Bitcoin

Bitcoin’s superpower: Immutability

Immutable = Resistant to Change.

To go ‘back in time’ and change one transaction on the Bitcoin Ledger, it would not only require you to accumulate enough [mining] equipment (capital cost), but also expend enough power to win the proof of work game & validate the blocks from that point forward to today.

This is not only financially insane, but almost physically impossible.

Why?

It’s the cost of validating transactions & maintaining the network of distributed but consistent ledgers that gives something like Bitcoin its immutability.

For someone to change something on this network in the past, it would cost billions.

In fact, it would require something like 3 trillion (with a “T”) modern, high-end laptops worth of computing power just to change ONE transaction on Bitcoin. That is the definition of immutable.

It’s this “Proof of Work” that brings the cost into Bitcoin and forms the basis of the game theory.

Proof of work is the bridge between the digital & the real world, and the sunk cost of capital and work done is what makes it immutable. People hear words like “cryptography” or “encryption” or “hashing” together with terms such as “blockchain” and mistakenly assume that it’s somehow got something to do with immutability. They also hear that “mining uses lots of electricity” and “is bad for the environment” from those with an ineptitude to math, probability or game theory, and by not understanding the broader recipe at work here; they think that they can discard “that expensive proof of work” part, and keep the nice, fluffy, inexpensive software [blockchain] part.

But as we’ve established; there’s a problem with that line of thought. If there is no cost to change something; then we’re back where we started, ie; taking someone’s word that this is the way it is, which as I stated works in 99.9% of cases, (ie; if you can’t trust your family member or co-worker; you’ve got bigger problems – putting it on a blockchain is not going to solve it), but NOT when you’re driving the narrative of immutability, sovereignty, or security.

So I’ll say it again.

Security & Immutability are functions of cost.

Proof of work is the part that looped it all together and helped us, for the first time in history; associate a real world cost to an ephemeral, fungible, digital object.

Furthermore; because proof of work is a compounding phenomenon; it only gets stronger & more immutable with time. This is at the core of why people say “Bitcoin is antifragile”. It benefits from the passage of time (lindy effect).

Bitcoin is the first time we’ve had a digital good that functions like something physical. And because it’s bound by math, it’s able to be verifiably scarce, whilst maintaining the scalability that only comes with something that is natively digital.

The Banana example

If I give you a banana in the real world; I no longer have it. If I “send” you a digital banana, all I did was copy it & we’ve now both got a record of it.

If I send you some Bitcoin, I no longer have it – just like the banana in real life; it’s now yours. I didn’t create a new one, I didn’t copy it; and I can’t reverse it, I can’t go back in time. The only way I can get it back is if you send it back – but that’s a new, totally separate transaction (forward in time).

Bitcoin is the first (and probably last) network of its kind that’s reached this status.

Why?

A big part of it was luck & timing.

Bitcoin got: “This is bullshit” for 5yrs, before anyone even took it partially seriously. For someone to catch up & replicate this level of infrastructure,they’ll need something like $100bn, and HOPE that nobody realizes what they’re doing and attempts to compete – because it will then cost each player more than $100bn. The result of all this would only reinforce Bitcoin’s importance and drive it’s value higher, and create this self-reinforcing feedback loop which asymptotically approaches a cost of infinite.

Bitcoin was a once-in-a-lifetime thing.

Proof of Work in Bitcoin is now significant, because it was historically insignificant. – Andreas Antonopolous.

People take it seriously now.

If you try to replicate this experiment again, you’ll be noticed, you’ll be attacked and by the time you’ve made any headway, Bitcoin will have progressed further.

Think about it. This network grew from $0 to $100bn’s worth of value stored on it; along with infrastructure built around it – with NO marketing budget. Tell me the last time something like that occured? The closest analogy is the internet; except this time “measurable value” is associated with the network; so it’s a little more contentious.

This also explains why all the others have had to raise non-dilutive capital rounds & sell the “fat protocol” thesis in order to make noise & get some attention. I guess everyone wants to “own” this; like the telcos wanted to own the internet. The reality is that public networks so far down the societal stack are owned by the collective; which is what gives them power. Time & volume of participants are on their side.

Every day that Bitcoin remains operational, it gets stronger, more secure, more immutable, more robust, more trusted & more valuable.

In fact, its Lindy effect seems to be accelerating – which is something we’ve not seen before.

For every day a competitor grows, Bitcoin grows by multiples (or magnitudes) more.

Network effects are runaway trains, and Bitcoin’s immutable proof of work network has taken off & will be practically impossible to catch up with.

This is why I believe trillions worth of economic activity will anchor to it. The same way as the internet was the most robust way to route information across the new digital world, Bitcoin is the most robust, global network upon which money can live; and via which it can be settled & routed*.

*should the value be large enough to justify routing directly on it.

Immutability as a Service

“Bitcoin provides immutability as a service”.

There are not many applications in the world that need immutability, and perhaps only a couple that need to build immutability as part of their core stack. It’s just too expensive!

Now…If we view immutability as a service – one that any application in the world can “anchor” or connect to, then we begin to reframe how we view Bitcoin, ie; as a broader network that settles transactions or states with value associated to them.

An example here will help.

There is NO reason (or very very little reason) that any company (tech or otherwise) today needs to buy, host & maintain its own server infrastructure. It’s costly and it makes up only a fraction of what matters in their actual business. So they use a cloud-based service such as AWS.

You’ll also note that because of the economies of scale; there are only three real options:

1. AWS

2. Azure

3. Google

Why? They got in early and they poured billions upon billions into it.

Immutability is similar (but also different).

Similar because the infrastructure required to make something truly digitally immutable is extraordinary (perhaps even more than all of the combined infrastructure that AMZN, MSFT & GOOG operate), and it only makes sense that people will anchor to it as & when they need to.

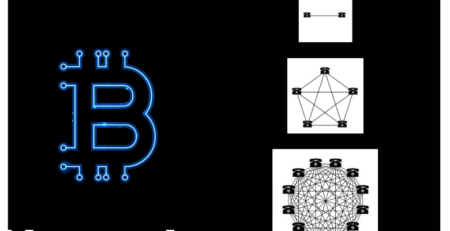

Different because it’s not something that can be run by one or a few parties. A concept like immutability (and things that inherently need it, ie; money) are only so if broadly owned. In other words; the more distributed & decentralized the architecture & higher the number the owners, validators & nodes, the more robust, costly & therefore immutable it is. Should one (or a few) entities manage all of it; it then undermines the value proposition & defeats the entire purpose.

The Immutable Network

Immutability as a service is what will bring more economic activity to the Bitcoin network in the long run, again; similar to the internet. The internet started off as a way to connect computers at a distance, and over time (as more people used & trusted it) it evolved into this new communication network that provides data / packet routing as a service. We built everything on top – and the innovation has been extraordinary.

The next step is baking monetary value into a protocol owned by the collective, who’s core tenet is absolute digital immutability. A network where you can’t turn back time (like in the real world).

All of the economic value from applications that require this feature, along with any broader monetary / banking / capital or financial applications that require an absolute guarantee of the following key functions:

– Send

– Store

– Receive

Will accrue on it.

And as I’ve stated ad-nauseum, the more economic activity that occurs on and on top of the Bitcoin network; the more immutable & secure it will become. It’s compounding, it is self reinforcing, it has already hit a critical mass, and it’s now a runaway train.

Other consensus mechanisms

There are, and there will continue to be lots of other consensus mechanisms created. Some that might work; most that definitely won’t.

They may be used on their own networks, for applications that are either private, proprietary; or for applications that don’t require an absolute guarantee of immutability & security.

I personally don’t believe any money-related or high value applications will run on their own networks (except in vain as this space evolves) because networks, especially those where the broad population participate; generally converge to unity.

It’s why we largely have one internet; one set of protocols for email; why we all use AC power; why, within a particular jurisdiction; the network of language converges to one, and similarly so with money (there is one USD in USA, likewise one AUD in AUS).

In fact – we see this as the world has become more “global”. English hit a critical mass, attained the primary network effect, particularly since the dawn of the digital age, and it’s now more useful to speak English in most places around the world.

Aside from converging to unity due to efficiency & practicality, the world can probably only sustain ONE absolute, immutable, uncensorable, secure proof of work chain – because it’s expensive!

This chain is likely (at this stage at least) to be Bitcoin.

a) If we had to run proof of work for everything; we’d destroy the planet (plus it assumes nobody trusts each other for anything, which is a bigger problem anyway), and

b) If someone wants to use it as a service; they’re going to go to the one that’s got the highest guarantee. That in itself will increase that network’s guarantee; leading to that self-reinforcing recursive effect I described earlier.

Furthermore; if you do have a novel, “light” consensus mechanism, that’s fast – you could in future anchor it to something like Bitcoin as and when you need to, to substantiate any claim or make a final judgment.

It’s this line of logic that leads me to believe most of the economic value will be swallowed up by the Bitcoin Network over the long term, not to mention the new concepts & innovations that will emerge using the ingredients of immutability & verification – like how facebook & instagram emerged from the internet.

Bitcoin is a new “Monetary Network”, not a “Payments Technology”

Bitcoin is the first time we’ve combined Money as a unit, with Money as a Network; into one thing. You can learn more about this here:

And because it’s so different, it’s hard to wrap our heads around it.

The problem is further compounded by the fact that nobody really understands money, but most people get payments (which is easy: move money), especially because it’s been handled digitally for the last 20 – 30yrs now.

To understand this better; we’ll need to understand Bitcoin’s real innovation, and in the process separate money from payments.

As we’ve established; Immutability is a derivative of COST. It’s this cost of validating transactions & maintaining the network of distributed but consistent ledgers that gives something like Bitcoin its immutability.

Bitcoin’s true innovation was an autonomous network that can establish the authenticity & validity of the state of the broadly distributed ledger.

The ONLY advantage of using this type of costly infrastructure is for actions that require a large degree of trust & assurance, those that should never fail and those that should not be easily reversed. There are a limited set of these, ie; every transaction / or state change that happens in the world does NOT need this.

The world works pretty fine right now.

Could we make it better by stamping a “net state” to something immutable once a week / once a month? Yes – definitely. But every transaction? No way. It’s just overkill.

Bitcoin is the most secure / immutable network that exists, NOT because of its “blockchain”, but because of its elaborate & expensive authentication mechanism. Your laptop has the ability to process hundreds of thousands of transactions a minute. That process is trivial. Payments are trivial.

Autonomous, distributed validation is the innovation. And this is where people go astray.

People don’t ‘get’ bitcoin because they perceive it as some form of payments technology, or some “blockchain” mechanism (they don’t really understand) for moving internet funny money (which they also don’t understand). That’s not what Bitcoin is.

Bitcoin is a complete reinvention of “money” – the world’s oldest social contract and society’s most fundamental layer. To understand its impact, you need to have a broad understanding of both Networks & Money. The problem is, most people don’t. In fact, nobody really understands what money is, because it’s not taught anywhere. Few can define it, whether they’re in banking, finance, technology, fintech, capital markets, and especially payments – so they apply their biases to it, and completely miss the point.

It’s like discussing the structure of the Egyptian pyramids with your pet goldfish.

The goldfish simply lacks context.

Money requires an understanding of our evolution as a species, anthropology, biology, social engineering, psychology, game theory & what I like to call; the societal stack. Discussing this is well outside the scope of this paper, but I’ll touch on an area which I hope will give you a reference point, the societal stack, in a subsequent section.

The complexity of Network dynamics doesn’t make the job of understanding Bitcoin any easier. I will touch on this further in a dedicated section – but suffice it to say networks are just as foreign to our intuitive understanding of the world as the pyramids are to the goldfish – the track record of the experts adds weight to this.

Back to payments VS money.

Bitcoin is not a “payments technology”. It’s fundamentally a reinvention of money. Like the motor vehicle was a reinvention of transport – not a better horse & cart. Same as the internet. It reinvented the fabric upon which we communicate. It reinvented the way information is transported. It did not push more, richer or smarter “data” through the phone networks infrastructure. It used that infrastructure as physical onramps; but the internet is not the hardware – it’s so much larger.

That’s why it swallowed them up & is the foundation upon which the majority of today’s society operates. And what’s more, the internet is only picking up speed. Bitcoin is where the internet was in the late 80s. Still largely misunderstood. People are still arguing about the speed of payments! They don’t realize that “Payments” as we know them today will completely transform. The same way we’re no longer talking about the quality of the phone call & number of phone calls this “internet thing” will support, we will see new conversations emerge for what can be done on Bitcoin.

The world is changing. The internet was only the beginning….Bitcoin is the next Chapter.