^2 – x, where ‘x’ is the number of nodes, and the result is the number of connections, you get the following:

1 node = No connections

2 nodes = 1 connection

10 = 90 connections

100 = 9,900

1,000 = 999,000

1,000,000 = 999,999,000,000

That’s a lot of connections – and by the time you get somewhere between 1000 – 10,000, it’s taken off.

Lightning has currently around 3500 visible nodes (as at 18th Feb, 2019), and likely the same amount (if not more) that are private.

Something to think about.

“Dumb VS Smart” Networks

There is another reason why the internet won out as the primary communications network, and not the private consortiums / networks like AOL or the telecommunications companies who dominated the communications infrastructure for 100yrs prior.

It’s because the base layer needs to be “dumb” – or in other words basic & robust for it to work best.

The internet was built on a few basic packet switching & routing protocols, which did what they did very simply but very well – and created the most robust communications network our species has ever seen.

As a result, it incentivised the rest of the world to build on top of it. Why?

Because when you have a solid, robust foundation, you can abstract any function & you can deliver services which can later interact & integrate with other services.

This cumulative effect is another function of how networks (such as the internet, and now bitcoin) accelerate, further entrench themselves and dominate.

All of the economic activity will go to where it can maximize its yield & the more complex and all-inclusive you try to make a foundational network (especially something as broad as communication or money), the less room there is for free market / open innovation, AND, the more of a threat there is from competing networks to develop something that’s more basic & robust that the COLLECTIVE can build on top of.

Blockchains are dead because they’re either useless or contain unnecessary complexity.

Their two major selling points; security & immutability are not some inherent, magical trait that emerges thanks to their technical architecture; or their segregation of data.

The only networks that have this are open, public, game theoretically sound networks such as bitcoin; and perhaps a few others, although bitcoin has a significant advantage – and in the game of networks, when you have the lead combined with the serendipitous beginnings, the stubborn minority, the most infrastructure & the best minds working on it; the probabilities of catching up, let alone keeping up; fall exponentially.

I posit that it’s too late to catch bitcoin. At least this century.

It’s time to double down on the bet & not wonder why you got left behind.

And for those of you who think “no bank is ever going to use bitcoin as a settlement layer”, just remember:

In the 90s, every bank was saying they would never do any form of banking on the internet.

Times change.

And you can either play catch up, or you can lead.

Investing in Networks

Another reason why Blockchain has and continues to fail is because its focus is on being a ‘proprietary technology’. There is no network effect in building private blockchains or “DLTs”.

That’s called incremental (or in a lot of cases; phantom) innovation. The real investment opportunity and innovation lies in the development of networks such as Airbnb, Uber, App Store, Facebook and the network which was the game changer for everyone; the Internet.

If you look at society you find that the substrate upon which everything is built is communication, information, language.

The first layer that sits on top of that is actually money.

Most people don’t appreciate the importance money plays in the evolution of our species & our ability to build this thing called society.

I’ll touch on Money briefly in a dedicated section later so that you appreciate its gravity.

For now; suffice it to say it’s fundamental to the operation of everything in society, and is core to our ability to cooperate & collaborate as humans (Homo-sapiens specifically).

Currently the only digital monetary medium that is anti fragile, robust & secure with a truly scarce unit of account is Bitcoin. Is that not a network worth investing in or building on top of?

If you want to be an investor that invests in incremental innovation that will just be taken over tomorrow, you’ll be continually looking for the next best thing. The alternative is to use the Peter Thiel / Reid Hoffman approach: look for networks that are gaining momentum, that have a dedicated, stubborn minority, which despite bad press, continue to grow – and you’ll find the 1% which change the world.

As Marc Andreesen said years ago; “Software is eating the world” – and it still is.

As an investor, you need to decide whether you want to be a part of the blockbuster world, or whether you want to be streaming in the new world.

Innovations that benefit from time and network growth only get stronger as more activity happens on them.

Email helped bring more activity to the internet, Lightning and simple multi-sig, time lock & “judge” smart contracts will help to further advance Bitcoin’s network effects.

The digital, “neo” banks are out there trying to put lipstick on a pig by making an old infrastructure more modern – and it’s difficult – it’s like trying to make a horse and carriage faster.

Messing around with legacy baking, whilst we have something like bitcoin is madness.

Bitcoin is the only secure global digital settlement network upon which real digital and neo banks can be built with far greater integrity, complexity and transparency – and the same way we didn’t know what sort of applications were going to emerge by liberating information and communication with the internet, so too we have no idea the magnitude of changes and innovations that will emerge when we liberate money and value exchange in a digital world.

No – this is not an overnight transformation, but make no mistake about it; the next Amazon, Google and Netflix’s of the world are being built right now – on the next great, public, global network: Bitcoin.