Making Time Preference Low Again

The hardness of money is the control knob for time preference. Austrian economics arrives at this by reasoning from first principles. Bitcoin illustrates it by fixing you and everyone it touches.

A primer on Time Preference

The scarcity of time is the starting point of all economic choice. The scarcity of time forces man to choose between alternatives at all points in his life, and it means that every decision has an opportunity cost. Even with no restraint on the amount of resources available, an individual’s choice of how to spend their time results in the elimination of all other choices for which he could have used the time.

Economizing time is unique because time passes and cannot be stopped or reversed. When he is born, man’s life’s clock begins ticking, it continues ticking relentlessly, and only stops when he dies. There is no knowing when that clock will stop, and there is no restarting it after it stops. Man gets one uninterrupted shot at life, and he never knows when it will end.

Time is not a normal commodity for which man can choose the quantity he would like to have. There is no market choice between different quantities of time. Different periods of time “appear in different perspective according to whether they are nearer to or more remote from the instant of valuation and decision.” The nearer the period of time from the present, the more valuable it will appear to an individual. The present is certain, as it is already here, but the future is always uncertain as it may never come. The future can only come through successfully securing survival in the present, which makes the needs of the present always more pressing and important. The present is where all senses experience life and its pleasures and pains. Future pains and pleasures are hypothetical, but those of the present are real and visceral. Hunger felt in the present is far more pressing than hunger anticipated in the future, which makes food more valuable in the present than the future. Danger in the present is far more pressing than future danger, and tools that secure safety today are thus more valuable today than in the future. Given a choice between obtaining a physical good in the present, or the same good in the future, man chooses the present.

The higher valuation of present goods is a permanent fixture of human action. It is confirmed by the fact that humans choose to consume rather than just accumulate more of the goods they value, including money. Their choice to consume in the present implies they place a higher valuation on a present good than the same good in the future. Time preference is the degree of preference of present goods over future goods. It is always positive, because humans always prefer present goods over their future equivalents, but the magnitude of this differential varies from person to person, and for each person across their life. A high time preference indicates heavy discounting of the future in favor of the present and more present-orientation, while a low time preference implies a lower discounting of the future and more future-orientation.

An endless variety of factors can affect an individual’s time preference.

Hoppe distinguishes between external, biological, and social or institutional factors as follows:

It is a given that man is born as a child, that he grows up to be an adult, that he is capable of procreation during part of his life, and that he ages and dies. These biological facts have a direct bearing on time preference. Because of biological constraints on their cognitive development, children have an extremely high time-preference rate. They do not possess a clear concept of a personal life expectancy extending over a lengthy period of time, and they lack full comprehension of production as a mode of indirect consumption. Accordingly, present goods and immediate gratification are highly preferred to future goods and delayed gratification. Savings-investment activities are rare, and the periods of production and provision seldom extend beyond the most immediate future. Children live from day to day and from one immediate gratification to the next.

In the course of becoming an adult, an actor’s initially extremely

high time-preference rate tends to fall. With the recognition of one’s life expectancy and the potentialities of production as a means of indirect consumption, the marginal utility of future goods rises. Saving and investment are stimulated, and the periods of production and provision are lengthened.

Finally, becoming old and approaching the end of one’s life, one’s time-preference rate tends to rise. The marginal utility of future goods falls because there is less of a future left. Savings and investments will decrease, and consumption-including the nonreplacement of capital and durable consumer goods-will increase. This old-age effect may be counteracted and suspended, however. Owing to the biological fact of procreation, an actor may extend his period of provision beyond the duration of his own life. If and insofar as this is the case, his time-preference rate can remain at its adult-level until his death.1

Numerous social and institutional factors affect an individual’s time preference. Perhaps most important among them is the security of property, which would provide man a very effective way of providing for his future. Acquiring durable goods is arguably the initiation of the process of the decline of time preference for humanity. A man who commands a valuable good that can be used in the future, reduces the uncertainty that surrounds his future, and becomes likely to discount it less. As the concept of property rights becomes widely accepted in a society, it leads to widespread decline in time preference as individuals begin to increasingly value their increasingly secure future. The security of property rights strongly influences time preferences. As a property owner’s certainty of their command of a good increases into the future, he is likely to maintain the good in good shape, and more likely to act with the future in mind.

Time preference and money

Providing for the future suffers from the problem of coincidence of wants. The future is unknowable and uncertain, and no individual can know for sure what goods they will require in the future. In the same way that money solves the problem of coincidence of wants in trade, it solves it for future-provision. By saving the most liquid good, and the generalized medium of exchange, the saver is able to exchange it in the future for the most valuable goods available, and to do so at the time of their choosing.

Money is thus held precisely because of uncertainty. In a future that is perfectly predictable, individuals could arrange all their future financial inflows to go directly to the providers of the goods they would need at the time they need them, and would not need to hold any money. But in the real world where the future is unpredictable, money is the best tool for providing for the future, as its liquidity allows it to be converted to whatever goods are desired in the future.

Money can therefore be understood as the economic good likely to have the highest marginal utility in the future, as it can most easily be converted into whatever good has the highest marginal utility in the future. As human society develops money as a good, humans find a very convenient and powerful tool for transferring value into the future, and that allows them to lower their time preference, and engage in more saving and future-provision.

As humans use money to conduct trade, the technology used for money improves and becomes more efficient at carrying out its task as a medium of exchange, both in the present between individuals, and between the present and the future. Money is a technology, and the preponderance of users leads to a preponderance of choices competing against each other. Better ideas and technologies win out and drive out the inferior ones. In money, the productivity of the technology pertains to how well it performs its function as a medium of exchange, store of value or unit of account.

A monetary medium which is easy to produce in excessive quantities in response to demand increases will likely experience substantial increases in its supply, and a reduction in the economic value stored in it over the long term. On the other hand, monetary media that are difficult to produce in increasing quantities in response to demand increases are likely to witness their supply expand to a limited extent, and so they will be much better at preserving value. Those who store their wealth in the harder moneys witness their wealth preserve and appreciate, while those who store it in easy money witness it dissipate. They may learn this lesson before it’s too late, moving their wealth to the harder money, or they may not. In both cases, the end result is the same: the majority of the wealth will accrue to the hardest money, all other attributes being equal.

This process, discussed in more detail in The Bitcoin Standard, explains the demonetization of seashells, glass beads, iron, copper, and other primitive moneys in favor of gold and silver, all over the world. It also explains the demonetization of silver in the nineteenth century, and the precipitous decline in its value compared to gold, the undisputed winner of the global market for money at the end of the nineteenth century. As the vast majority of the planet converged on the one commodity which had the lowest reliable annual supply growth rate, secure savings into the future became ubiquitous, encouraging people around the world to save for their future, lowering their time preference, making plenty of savings available for capital investment, increasing labor productivity, incentivizing investment in technological innovations and increased prosperity.

As humanity progresses into using monetary media that are harder to produce, our ability to provide for our future increases. The efficiency of transacting with our future selves increases, and the uncertainty of the future declines. As the uncertainty of the future declines, and the expected wealth we are able to transfer to it increases, the discounting of the future decreases, and time preference declines.

Time preference and civilization

As individuals lower their time preference and accumulate more capital, their productivity increases, resulting in an incentive to further lower their time preference. In The History of Interest Rates, Homer and Sylla show a 5,000-year process of decline in interest rates, intertwined with significant increases during periods of war, diseases, and catastrophes. The move toward harder monies with better salability across space and time can be viewed as a contributor to the epochal decline in time preference by allowing humans better savings technology, making the future less uncertain for them, and thus making them discount it less, resulting in more savings, and thus more capital available at lower interest rates.

For as long as individuals are able to accumulate capital and reasonably expect it to remain theirs after they invest in it, this process is likely to continue, generating a higher stock of capital and a lower interest rate. This process however can be interrupted and reversed through various factors. Natural disasters, for example, can destroy property and capital, lower living standards, and endanger survival, leading to a higher discounting of the future and a need to consume more of available resources in the present, reducing capital accumulation, and raising time preference.

Violations of property rights are the most important social and institutional factor affecting time preference. Theft, vandalism, and other forms of crime have a similar effect to natural disasters in that they reduce the stock of capital and goods available to an individual, forcing them to consume a larger fraction of their resources in the present, and increasing their uncertainty about the future. The increased occurrence of crime further leads to the expenditure of increasing resources on protection from crime, taking resources away from other productive enterprises. The more prevalent crime, the more resources need to be dedicated to protection, which produces no increase in wealth.

Far more significant than individual crime is institutional or organized crime in the form of predatory government policies. Whereas it is possible to purchase protection from random individual criminals, government violations of property rights are systemic, recurring, and inescapable. Because they are considered legitimate, it is much more difficult to defend against government violations of property rights than individual crime. Taxation implies a reduction in future income and a reduction on the return to investment.

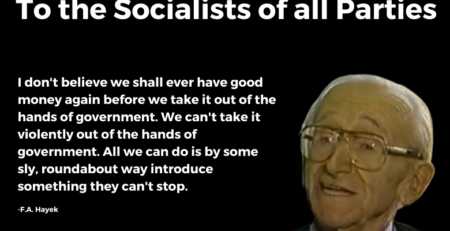

The devaluation of the currency is one violation of property rights that is highly destructive of future orientation and the process of the lowering of time preference. The process of lowering time preference is inextricably linked to money. Having money allows man to delay consumption in exchange for something that can hold value well and can be exchanged easily. Without money, delaying consumption and saving would be more difficult, because the goods could lose their value over time. You could store grains to grow, but the chance of them ruining before the next season is higher than the chance of a gold coin ruining. If you can sell the grain for gold, you are able to exchange it back to grain whenever you need to, and you can use it to purchase something else meanwhile. Money naturally increases the expected future value of deferring consumption, compared to a world with no money. This incentivizes future provision. The better the money is at holding on to its value into the future, the more reliably individuals can use this money to provide for their future selves, and the less uncertainty they will have about their future lives.

Salt, cattle, glass beads, lime stones, seashells, iron, copper, and silver had all been used as money in various times and places, but by the end of the nineteenth century, the entire globe was practically on a gold standard. The use of an easier monetary medium would lead to its overproduction, and thus a decline in its value and the dissipation of its monetary premium. With the gold standard of the late nineteenth century, the majority of the world had access to a form of money that could hold its value well into the future, while also being increasingly easy to transfer across space. Saving for the future became increasingly reliable for more and more of the world’s population. With the ability to save in hard money, everyone is constantly enticed to save, lower their time preference, and reap future rewards, seeing the benefits around them every day through falling prices and in the increased wealth of savers. Economic reality is constantly teaching everyone the high opportunity cost of present spending in terms of future happiness.

The twentieth century’s shift to an easier monetary medium has reversed this millennia-old process of progressively lowering time preference. Rather than a world in which almost everyone had access to a store of value whose supply could only be increased by around 2% percent a year, the twentieth century gave us a hodgepodge of government-provided abominations of currencies growing at 6%-7% in only the best examples, usually achieving double-digit percentage growth and occasionally, triple-digit. The numerical average for the growth of all national currency broad supply during the period between 1960 and 2020 is 30% per year. Calculating the average weighted by currency size shows us roughly a 14% annual increase in the market supply of all fiat currencies, which can be viewed as the average money supply increase experienced by the average citizen of the fiat nations of the late twentieth and early twenty-first centuries.

Rather than expecting money to appreciate and thus having a reliable way to retain value into the future, fiat returned humans of the twentieth century to far more primitive times, when retaining value into the future was far less certain, and the value of their wealth was expected to be reduced in the future, if it survived at all. The future is hazier with easy money, and the inability to provide for the future makes it less certain. This increased uncertainty leads to a higher discounting of the future and thus a higher time preference. Fiat money effectively taxes future provisions, leading to a higher discounting of the future and an increase in basic present-oriented behavior among individuals. Why delay consumption today when you are unsure what will happen to your property tomorrow?

The extreme of this process can be seen when observing the effects of hyperinflation, i.e., the move to a very easy and rapidly devaluing currency. A look at the modern economies of Lebanon, Zimbabwe, or Venezuela through their recent hyperinflationary episodes provides a good case study, as do the dozens of examples of hyperinflation in the twentieth century. Adam Ferguson’s When Money Dies provides a good overview of the effects of hyperinflation in interwar Germany, a society that was one of the world’s most advanced a few years earlier.

In each of these hyperinflationary scenarios, as the value of money was destroyed, along with it went concern for the future. Attention turns instead to the short-term quest for survival. Saving becomes unthinkable, and people seek to spend whatever money they have as soon as they secure it. People begin to discount all things which have value for the long run, and capital is used for immediate consumption. In hyperinflationary economies, fruit-bearing trees are chopped down for firewood in winter, businesses are liquidated to finance expenditure, and the proverbial seed corn is eaten. Human and physical capital leave the country to go where savers can afford to maintain and operate them productively. With the future so heavily discounted, there is less incentive to be civil, prudent, or law-abiding, and more incentive to be reckless, criminal, or dangerous. Crime and violence become exceedingly common as everyone feels robbed and seeks to take it out on whoever has anything. Families break down under financial strain. While more extreme in the cases of hyperinflation, these trends are nonetheless ever-present, in milder forms, under the yoke of the slow fiat inflationary bleed.

The most immediate effect of the decline in the ability of money to maintain its value over time is an increase in consumption and a reduction in saving. Deferring consumption and delaying gratification requires one to give up immediate pleasure in exchange for future reward. The less reliable the medium of exchange is for transforming value into future reward, the lower the expected value of the future reward, the more expensive the initial sacrifice becomes, and the less likely people are to defer consumption. The extreme of this phenomenon can be observed at the beginning of the month in supermarkets of countries witnessing very fast inflation. People who get their paycheck will rush to the supermarket to immediately convert it into groceries and essentials, knowing that the quantities they can acquire by the end of the month will be far smaller due to the destruction of the value of the currency. Fiat’s slow and steady inflation does something similar, but it is more subtle.

The culture of conspicuous mass consumption that pervades our planet today cannot be understood except through the distorted incentives fiat creates around consumption. With the money constantly losing its value, deferring consumption and saving will likely have a negative expected value. Finding the right investments is difficult, requires active management and supervision, and entails risk. The path of least resistance, the path permeating the entire culture of fiat society, is to consume all your income, living paycheck to paycheck, or in more ‘advanced western societies’, to gamble your spare money on investment schemes because “cash is trash”.

When money is hard and can appreciate, individuals are likely to be very discerning about what they spend it on, as the opportunity cost appreciates over time. Why buy a shoddy table, shirt, or home when you can wait a little while and watch your savings appreciate to allow you to buy a better one. But with cash burning a hole in their pockets, consumers are less picky about the quality of what they buy. The shoddy table, home, or shirt becomes a reasonable proposition when the alternative is to hold money that depreciates over time, allowing you to acquire an even lower quality product. Even shoddy tables will hold their value better than a depreciating fiat currency.

The uncertainty of fiat extends to all property. With the government emboldened by its ability to create money from thin air, it grows increasingly omnipotent over all citizens’ property, able to decree how they can use it, or to confiscate it altogether. In The Great Fiction, Hoppe likens fiat property to a sword of Damocles hanging over the head of all property owners, who can have their property confiscated at any point in time, increasing their future uncertainty, and reducing their provision for the future.

The destructive impact of inflation on capital accumulation also encourages savers to invest in anything they expect will offer a better return than holding cash. When cash holds its value and appreciates, an acceptable investment will return a positive nominal return, which will also be a positive real return. Potential investors can be discerning, holding on to their cash while they wait to find the best opportunity. But when money is losing its value, savers have a strong impetus to avoid the devaluation of savings by investing, and so they become frantic to preserve their wealth and are less discriminating. Investments that offer a positive nominal return could nonetheless yield a negative real return. Business activities that destroy economic value and consume capital appear economical when measured against the debasing monetary unit and can continue to subsist, find investors, and destroy capital. The destruction of wealth in savings does not magically create more productive opportunities in society, as childish Keynesian fantasists want to believe; it simply reallocates that wealth into destructive and failed business opportunities.

Related to the general rise in time preference and the heavy discounting of the future is the rise of interpersonal conflict between individuals and the degradation of the manners and mores that make human society possible. Trade, social cooperation, and the ability of humans to live in close contact with one another in permanent settlements are dependent upon them learning to control their basest, hostile, animal instincts and responses, and substituting them with reason and a long-term orientation. Religion, civic, and social norms all encourage people to moderate their immediate impulses in exchange for the long-term benefits of living in a society, cooperating with others, and enjoying the benefits of the division of labor and specialization. When these long-term benefits seem far away, the incentive to sacrifice for them becomes weaker. When individuals witness their wealth dissipate, they rightly feel robbed, and they question the utility of living in a society and respecting its mores.

Under inflation, crime rates soar and more conflict emerges. Those who feel robbed by the wealthy elite of society will find it relatively easier to justify aggressing against others’ property. Diminished hope for the future weakens the incentive to be civil and respectful of clients, employers, and acquaintances. As the ability to provide for the future is compromised, the desire to account for it declines. The less certain the future appears to an individual, the more likely they are to engage in reckless behavior that could reward them in the short term while endangering them in the long term. The long-term downside risk of these activities, such as imprisonment, death, or mutilation, are discounted more heavily compared to the immediate reward of securing life’s basic goods.

As such, the effect inflation has on civilization is regressive. It heightens our time preference, erodes our capital and drives us backward morally, socially and institutionally.

Time preference and bitcoin

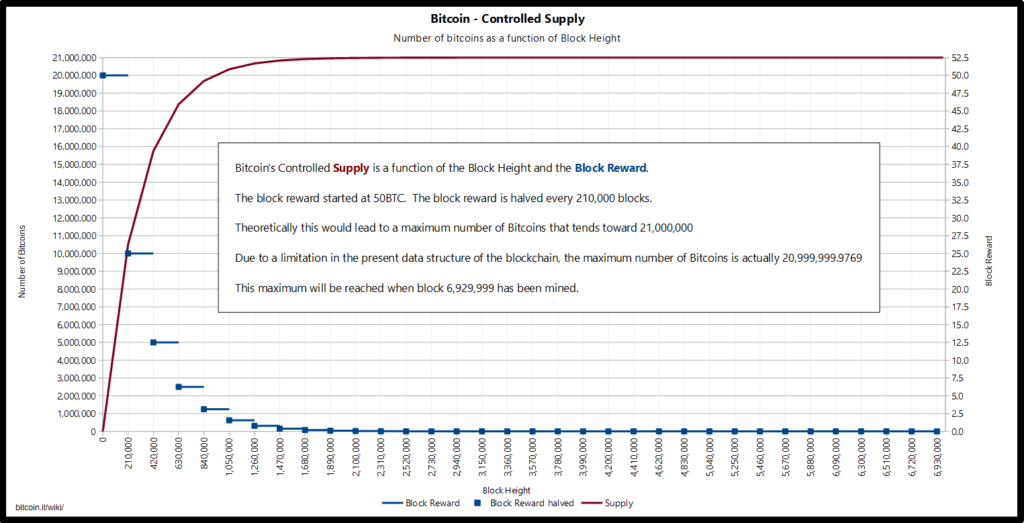

The emergence of bitcoin represents a fascinating opportunity to understand the role of money on time preference, as well as to reverse the global trend of rising time preference presented by fiat. Bitcoin is a peer-to-peer software for operating a payment network with its own native currency. The two most important features of bitcoin are that its native currency has a strictly fixed supply that is completely irresponsive to demand, making it the hardest money ever invented; and that it allows for cross-border payments without needing any political authority to supervise the transaction.

These two properties arguably give bitcoin the best salability across time and space. Its scarcity means that its supply cannot be diluted unexpectedly, ensuring it is likely to hold on to its value into the future. And its automated processing of payments means it can travel worldwide without having any single authority able to censor or confiscate it.

Bitcoin has no single point of failure, no single piece of critical infrastructure or hardware, no single critical individual or organization. Bitcoin is a software protocol open to anyone anywhere who has a device that can receive a small packet of data every ten minutes (between 1 – 4MB), and there are tens of billions of these devices worldwide. All bitcoin does is that approximately every ten minutes, it produces a new record of ownership reflecting around 3000 transactions’ reallocation of existing coins. This has never failed and has never produced a fraudulent transaction.

Bitcoin is a purely voluntary monetary phenomenon that does not require regulation, enforcement, or a judicial system to function. It fits into the Austrian definition of sound money because it is chosen on the market, its value cannot be dictated by any authority, its price is emergent and of all the moneys chosen on the market or imposed by government, bitcoin is the only one whose supply is fixed and cannot expand in response to increasing demand.

Analysts and experts have made many spectacular claims about what bitcoin can do, but most of that is hype. Bitcoin is pretty basic, and it simply allows you to hold and transfer ownership of currency units. In practice, the most prevalent use case for bitcoin has been its use as savings account replacement. Millions of people worldwide have used bitcoin as such, and have benefited from this immensely. Bitcoin’s price, and therefore purchasing power, has appreciated at a compound annual growth rate of 215% in its first 10 full years of trading.

This offers us very interesting insight into the importance of money to time preference.

Democracy, inflation, government predation, wars, the Keynesian managerial state, and the vast majority of modern factors causing a rise in time preference are still there, and usually getting worse. But for a small growing minority of the world’s population, bitcoin represents an escape hatch from monetary inflation. Unlike the vast majority of humans in the past century, bitcoiners today are able to save for the future, and expect, with relatively low uncertainty, to have their savings available in the future, and to have their purchasing power increase. If money is important for time preference, we would expect to see these people differentiate themselves from their fiat peers. My personal experience from years in the bitcoin space provides several compelling pieces of evidence to this extent.

In 2018, I published The Bitcoin Standard, an academic book which had a whole chapter on time preference. Three years later, it has become the best-selling book on bitcoin, translated to 25 languages worldwide, and I have been told personally by thousands of people of how it helped them explain the changes in their life they witnessed after moving to bitcoin. The very common story heard from bitcoiners is:

“I used to spend all my money every month on all kinds of stupid frivolous nonsense, but when I learned about bitcoin, I cut down on my expenses drastically, and started saving everything”.

Along with that came a marked change in future-orientation across all manners of personal behavior. Some decided to start a family, some got over depression and found meaning to life, and many quit bad habits. One of the most common stories is of people quitting alcohol and drugs. My personal favorite was someone telling me that they introduced their drug dealer to bitcoin, who started saving in bitcoin, made a lot of money on bitcoin, and decided holding bitcoin was a better use of their time and money than dealing drugs, forcing the person who introduced him to bitcoin to quit drugs as he could no longer find a dealer.

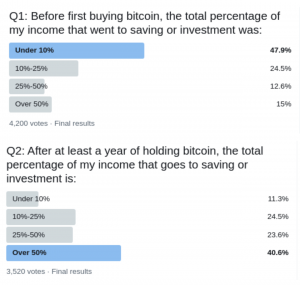

Recently I ran a poll for my followers on Twitter who have held bitcoin for more than a year asking them of the percentages of their income they saved or invested before getting into bitcoin, and what percentage they save or invest today. The results were stark.

The story of savings is a very common one. Before bitcoin, most people alive today simply had no conception of saving and delayed gratification. You spent all the money you earned, and when you had major expenses, you got into debt to pay for it. You continued to work and pay off the debts indefinitely. To the extent most people invest, they do so through their work retirement funds. Those who do invest are mostly those who spend considerable amounts of time studying the markets and trading, making it almost a job. The notion of saving passively while earning money from a job was very rare. After bitcoin it became increasingly common.

People from all over the world are now obsessed with “stacking sats”, where sat refers to the satoshi, the smallest unit of bitcoin, 100,000,000 of which make up 1 bitcoin. Millions of people worldwide now work their day jobs, spend as little as they can, and stack as many sats as possible. Once someone is introduced to the magic of bitcoin’s rapidly increasing value, it is inevitable that they start calculating how much wealth they could have if they had spent on bitcoin the money they had spent on other things, particularly frivolous spending.

Bitcoin is the free market’s solution to the problem of rising time preference. It is the technological solution that allows anyone to rejoin the process of lowering time preference, saving, capital accumulation, and civilization. It requires no political permission, it obviates politics and monetary policy, it is unstoppable, and it is hugely rewarding for everyone who adopts it.

As it is expected to lose its value over time, easy money is not a reliable way for providing for the future, which increases the uncertainty of the future, encouraging heavier discounting of the future, or a higher time preference, as observed in the twentieth century under the fiat standard. Because it can be expected to hold on to its value into the future, hard money increases the potential pay-off from saving and delaying gratification, reducing the uncertainty of the future, and encouraging more saving and more future-oriented behavior, as was the case under the gold standard, and in the nascent bitcoin standard.

August, 2022

The Bitcoin Times, Austrian Edition