Bitcoin makes Austrian Economics possible

How the Keynesians won some battles but will ultimately lose the war.

Being neither Austrian nor an Austrian economist, one might question what qualifies me to write an essay in this particular edition of The Bitcoin Times.

Other than my obvious delusions of grandeur, I like to think I’ve been able to grasp the core ideas not because I’ve read some books, but by virtue of the experiences I have had as an entrepreneur and perhaps also my background in engineering.

Both domains are forms of real-world problem solving, involving feedback, risk, reward and can only lead to success when adapting or responding to said feedback.

One cannot ‘pretend their way into prosperity’ when dealing with profits, losses, customers, sales, COGS, materials, forces or factors of safety.

Of course, one could pretend, lie, cheat and either defraud their customers, cook the books or use cheap material substitutes in their entrepreneurial or engineering endeavors, but none of these methods lead to long term success.

In fact, such lying and fraud rarely lead to success in any field, but they curiously seem to be the pathway to the top in the realms of Central Banking, Keynesian Economics or Politics.

I also like to think that Bitcoin has been extremely obvious to me, because like Austrian Economics, it just makes sense. It seems evident that a functional society would have a Money that keeps accurate scores and that nobody can manipulate in order to gain an unfair advantage.

I don’t think any of this is due to some novel or extraordinary insight. I credit each to a life having consisted of contending with real challenges, in the real world. Nothing special.

The early years.

I’ve always been in business. My one job, as a 16 year old, was ‘pizza delivery boy’ for Dominos. I was fired within two weeks because I crashed the car twice. I have since not worked for anybody else, and the past 15 years of entrepreneurial experimentation have led both to significant successes and catastrophic failures, all for which I have earned the reward or borne the cost.

There were no bailouts. There were no handouts. There was simply feedback.

My experiences have led me to believe that the best way to learn, grow and develop as a human being in this world is to be allowed to act freely, and then bear the responsibility of one’s actions. If I had to reduce Austrian Economics to a core idea, that would be it.

“The study of free and responsible human action and its consequences.”

This viewpoint has thus led me to the simple belief that freedom of choice for the individual, coupled with local responsibility for the consequences of one’s actions, leads to better people, and a more functional, fair and robust society. Once again, not rocket science.

My conclusions have been intellectually validated by reading works from Rothbard, Hoppe and Hazlitt, since my discovery of Bitcoin, and viscerally confirmed by contraindications to the ignorance of those writer’s wisdom, in the clown world simulation we’ve witnessed these past three years.

So all in all, the Austrian school of thought makes fundamental sense to me from a life of practical entrepreneurial experience, first principles thinking and observations.

It is with this foundation that I put forth my contribution to this year’s edition of The Bitcoin Times.

The Pillars of Austrian Thought

I’d like to begin by presenting what I understand as the “Pillars of Austrian Economic Thought”, but in my own language. The following is by no means exhaustive, and the giants who’ve come before me in the field have surely defined and presented these in far greater detail, but I will nonetheless do my best to make them accessible.

Austrian Economics (which I generally think of as Natural Economics) is a school of thought which places importance upon a-priori truths, human action (praxeology), feedback (prices), incentives, the marketplace, capital and private property.

As stated in The UnCommunist Manifesto:

Austrian economics does not seek to model, predict or organize an economy but rather to understand axiomatic, a-priori truths and then infer how the most complex of systems, the economy of human beings, may respond to certain stimuli. It is interested in studying praxeology, better known as ‘human action’, the marginal and subjective theories of value, human behavior and incentives.

Aleks Svetski & Mark Moss, The UnCommunist Manifesto

Austrians recognize that you cannot build models that represent the real world, because you cannot rewind time, nor can you replicate the actions of all individuals from one moment to the next. By acknowledging that all individuals differ in their wants, needs, goals and desires, the Austrian school of thought aims to understand behavior, actions and incentives in order to make better decisions at the level of the individual actor, in contrast to other schools of thought which attempt to impose top down control of many of the variables and force human behavior into the constraints of their empirical models – all which ultimately fail or give false readings anyway.

In this sense, Austrian economics is interested in grass-roots, emergent processes and respects complex systems as the unpredictable, non linear phenomenon that they are. It opts to observe, consider and understand the market, rather than control and manage it through the use of statistics and models. The latter by definition must be linear because managed, centrally enforced controls cannot be complex.

Austrians emphasize private property, entrepreneurship, free markets, and sound money as the key drivers of economic performance, and the subjective values and actions of real actors as the ultimate cause of all economic outcomes.

In other words:

Base Capital = Time, Energy and Natural Resources.

Meta Capital = Ideas, Information, Reputation.

Work = Use of Capital.

Work + Capital = Something of subjective or marginal value.

Capitalism = Enhancing value through more efficient & effective use of capital.

The Market = Multi-dimensional hierarchies of inter-subjective and marginal valuations.

Saleability = Feedback from the marketplace.

Profits = Good feedback.

Losses = Negative feedback.

Cumulative profits = Wealth.

Cumulative losses = Poverty.

While there might be some esoteric sounding terms in there, like multi-dimensional hierarchies (I just mean there are different things that different people and groups of people value), none of this is really ‘sophisticated science’, and in my mind, economics need not be more complicated than these basic set of axioms (noting that this list is not exhaustive).

The other area worth noting, that is more a position than a principle, is the “law of least intervention”. I don’t know if that’s actually a term or if I made it up, but it’s always been something that that drew me to this school of thought.

Austrian economics is non-interventionist. Whether it’s monetary policy, fiscal policy, government regulation, or just messing around with markets via arbitrary decrees, the standard position is that you do not touch something that’s complex without risking ramifications that you cannot quantify.

Attempted government (or central bank) control of a market can only lead to distortions. Markets are not machines that can be built and managed by some authority. They are living, organic, complex systems that self regulate if left to run of their own accord.

Sure, the rules of engagement must be established at the outset, as with any game, but constant meddling will only lead to unintended consequences (see The Cobra Effect).

MYOB (Mind your own business) is a sacred virtue, implicit in Austrian Economics, implicit in Bitcoin and counter to the narrative that has prevailed this past century.

I always have and always will be an advocate of personal responsibility. I think the worst kind of people are those who stick their nose in everyone else’s business, irrespective of their intentions. The do-gooders, intelligentsia and altruistic virtue signallers of the world have likely done orders of magnitude more damage to civilisation than all of the low IQ bigoted hicks who mind their own business, put together. The former are the ‘useful idiots’ that mobilize and weaponize the more sinister ideologies of those who actually want to take advantage of the system at the expense of others.

Which brings me to my next topic…

How Keynesians beat Austrians (and sanity) this century

You may be thinking…

”If Austrian Economics is so good, just, functional and obvious, why on Earth have I not heard about it and why is it so obscure”?

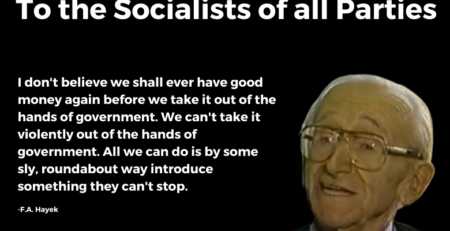

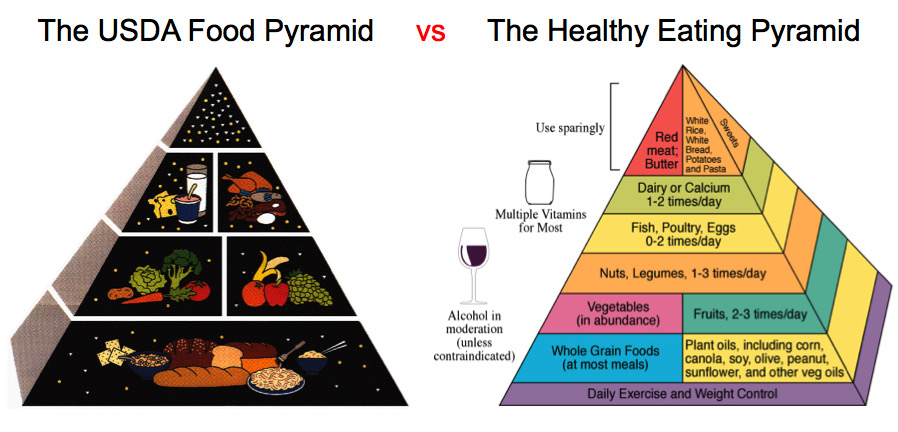

To which I would simply reply with the following image:

Modernity abounds with stupidity, and schools of economic thought are no exception.

And beyond this, there are actually strong reasons why Keynesianism won out this century and we shall explore those in this section.

Over the last century, Keynesians (and others of their ilk) have managed to outcompete the rational, natural Austrian school of Economics because their entire ideological corpus hinges on the idea of central authority, reducible models and economic tinkering.

The perfect storm of the centralisation of physical gold, coupled with the rise of public-representative-democratic nation states, central banking and the virtualisation of money have been a match made in heavenly-hell for this ideology and its proponents.

This perfect storm has meant that those who want power have had it at their fingertips. Literally.

Bureaucrats, Overlords, Tyrants, Bankers and Politicians of all sorts have raped and pillaged the wealth of nations, and strip mined the very capital base humanity has built up over the last three millenia, with the push of a few buttons, a couple of back room deals or a the act of a simple signature.

They’ve used Inflation, taxation and debt-ad-infinitum to effectively rob the productive class of the product of their labor, under the guise of “we’re all in this together”.

In this environment, the Keynesian method has been the ultimate alpha. Much like Communism; it is a model that justifies its existence on the basis of Entropy. It’s easier to destroy than it is to build. It’s easier to take than it is to make. It’s easier to cheat than it is to compete. Why work when you can get something for free? Why exert effort when someone else will, and you can just take half, overtly or covertly?

With the broad centralisation of power in the hands of the state, the winning move (in the short term, at the expense of a long term that would not come in one’s lifetime), bureaucrat after bureaucrat took the easy way out and justified it with the mere adjustment of the ledger.

To this day, they continue to pretend and promise their way into false pretenses of prosperity. To this day, the costs and consequences of their decisions are borne by others. But also, it is this day those chickens come home to roost. The age of Keynesianism and games of pretend politics is coming to an end, because there is no longer enough capital to sustain the current standards of living.

The Levers

Keynesian models rely upon someone playing with the levers, the most important one being the base lever: Money. They’re able to do so because economics has been handicapped by a money issued, legalized and standardized by some central authority.

And whether the concentration of money occurred by virtue of bad, good or indifferent people, institutions or technologies, it matters not. Whether it was concentrated back when private note issuers stored your gold, or by central banks who today claim ‘independence’, once more matters not. The levers exist to be pulled, and shall be pulled.

The Austrians have thus far ‘lost’ because their philosophy was based upon nobody, or as few people as possible, touching the levers.

Unfortunately for civilisation, brrr is a helluva drug. The Ring of ultimate power is too tempting a thing to wear.

To date, the

To date, the

Austrian school of thought has remained obscure and theoretical because you cannot apply free-market economic theories in the wild, while the actual resource through which we measure markets, economies and society is controlled by some central party. It just doesn’t work!

Whether through the issuance of Fiat money, the manipulation of interest rates (which are merely an aggregate measure of a civilisation’s time-preference) or through taxation and regulatory overreach, we have lived in a world where the theoretical simplicity, elegance and accuracy of Austrian Economic thought has been untenable.

The spoils have gone to the most adept cheater. The goal has not been to ‘win’ because you’re better or more suited / fit / competent, but to win because you got your hands on the lever. A fraudulent win.

It’s no wonder the world is mired in depression and nihilism. People think they’re winning when in fact they are either losing by losing, or winning by cheating, which is also losing.

But…Satoshi’s invention may have just been the metaphorical launching of The Ring into the fire. Bitcoin may well be the thing that breaks the primacy of that all-powerful lever, forever, Laura. Forever.

As such, Alpha and a competitive edge will no longer come from fraudulent, fiat-like behavior. Edge and primacy will stem once more from competence and fitness.

Bitcoin will Make Winning Great Again.

Stealing back The Fire

In 2020, I released the Third Edition of The Bitcoin Times. It was inspired by the Promethean idea of “Stealing back the Fire”.

I believe we are indeed at a historical nexus. With Bitcoin, we Steal back the Fire, in a sly roundabout way. With it, the sound ideas, methods, processes and observations that are the school of Austrian Economic thought, flourish. Good sense can finally prevail and although battles were lost, the war for the soul & sanity of humanity can be won!

I would argue that to date, there has not existed an object or good that was able to truly and accurately measure the inter-subjective value of the product of our labor, and the relative scores of all participants in the economic game of civilization.

Gold tried but failed because of inherent physical properties. Gold was humanity’s little test run. A shiny yellow metal allowed us to form the basis of sound economic thought, and gave us a glimpse into the progress that could be made when money was in part bound by physical constraints. But…It was never going to work long term.

The challenges of scaling digital scarcity are difficult enough. Scaling physical scarcity (Gold) globally in a digital, interconnected economy is impossible. Its handling, distribution, and very source of validity are always going to concentrate, and by virtue of the economies of scale needed for the management of such a physical-money-based system, the timeline will always venture back to the creation of promissory notes, bank notes and subsequently fiat money.

Bitcoin is a significant fork in that road and takes us where no civilisation on Earth has gone before.

Bitcoin is the first time in recorded human history that we have a cheaply, simply and mathematically sound method of verifying a total supply of monetary units which embody all of the core attributes of money. Combined with the fact that it is fixed in supply and independent of policy, vote or opinion, the most significant problems-of-money humans have built entire institutional monstrosities to contain and manage, are entirely solved for.

What does this do for us as a species? That’s a large question and one out of the scope of this particular essay, but I can with certainty say that it will “Make Austrian-Economics Great Again”.

In fact, it will for the first time ever, make it the dominant school of thought and inquiry because economic miscalculations and shenanigans will have local consequences. There is no room for playing pretend on a Bitcoin standard. In the absence of socializing poor economic actions, Keynesian forms of fantasy will face bankruptcy and obsolescence.

The beauty of Bitcoin is that we will no longer need to ‘argue’ about why sound economic principles matter. Bitcoin will just show you. Survival shall depend on people reading, understanding and implementing the principles of Hoppe, Rothbard, Mises and Hayek. Those texts will become the new age “personal development” and “personal finance” books. What a genuine Renaissance this will be.

Imagine a populace that gives their children Economics in One Lesson, by Henry Hazlitt, or Basic Economics by Thomas Sowell as early primers on ‘how to win at life’, followed by Hoppe’s Economic Science and The Austrian Method when they’ve matured and are ready to tackle the challenges of the world.

A golden age truly awaits us, and once again I make clear. Bitcoin makes this possible. No amount of reason and writing will ever have done it.

As Taleb (or his ghost writer) has told us many times. Practice beats theory every time. Bitcoin is Austrian Economics in practice.

We’ve had to endure much this century. It has been a time for vultures.

By virtue of the central Keynsian decree; “In the long run, we’ll all be dead anyway”, central bankers and planners have proceeded to rob, rape and pillage society, irrespective of the cost, or whom actually bears it.

The few with integrity who neither bent the knee or sold out, were largely ignored, but lucky for humanity, they did exist. They spoke out. They wrote and left us ideas which cannot die, because those ideas were in fact, timeless truths.

Their words inspired our undying pursuit, and with the advent of perfect money in the form of Bitcoin, Austrian Economics finally has its day, for there is nothing that can stop a truthful idea whose time has come.

In Closing

I don’t believe we’ve ever really truly lived in a free market capitalist society. We may have had periods of rugged prosperity, such as 1800s America, and even short snippets of time where institutions were established post some politically engineered tragedy that said; “Alright, now we’re going to do things the right way.”

But over time, this rugged prosperity was suffocated and these institutions became concentrations of corrupt bureaucrats. Why? For many reasons of course.

People are always seeking an advantage and looking to economize on effort. The nature of progress in the industrial and information ages, combined with the length of our individual lives means that the temptation to sacrifice the future for a short term gain will always be too high. Add to that, the fact that one could effectively offload the cost or consequence of decision making on some nebulous entity known as ‘society’ and you have a potent mix. A forbidden fruit that very few in the world could hope to resist.

The finger was always too attracted to the money button. The allure of the all-powerful “Ring” was too strong.

But Bitcoin destroys the button, the lever and the Ring.

This is why Bitcoin is such a profound discovery and invention. Digital scarcity and ‘energy money’ had to be discovered. Bitcoin was the invention that did it.

It now places us in a situation we’ve not been in before. As Juice says; it removes the need for a “Great Guardian”.

As such, I believe it will form the basis for a world in which a true, long-term unfettered capitalism may flourish. Where real wealth can be created and accumulated through the increased productive capacity of the constituents of society, i.e. its people.

A world which the Austrians have described for over a century now.

Of course there will be trials and tribulations along the way. There will be many mistakes made, fortunes lost and resources squandered, but most important of all; the scorecard will reflect all these truthfully – and we will learn.

As we learn, we will improve and as we improve, we will once again make progress.

Honest, Consequential Money will measure and reflect the results of decisions and actions accurately, because it is fixed in supply and independent of all political influence. It will localize consequences, both positive and negative, thereby making civilisation more just.

Bitcoin will enable a modern, complex economy to function, and will do so orders of magnitude better than what we’ve had to date.

It is an improvement on the best elements of Gold, on the best elements of digital, virtual fiat, on the best elements of ‘ledger-money’, and on the best elements of physical cash.

Bitcoin is as close to perfect, engineered money as we’ll come and our job now is to continue building atop this foundation.

The School of Austrian Economics will help guide us along thatthe path that Bitcoin has made way for. Take heed, and pay attention.

Aleksandar Svetski

@SvetskiWrites

August, 2022