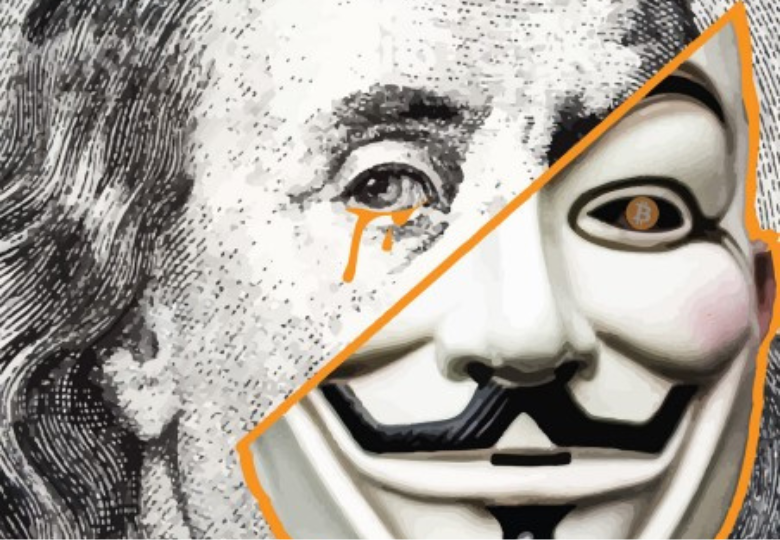

The Separation Of Money And State

Changing the course of History

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take them violently out of the hands of government, all we can do is by some sly roundabout way introduce something they can’t stop.” – Friedrich Hayek

The political economy of fiat is one of toxic bigness.

Given fiat money exists only as the liabilities of state-licensed banks with politically preferential access to artificial credit, bigness in banking is rewarded by default, and bigness in business is rewarded by proximity to bigness in banking. The losses of both are socialized under the pretence of preventing financial catastrophe, but of course the real catastrophe is the thumb on the scale against the small and the politically unconnected. Capital markets abjectly fail in their titular goal of creating a market for capital. They become, instead, political tools, whose politics, by the way, are anything but “local”.

This is clear enough from the fallout of Operation Choke Point (aptly named given the core premise of political capture) but the reasoning bleeds also into analysing the architecture of the internet. Given the lack of native digital value prior to Bitcoin, online monetisation has primarily been architected around the assumption of advertising, which of course means surveillance as well. Every action one takes in consuming online content is relentlessly spied upon as potentially valuable, while capturing and processing this value has enormous returns to scale given single such data points tell you nothing, but trillions can be mined for patterns that no human could identify. You cannot run an online business without appeasing those who have mastered this game and who, surprise, surprise, have also been politically captured. Their bigness makes them targets for political capture, and their political capture keeps them big and makes them bigger.

It is becoming more widely understood how bitcoin fixes this, and, in general, encourages economic thinking along more local lines and heuristically warns against the interdependent and fragile. Energy markets are perhaps the most obvious example: “toxically big” is perhaps an odd criticism of the grid, given it is more of an economic miracle creating a clearing price for power – a necessarily transient economic phenomenon. And yet, Bitcoin allows detachment from this vast, costly, and systemically fragile infrastructure by allowing for the creation of a clearing price bought and sold only over the internet.

On a long enough time horizon, we can reasonably hope that Bitcoin will remove the thumb from the economic scales. The small and the local will no longer be politically disadvantaged on economic terms, and the big will have to compete on even ground.

But what of politics itself? Might we worry that a return to localism in capital formation and consumer behaviour will not amount to much in the face of an overbearing state and a class of noneconomic institutions and their parasitic constituents with the lingering fiat taste for the transnational?

I think not. It is all well and good championing localism as obviously good, transnationalism as obviously bad, Bitcoin as obviously good and contrary to transnationalism, and hence Bitcoin as a natural complement to localism. But correlation is not causation. My argument is stronger even than this: Bitcoin will cause localism, politically as well as economically. There will be no other choice. Toxic bigness in government will become every bit as unsustainable as in business.

That is not to say that Bitcoin will lead us to a pacifist utopia in which any attempt at violence suffers metaphysical intervention by the spirit of Satoshi. That money can grant power is clear enough as there will always be a clearing price for violent thuggery. But what will distinguish a Bitcoin standard is that power will not grant money.

There are two reasons to believe this. The first is that bitcoin simply cannot be seized by any force less severe than torture, and even then, it is possible – and will surely become widespread for any value worth protecting – to render even torture obsolete. If you want bitcoin, you will have to provide something deemed more valuable to its holder.

The second is subtler, and I believe is not widely understood, except perhaps by the subset of Bitcoiners intimately interested in political history. A distinguishing feature of Bitcoin is that it is the first ever truly stateless money. Contrary to some naïve Bitcoiner and even gold-bug talking points, gold has constituted the base for specie throughout history, but has never acted fully and wholly as money. This historical observation provides an amusing afterthought to what I have previously described as The Semantic Theory of Money:[1] that money can be, and is, defined entirely by an academic checklist and not at all by reference to reality. Something is money if and only if it fulfils “the three roles of money”; that is, store of value, medium of exchange, and unit of account. To economists enamored with this taxonomic vacuity, it doesn’t matter in the slightest how something is being used in the real world. “Money” is a semantic category, not an explanatory one.

Curious, then, that in medieval and renaissance Venice or Florence these alleged “three roles of money” were each fulfilled by different objects or concepts: elemental gold was the store of value (sometimes silver or billon), bank transfer via attested ledger alteration (tellingly called ghost money in Florence[2]) was by far the most common medium of exchange, and the polity-prescribed (that is, government) denominations of coinage via the mint were the units of account.

The reader might object that this itself is irrelevant semantics that allows us to escape the primacy and importance of gold and the gold standard. Quite the contrary. Elemental gold has a cost – indeed, a very high cost. Nearly all human civilization across the world and throughout history independently arrived at the utility of elemental gold as a store of value because, of the options, it has the highest cost and greatest scarcity, hence the weakest market response of increased supply to its premium as a store of value, hence the lowest inflation, and, finally, the greatest monetary utility.

Elemental gold approximates what Nick Szabo called unforgeable costliness. Brilliantly anticipating contemporary pushback against “wasteful” Bitcoin mining, in Shelling Out, Szabo explains that,

“At first, the production of a commodity simply because it is costly seems quite wasteful. However, the unforgeably costly commodity repeatedly adds value by enabling beneficial wealth transfers. More of the cost is recouped every time a transaction is made possible or made less expensive. The cost, initially a complete waste, is amortized over many transactions. The monetary value of precious metals is based on this principle.”

Even though the typical government monopoly on violence has, across the years, included a monopoly on the right to mint coins (or, at the most removed, a government-granted private right, liable to be revoked at a moment’s notice) it has never extended to a right to escape economic reality. Debased coins would be valued abroad precisely in line with their debasement: that is to say, not by their government-insisted fake unit of account, but the true store of value of whatever unforgeably costly precious metals they contained. Foreign exchange markets kept government mints (relatively) honest given economic feedback from seigniorage allowed only the smallest windows of temporary benefit prior to longer-term and more extreme damage.[3]

Even when backed with such military might as were the Roman, Spanish, or British empires, for example, that we might think could overrule economic feedback essentially emanating from decentralized trade webs that could simply be co-opted, the essential cost of elemental gold still forced itself to be felt. Organized violence at such a scale has a cost. The greater the scale, the greater the cost, and in fact, the greater the incentive to maintain a gold standard effectively than to attempt to subvert it. While not a singularly causal factor, it is certainly not a coincidence that the three great empires just cited all collapsed more or less in line with the rate of debasement of their currencies in pursuit of economically destructive militaristic ends.

But the fiat era created a dramatic historical anomaly. For the first time in recorded history, the cost of creating new money literally was zero. This has had profound effects on political economy. While money can always buy power, power could now buy money, and without economic calculation. There is no cost too great to seizing power, and next to no incentive not to give it a shot, because any costs can later be paid back, and then some. This, we believe, is the root cause of the cult of toxic bigness now endemic across the developed world.

Rather than a naturally homeostatic process of increased size leading to inefficiency, in the fiat era, the bigger you are – either as a business or a government – the more powerful you become, hence, entirely perversely, the more efficient you become. Of course, the less efficient everybody else becomes because they are transparently being stolen from. The more communal capital is consumed, the more energy the capital consumer can direct towards seizing power and paying back himself, but likely nobody else.

Bitcoin fixes this. And in a remarkably simple way; it undoes everything just described. It returns a cost to money – a higher one even than gold – and makes toxic bigness unsustainable. Hence, Bitcoin isn’t so much explicitly a pro-localist tool. If anything, the reality is even more profound: localism itself is natural, healthy, sustainable, and right. Bitcoin destroys the historically anomalous countervailing force and, in doing so, will let localism happen without having a particular bias of its own beyond the far more abstract concerns for sustainability, efficiency, accountability, and truth – all natural bedfellows to localism.

One way to conceive of the tragedy of modernity, and its impact on the strip mining of economic, social, and cultural capital is perhaps that narcissism is artificially subsidized. Through subsidy it is normalized, and through normality it becomes a part of the culture itself, and encourages its own championing and reproduction. From an artificial inception, it takes root and sustains itself as it drags the culture down. In The Culture of Narcissism, Lasch points a way out the nightmarish labyrinth:

“In a dying culture, narcissism appears to embody – in the guise of personal “growth” and “awareness” – the highest attainment of spiritual enlightenment. The custodians of culture hope, at bottom, merely to survive its collapse. The will to build a better society, however, survives, along with traditions of localism, self-help, and community action that only need the vision of a new society, a decent society, to give them vigor. The moral discipline formerly associated with the work ethic still retains a value independent of the role it once played in the defence of property rights. That discipline – indispensable to the task of building a new order – endures most of all in those who knew the old order only as a broken promise, yet who took the promise more seriously than those who merely took it for granted.”

Insufficient but necessary, Bitcoin provides such a vision. Let’s build.

Originally in the online post, Wittgenstein’s Money, shortly to feature in expanded form as Chapter Four of the book, Bitcoin Is Venice.

Goldthwaite, Richard, The Economy of Renaissance Florence

This, by the way, is the real meaning and origin of Gresham’s Law, now commonly, if not exclusively, misstated as implying that a higher quality money will suffer competition as a medium of exchange to lower quality moneys on account of its higher quality as money. This is nonsense, and has nothing to do with Gresham’s Law, which articulates a disincentive to excessive debasement of coinage by predicting the arbitrage opportunities it offers mobile merchants with access both to foreign markets and mints.