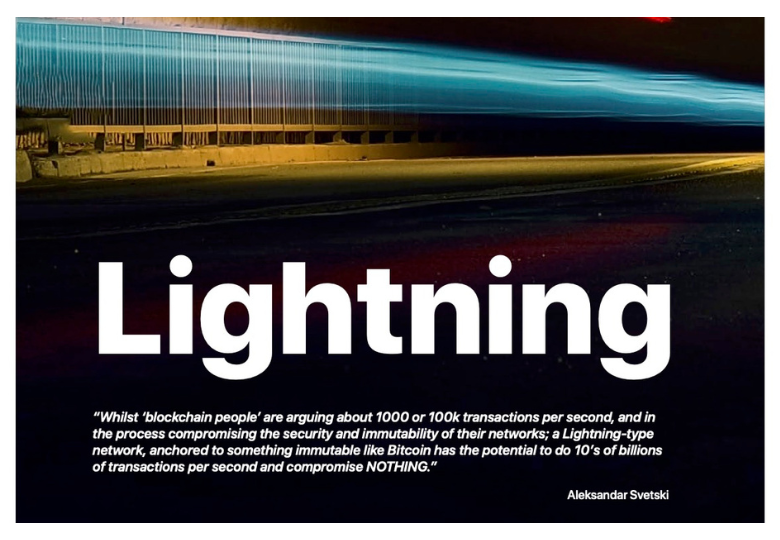

LIGHTNING

Whilst “blockchain people” are arguing about 1000 or 100k transactions per second, and in the process compromising the security & immutability of their networks; a Lightning-type network, anchored to something immutable like Bitcoin has the potential to do 10’s of billions of transactions per second and compromise NOTHING.

What is Lightning?

Giving it the explanation & time it deserves is out of the scope of this paper, but I’ll attempt to give you enough of an understanding to go further down the rabbit hole with.

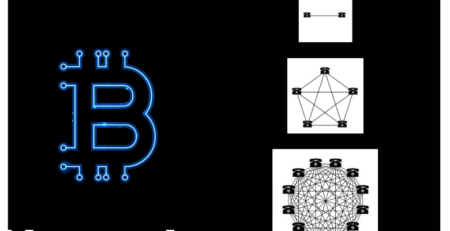

Imagine a network, where each of the participants are not only route ‘users’, but also route operators.

Where every participant becomes a node, that strengthens and broadens the network for not only themselves, but for everybody using it.

The best analogy I can think of is the internet (once again).

The internet really exploded, when we became not only ‘consumers of content’, but also creators and routers of this data & content.

Testament to this explosion is the company which arguably capitalized on this the most. Facebook is barely 15yrs old & is one of the largest in the world. It gave everyone a forum to consume, create & share content; in other words – everyone was a node that made Facebook more valuable (and not just in relation to its market cap).

What happens when you apply that same concept of read / write / route to money & payments?

In short – it changes the game.

Whilst not entirely accurate: Bitcoin is like the internet (one transformed information, the other money) and Lightning is a little like Facebook in that it makes money a content type that everyone can collectively participate in. Money has never had that kind of fluidity.

This is a high level of what Lightning represents.

BUT…

You might say: “Wait a minute. Not everyone can route money. They’re not a bank! How can we trust them”?

That’s where Bitcoin comes in.

Lightning is technically able to be applied or “anchored” onto other networks, but it’s maximum utility comes from doing so on a network that gives the highest guarantee of immutability.

That’s the entire point, and how we unlock Lightning’s potential.

If you can refer back to something that has prioritized security, stability, resistance to censorship & shutdown, then you can begin to really abstract & build financial complexity on top of it; without worrying about the potential of error, compromise, fraud or failure.

Bitcoin + Lightning is where the future is at.

Lightning enables:

1. Instant Payments: Because we’re not worrying about block confirmation times, payment speed is measured in milliseconds to seconds. It’s truly peer to peer, and as fast as data can move.

2. Scale: When all participants are also nodes, you don’t get the congestion we have in today’s archaic, centralized payment networks. You get true scale; capable of millions to billions of transactions per second across the network. This blows away any high-speed blockchain or any other legacy payment rails by many orders of magnitude.

3. Low Cost: Non custodial micro payments (eg: pay per action/click) are truly possible at fractions of a cent. This is the foundation for a set of use cases yet to emerge.

4. Security: By anchoring to a source of truth (aka; Bitcoin) with simple, robust “smart contracts” one can ensure the integrity of the second layer without recording transactions on chain (via a complex version of netting).

So how does this thing work?

Whilst it’s way outside the scope of this piece, the next section will give a high level explanation.

How does Lightning Work

Lightning is a second layer technology.

By using the native smart-contract scripting language of a network (such as Bitcoin) to anchor or connect to, it’s possible to create a secure second layer ‘network’ of participants who are able to process & route transactactions at high volume and high speed.

For example:

Bob and Alice decide they want to transact. Lots of times. Instead of bothering everyone on the core network and having every single validator on the core network have to record their transactions, they decide to open up what’s called a “payment channel”. Think of it like putting some money on your transaction account.

They can then transact between each other, back & forth, as much as they want – each time netting off against the prior transaction. After a certain period of aggregating these transactions, and updating the final net state; they could choose to close out the channel by broadcasting the final net result to the underlying network (eg: Bitcoin) and settle.

It’s important to note that this final, net entry can be closed out at any time by either party – without any trust or custodianship – by broadcasting the most recent version to the blockchain.

Closing a channel is also how the network deals with cases of attempted fraud or “bad acting”. The last valid, signed set of transactions between both parties wins – and there are some incentive / disincentive rules that help to to ensure it’s in everyone’s economic self-interest to do the right thing (ie; attempt to defraud the other user, but last signature shows otherwise, you lose the funds you committed to the channel).

This is all similar to how legal contracts function. One does not go to court every time a contract is made (that’s analogous to doing ‘everything on the blockchain’). Only in the event of non-cooperation is the court involved, and by making the transactions and scripts parsable and thus “anchoring” to the underlying network, these smart-contracts can be enforced and the result settled.

Lightning’s potential

A payment channel between two participants is just the beginning. It’s a building block for a larger network. In fact; the network only forms when numerous payment channels join to form a web. In this way, two participants who are not directly connected can transact with each other.

Let’s say Bob wants to pay Jim. He can still do it even if he doesn’t have a direct connection (payment channel) with him, but as long as Alice from earlier can connect them via a chain (ie; route).

The exciting part is that as the network grows, you won’t necessarily even need to set up a dedicated channel to send funds to a certain person. Instead, you will be able to send payment to someone using channels that you’re already connected with. The system will automatically find the shortest route.

By creating an entire network of these two-party ledger entries, it’s possible to find payment paths across the network similar to how packets are routed on the internet.

As all the pieces of the puzzle come together; one starts to see the magnitude of this innovation.

This is how everything else in nature works, along with the functional systems of cooperation we’ve built throughout the millennia.

You abstract the small, you settle when you need to – whether that be at closure, or on disagreement.

In fact, it’s a big part of how modern banking evolved (because it’s more efficient).

The difference (and beauty) with Bitcoin is that you can’t influence or manipulate it (remember: Immutability as a Service) so it will be the ultimate arbiter & settle as per the original rules.

It’s time to move to a new model where the arbiter / settlement function is digital and owned by the commons, not by the few.

The Future is on Lightning

What could the future hold?

Aside from the potential of doing billions of transactions per second (seeing as though speed is what everyone wants), and transforming payments & value transfer from things that happen at a time & place, to something that “streams” over time & space, perhaps something a little easier to imagine is the launch of a Bitcoin bank.

One where anyone, anywhere in the world could set up an account in seconds, and begin participating in global commerce.

Where all reserves are held & denominated in Bitcoin, on Bitcoin – and the organization can be held 100% accountable because it’s all transparent and able to be queried.

Could we open up the ability to lend, borrow, spend, save, trade & interact globally – without worrying about exchange rates, inflation & manipulation?

I don’t know. Maybe.

Or perhaps I’m thinking way too small. I don’t know.

What I do know is that the real innovation is yet to come – and those innovations (like Facebook and cat videos on the internet) will not be skeuomorphic. They will not be something we can predict or even imagine today. Myself & my team at Amber are making inroads in the new world, and we’ll continue to be at the cutting edge – but we are well & truly at the beginning – And all we can do is keep pushing the envelope.

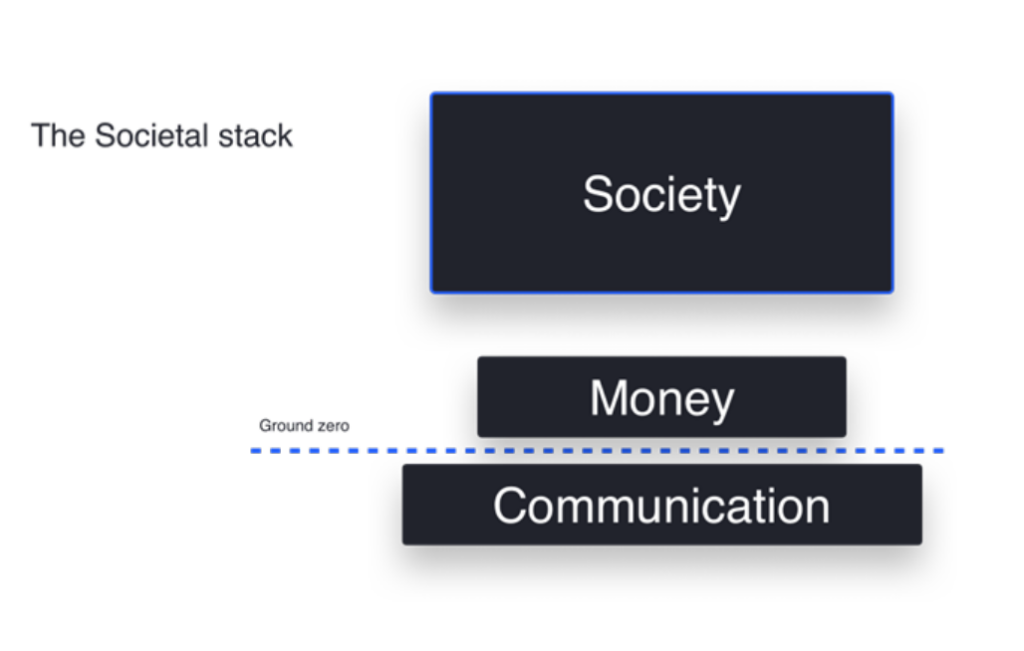

The Societal Stack

Nothing great was ever built on $#*& foundations – Aleks Svetski

To understand money & Bitcoin, we need to go back in time, and down the ‘societal stack’.

Understanding things from first principles helps us make more sense of the world around us.

As per the diagram above, you’ll note we have communication as the lower foundation, or the basis for everything. I like to call it the “Societal Substrate”.

The lower down the stack, the more rigid, fixed & robust it must be. This is the definition of a strong foundation.

Money as a mechanism via which we can exchange, specialize, measure, collaborate, cooperate & organize sits at the bottom, with communication. In fact, it may even be the most important form of communication because it does not express words, but value, resources and action.

Everything else, called “society”, then sits above it.

Humans, of the Homo Sapien kind, are the only species able to cooperate both flexibly & in large numbers

This unique ability has allowed us to build the complexity in society that we often take for granted today. It allows us to cooperate in numbers that exceed what’s called “Dunbar’s number”.

This ability has made us the apex species, and our most important technology is the one which enables value judgment and cooperation.

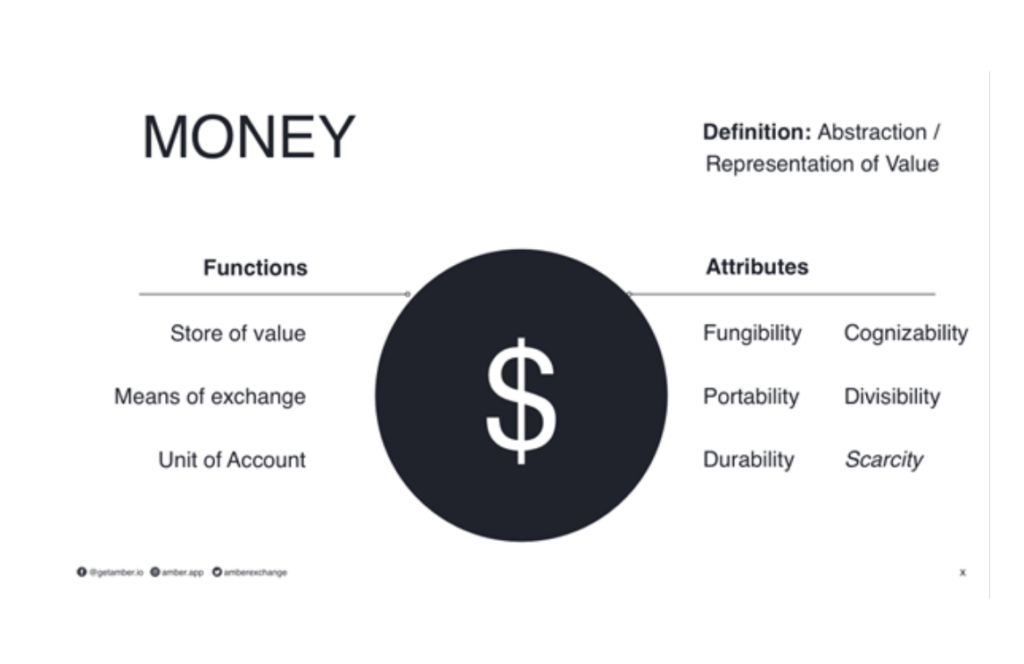

Money

Money is the ultimate tool of human cooperation, and it’s how we’ve created everything we see around us. When people tell me that it’s “just money”, they truly don’t get it.

Money is your labor, in measurable form. Without the ability to objectively & collectively agree on something to represent value, the entire world stops.

This is why we need to take any reinvention of money seriously, and it’s also why Bitcoin is such a big deal.

The internet transformed the way we communicate, making information and data natively digital. The current monetary infrastructure has not yet taken that step. It’s a digital veneer on an analogue system.

This transformation is going to happen – it’s no longer an if, but a when – and the best “stack” for a global monetary infrastructure is a digital one with a robust, secure foundation, where layers of abstraction and complexity can be built on top.

Remember:

You can’t build monuments on poor foundations.

Money is fundamental to the societal stack, and as a result it must be sound.

If you enjoyed this section and would like to learn more; the following articles I wrote in 2018 will help give you more context and a better understanding of how we’ve evolved, the role money played and Bitcoin’s potential place in society. You can find them on my personal blog on Medium.