The Pioneer Species

Exploring Bitcoin Mining through the lens of ecology

How does life colonize a desolate environment for the first time?

Let’s say a volcano erupts and wipes out all life on an island. Is this island destined for desolation? Fortunately not, thanks to “pioneer species” who colonize bare earth after a disturbance, or when the environment is too harsh to allow for colonization by other species.

Pioneer species are usually hearty plants and lichens with few soil requirements. They typically travel by sea or by air with wind blown seeds (or spores) that serendipitously land on virgin land. They enjoy the competition-free environment, produce their own food through photosynthesis, and if successful, bootstrap a new ecosystem.

After planting roots in a virgin ecosystem, the pioneer species slowly transforms their surroundings, making conditions suitable for more complex organisms to join the party. Before long, this once barren wasteland becomes an oasis of life. In the Bitcoin ecosystem, miners are pioneer species uniquely capable of colonizing energy deserts anywhere within the “hash horizon”, which includes the north pole, volcanos, and even outer space. After forming symbiosis with energy producers, the ecosystem is positively transformed and attracts more sophisticated allies.

The small disturbance of Bitcoin miners colonizing a new territory changes the local ecological incentives.

“Large streams from little fountains flow,

Tall oaks from little acorns grow.“

Think of Bitcoin miners as citadel seeds. They may be unassuming now, but given enough time a simple mining operation can transform a barren wasteland into an oasis of human flourishing.

Ecology as a framework to understanding Bitcoin

Ecologists often focus on disturbances, defined as “temporary changes in environmental conditions that cause a pronounced change in an ecosystem.” The goal is to predict how a system will respond to a disturbance, possibly caused by a change in incentives.

In this article we’re going to explore Bitcoin mining through the lens of ecology. We’ll examine how Bitcoin miners and the energy markets influence each other. As incentives shift in the system, we can start to theorize as to how the system might respond.

From an ecology standpoint, life is all about harnessing energy

Energy, along with food, water, and shelter, are examples of “limiting factors” which prevent individual organisms, populations, or entire human civilizations from multiplying ad infinitum.

For example, a herd of elk can only grow as large as their food supply (mostly grass) allows.

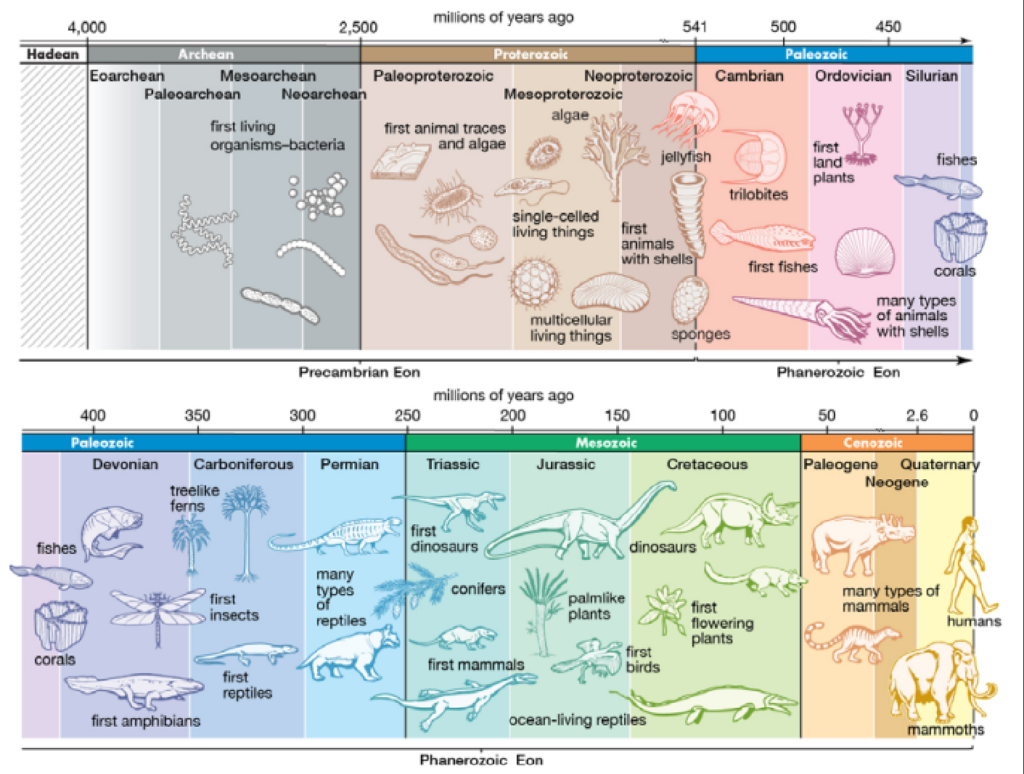

Viewing history through a geological time scale, we can identify major breakthroughs in harnessing energy. Each served as an energetic inflection point throughout evolutionary history.

Major breakthroughs in harnessing energy

The “Oxygen Revolution” (3b years ago) – The first organisms (Cyanobacteria) learned how to harness energy from the sun to produce food through photosynthesis. These organisms exhaled oxygen which radically transformed their environment. This was the first example of ecology at work.

The emergence of Eukaryotes (2.1b years ago) – Complex life, including plants and animals, finally emerged. The leading theory is that the evolution occurred through “endosymbiosis”, in which one organism eats another and they merge into a singular organism. This new organism contains two organelles, one of which is Mitochondria (the power plant of the cell). This happy little accident was a prerequisite to the Cambrian explosion.

Homo Sapiens (300k years ago) – Humans went from burning wood (biomass fuel) to domesticating animals for agriculture. Then during the industrial revolution, we harnessed energy dense coal, petroleum and natural gas (hydrocarbons), enabling the steam engine. As our ability to harness energy improved, so did our tools and our quality of life. We had time for leisure, humans specialized, and commerce exploded. Each energetic advancement dramatically increased the carrying capacity of our species.

Harnessing energy is required for humans to flourish.

Just because we’re familiar with a concept, doesn’t mean we actually understand it. Bitcoin, energy, electricity, and the complexity of their relationships are a great example of this.

There is a popular narrative today that goes something like: “we need to reduce our energy consumption otherwise we will destroy our planet and everyone on it.” Similarly, reporters criticize Bitcoin for ‘wasting energy,’ which reveals how little they understand about energy markets and the value Bitcoin provides. To be fair, it’s not easy to grasp.

“Bitcoin mining is everything you don’t understand about energy combined with everything you don’t understand about Bitcoin.”

Our ability to harness energy is a prerequisite for human flourishing. Energy has enabled humans to live anywhere on earth without dying from heat, cold, or natural disasters. It powers our hospitals, enables transportation, and provides food security.

“There is no optimistic version of the future in which humanity does not use significantly more energy than it does today.” – Bitcoin Mining and the Case for More Energy

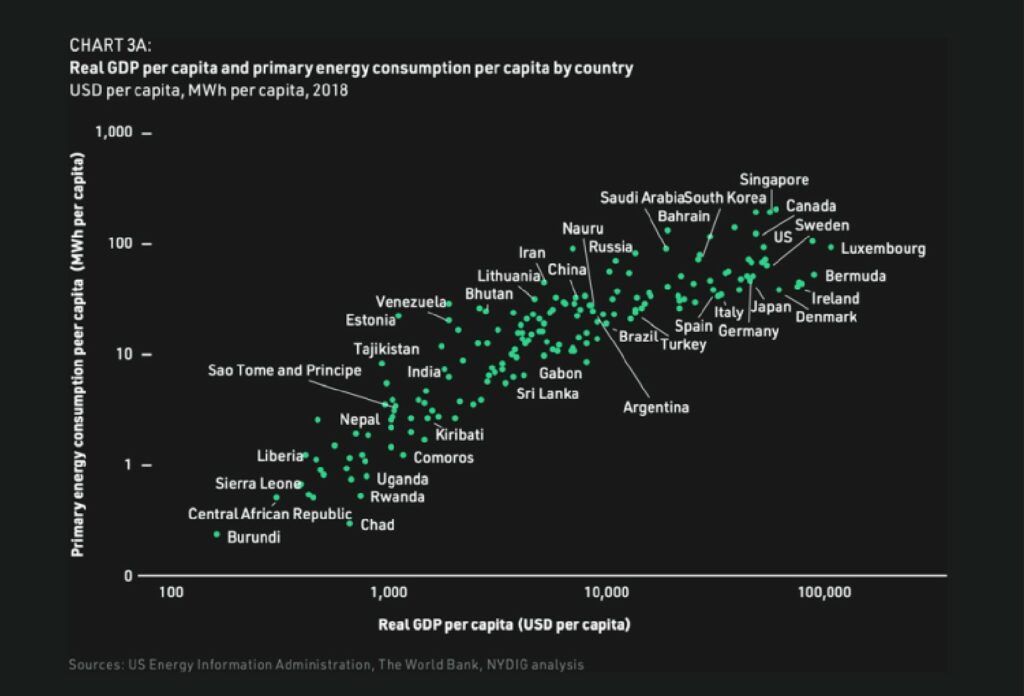

GDP per capita is directly correlated to energy consumption per capita. While not a perfect comparison, this chart wouldn’t change much if we replaced GDP with “standard of living.” If you care about making life better for all people on this earth, you should support harnessing more energy, not less.

Ecosystem ecology: Deserts vs Rainforests

In ecosystem ecology, we examine how energy flows through a system. How much solar energy is captured, how much food is available, who eats whom, and what happens after things die.

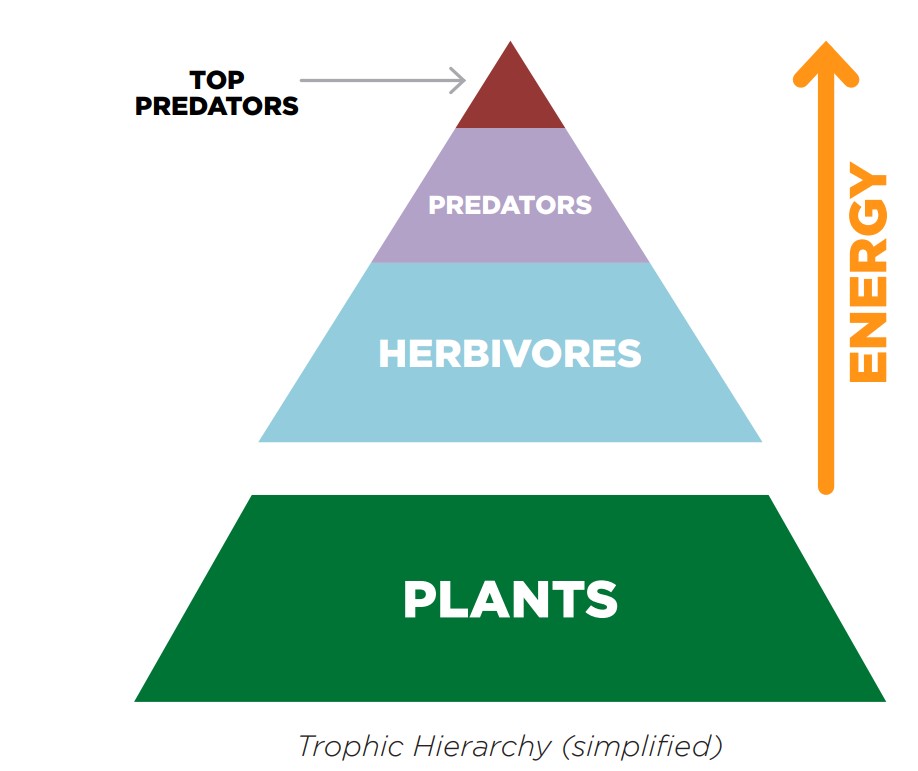

Energy (food) is the limiting factor in most ecosystems. Most food chains consist of three or four trophic levels.

The foundation of all ecosystems are the “primary producers”, which are mainly plants. These organisms produce their own energy, typically through photosynthesis. Without a robust population of primary producers, an ecosystem will be constricted. Then we have the “primary consumers,” typically herbivores, who feed on the “primary producers” (e.g. deer, buffalo, insects). Their limiting factor is finding enough plants to eat. Finally, we have “secondary consumers” which are the predators who eat the herbivores (e.g. wolves, bears, eagles). Their limiting factor is the availability of prey for hunting. Technically there are tertiary and quaternary consumers, but we’re keeping things simple.

The foundation of all ecosystems are the “primary producers”, which are mainly plants. These organisms produce their own energy, typically through photosynthesis. Without a robust population of primary producers, an ecosystem will be constricted. Then we have the “primary consumers,” typically herbivores, who feed on the “primary producers” (e.g. deer, buffalo, insects). Their limiting factor is finding enough plants to eat. Finally, we have “secondary consumers” which are the predators who eat the herbivores (e.g. wolves, bears, eagles). Their limiting factor is the availability of prey for hunting. Technically there are tertiary and quaternary consumers, but we’re keeping things simple.

Why are there fewer animals in a desert compared to a forest?

Deserts are defined by very little rainwater. For desert plants this means water is the limiting factor preventing growth. Cacti responded to this evolutionary pressure by developing spines (modified leaves) which minimize surface area which reduces water loss, as well as to protect themselves from animals who might eat them. A limited water supply means very few plants (primary producers) can survive here. Plants are the foundation of the trophic hierarchy and they’re very limited in deserts. With very little energy (food) at the base of the pyramid, deserts can only host a few primary consumers (herbivores). A few rodents, insects, camels, etc. With very little prey (primary consumers), it’s no surprise deserts can hardly sustain any predators (secondary consumers) such as snakes, coyotes, and roadrunners.Now compare this to a lush forest ecosystem. A strong foundation of plants (primary producers) can sustain exponentially more biodiversity up the trophic hierarchy. An abundance of plants feeds more prey, which in turn can sustain a healthy population of predators.

Bitcoin’s Proof of Work is a Darwinian Competition

Why does Bitcoin have miners anyway? Satoshi used Proof of Work (PoW) to create consensus reality in a distributed system when conditions may be hostile. PoW is also used to issue new tokens, fairly, according to the predetermined supply schedule.

Satoshi understood that monetary units must have “unforgeable costliness,” which is to say the creation of new monetary units requires a real cost (work) which can be easily verified. Fiat money (including Proof of Stake blockchains) is “costless” to produce which inevitably leads to a politically captured monetary system.Bitcoin’s Proof of Work function relies on two fundamental assumptions:

Thermodynamics – miners must consume physical energy (work) to generate hashes. Evolutionary Biology – humans are genetically programmed to be self-interested.

Bitcoin lives primarily in the digital realm. Proof of Work enables this digital organism to interface with the physical realm which provides thermodynamic certainty that the miners did the work. This interplay also enables Bitcoin to create incentives that disrupt things in the real world such as energy markets. Or as Dhruv Bansal says “bits move atoms.” The Bitcoin network pays miners for their work. Rational economic actors respond by competing for this bounty. How do miners find the best location, the right machines, and the optimal energy mix? No one knows. Instead we turn to the market. We let a thousand flowers bloom and only the best survive. Miners seek a balance of energy cost and long term political stability. Relocating when necessary to find a better niche upon which to plant roots. They put capital at risk and require multi-year time horizons to be profitable. This alignment of incentives is what makes miners good partners to the Bitcoin network.Zooming out to the entire miner ecosystem, it’s a Darwinian competition for who can source SHA-256 hashes with the greatest efficiency. Those who are adaptable and make the best decisions survive long term and are rewarded handsomely. The losers forfeit their capital, and their machines get recycled back into the ecosystem.

What do Wolves and Moose teach us about Bitcoin’s Difficulty Adjustment?

Satoshi needed an adaptive system that could plausibly survive long term.

What happens if Bitcoin experiences a rapid increase in hash power? Moore’s law alone would lead to increasingly better machines with exponentially increasing hashpower. If Moore’s law was not accounted for, Bitcoin’s programmatic supply schedule could not be trusted.

Alternatively, how could Bitcoin survive a sudden decrease in hashrate? If the system doesn’t adapt, the network may grind to a halt. China recently banned Bitcoin mining resulting in a 50% drop in hashrate.

Enter the “Difficulty Adjustment”. Every 2016 blocks (roughly two weeks) the system rebalances the difficulty of the computation the miners are attempting to solve in order to ensure blocks come in, on average, every 10 minutes and the issuance stays on schedule. This ensures the mining ecosystem is constantly seeking a dynamic equilibrium, longterm, under unknowable conditions.

Satoshi borrowed many principles from nature, including the difficulty adjustment. Let me explain…

Isle Royale is a natural laboratory for studying ecology

An example of this in nature is Isle Royale, an island located 15 miles from shore in Lake Superior. Wolves and moose are among the only animals living on the island. The moose is the only prey available for the wolf, and the wolf is the only predator concerning the moose. The simplicity and isolation of this ecosystem makes it the perfect laboratory for studying ecology.

The populations of moose and wolves on the island are constantly in flux. When the moose population is large relative to the wolves, even the weakest, slowest, oldest wolves get fed. But soon the over-sized wolf population decimates this food source. Now with little food for the wolves, the weakest will die from starvation, which reduces pressure on the moose population. Eventually a temporary equilibrium is reached. As it turns out, ecology comes with a built-in difficulty adjustment.

The same dynamic plays out in the Bitcoin miner ecosystem. When Bitcoin’s price is high relative to the total hashrate, even the slowest, oldest generation miners are profitable (fed). The good times don’t last as eventually the difficulty adjusts upward, and the least efficient miners must turn off (starve).

Just like the moose and wolves on Isle Royale, the miner ecosystem, modulated by the difficulty adjustment, is constantly seeking equilibrium where marginal cost to mine a block equals marginal revenue. At maturity, mining Bitcoin should be a relatively boring, low margin, business similar to an energy utility today.

You cannot cheat nature.

If the wolf doesn’t find a meal, it dies. There are no magic potions to revive the wolf. It’s necessary for the weakest individuals to be culled to ensure the rest of the population has enough food to survive. If a wizard did revive all the fallen wolves, they’ll eventually eat all the food and lead their own species to extinction.

We see this unnatural imbalance arise when central bankers bail out zombie companies. Sure you save one company, but you put the entire economy at risk. Rather, we must let the market settle and recycle capital.

Reviving the wolf and bailing out zombie companies are examples of cheating nature. Each time nature is cheated, long term systemic risk builds in the system increasing the risk of catastrophe or extinction.

Alternatively, there are no bailouts in Bitcoin. Bitcoin obeys the rules of nature. The net effect is accepting short term price volatility in exchange for long term systemic stability.

Energy Markets are Widely Misunderstood

This essay will rely on a few assumptions about energy.

Energy doesn’t travel well and cannot be easily stored. Supply must be near the demand. Battery tech is too expensive, building high voltage transmission lines is expensive, and there is significant loss of energy when transmitting over long distances. This leads to energy with no buyer, known as “stranded energy” supplies that are too far from sources of demand. Historically, aluminum smelting has absorbed some of this glut, but that requires high capex, it’s not modular, not on-demand, and cannot tolerate interruptible loads. In other words, Bitcoin mining is far superior for absorbing excess energy supply.

Energy ≠ electricity. These are often used interchangeably, but this is a mistake. All electricity is a form of energy, but not all energy is electricity. Energy can take many forms including mechanical, heat, and nuclear. The challenge is harnessing energy in a manner that is easy to deploy. What good is the sun’s energy if you’re not a plant or don’t have solar panels? Electricity, electrons on a wire, is a highly distilled, extremely dense form of energy with high fungibility making it deal for our grids.

Energy grids are forced to overproduce. Grids must produce enough capacity to satisfy peak demand (such as the hottest day of the year). However, average demand is typically less than 50% of the peak which leads to tremendous oversupply that just gets wasted. Not to mention, energy grids often require “peaker plants” which are power plants that only run when there is peak demand. These plants serve as “peak demand insurance” and tend to be CO2 heavy plants.

“Consuming electricity” doesn’t necessarily produce additional CO2. The CO2 is produced when we convert some energy sources into electricity. Practically speaking, anytime Bitcoin miners are consuming surplus electricity from the grid, there is no marginal increase in CO2 production. What percentage of Bitcoin’s energy mix comes from surplus electricity? It’s hard to calculate and always changing. Nic Carter explores this topic here.

Wind and Solar cannot save us. Energy grids need to temporally match the production and consumption of energy. We rely on nuclear and natural gas because they are consistent energy sources we call “base load.” Wind and solar are “intermittent,” unpredictable, and poorly tuned to the shape of demand which causes the duck curve. Put more simply, the sun only shines during the workday, when demand is low. Demand spikes after work when the sun is no longer shining. This mismatch causes grid congestion which can be remedied with Bitcoin miners in the short term, and (hopefully) increased transmission capacity and improved battery storage over the long term.

Now that we have a foundational understanding of Proof of Work, energy, and why harnessing more energy is better, we can build on it.

The Ecology of Energy Markets and Bitcoin

Let’s explore the base incentives driving energy utilities, Bitcoin miners, and then tie them both together…

Energy utilities are constantly trying to predict the future. What is the future demand for energy in my area? Who will purchase it and at what price?

This is a challenging endeavor making securing capital investment for energy assets tricky because ROI is long and there are many unknown and unknowable variables.

Bitcoin reduces economic uncertainty for energy producers. Before committing upfront capital, the utilities can lock in a captive customer in the form of a Bitcoin miner.

“Bitcoin isn’t competing for resources. Resources are competing for Bitcoin.” – Obi-wan Kenobit

Incentives driving the Bitcoin mining industry

Bitcoin miners only need three things: specialist hardware, energy, and an internet connection.

The primary cost is energy, which incentivizes miners to find the cheapest source. Usually this means Bitcoin miners seek out “non-rival energy” or energy that would otherwise be wasted. In fact, Bitcoin doesn’t waste energy, it often converts otherwise wasted energy into a highly liquid, digital, commodity. Not to mention, the Bitcoin miners pay for the energy, which by definition, means it’s not wasted.

From this vantage point, Bitcoin appears to be a permissionless energy sink. A “buyer of last resort” setting a global price floor for energy. Effectively, Bitcoin miners are a free-market energy subsidy. Over the long term this is a much more sustainable solution than the government issuing subsidies that cause unintended negative consequences such as malinvestment and making our economy more fragile.

This incentivizes humans around the world to produce energy more efficiently. Imagine how these incentives will change the world in a 100 years. More on that below.

What kind of organisms are Bitcoin Miners?

What kind of organism is Bitcoin? What makes Bitcoin miners uniquely valuable sources of demand? What niche do Bitcoin miners satisfy?

Bitcoin miners’ role, as a pioneer species, is to colonize harsh environments and convert them into a complex system full of biodiversity. Usually pioneer species are plants, fungi, and lichen.

What makes a good pioneer species? They are hardy, drought-tolerant species that cooperate well with others and can easily disperse their seeds (highly mobile) to ensure many ‘chances at success.’

This forms a nice parallel with the energy industry. What makes Bitcoin miners an attractive partner to energy utilities? Bitcoin miners are a unique source of demand due to: colocation, interruptible load demand, and high mobility.

Colocation: Since shipping energy long distance is inefficient, capital-intensive, and portable modern battery tech doesn’t scale well, much of the energy we produce has no buyer (which is where the “stranded energy” term comes about.)

However, Bitcoin miners are able to travel to the energy source (colocate) and monetize excess energy capacity that would have otherwise gone to waste. The Bitcoin Mining company, Great American Mining, calls this “bringing the market to the molecule.” This symbiosis reduces risk/uncertainty for the energy utilities and allows Bitcoin miners to gain access to cheap energy.

From an ecological perspective, colocation illustrates how Bitcoin is uniquely able to survive under any condition. If someone figures out how to harness energy on the north pole, Bitcoin miners can survive there. If we harness geothermal energy inside a remote volcano, Bitcoin miners can survive there. Bitcoin miners aren’t picky eaters, they can consume any frequency or flavor of energy that can be turned into electricity. No other source of energy demand can do this. Of course, Bitcoin miners cannot do this alone, they form symbiosis with the energy utilities which provide them with cheap food (energy).

Interruptible load: Most industrial consumers, such as factories, hospitals, and data centers, require predictable, reliable energy supply, otherwise they’ll face catastrophic consequences. Bitcoin miners prefer consistent supply but they can handle power outages or reductions with little consequence. This makes Bitcoin miners uniquely symbiotic with energy grids serving as “demand response” partners. If energy is ever in short supply, people get priority over Bitcoin miners. However whenever there is excess energy, it gets monetized. This symbiotic relationship leads to more energy abundance generally.

In ecological terms, being tolerant to “interruptible load” is like being “drought tolerant.” Life as a pioneer is harsh and unpredictable. Success comes to those who can survive a drought. Bitcoin miners can turn off at a moment’s notice and thrive without 100% uptime unlike fragile species such as hospitals or people heating their homes during winter.

Mobile/Portable/Recyclable: Most sources of energy demand are in a fixed location. While the aluminum smelting plant is a great user of excess energy, it cannot be moved if there are fluctuations in the energy market. Conversely, because mining hardware is quite portable, miners can chase energy surplus wherever it occurs.

Historically, Chinese miners would move to Szechuan during the rainy season to take advantage of excess hydroelecticty, then leave during the dry season when energy prices increased. However, China banned Bitcoin mining in 2021 which led to a 50% decline in hashrate. This is an example of a niche disturbance which changed incentives and led to hash power migrating to friendlier jurisdictions. Six months after China’s ban, Bitcoin hashrate made a full recovery which demonstrates it’s resilience.

The ecological parallel here is how pioneer species can easily disperse their seeds (mobility). Some pioneer species reproduce with spores that are lighter than air, some float through the ocean until finding dry land, others trick birds to eat their seeds, which they defecate serving as fertilizer.

In summary, Bitcoin and energy utilities are symbiotic. Miners improve the economics of energy utilities, provide jobs, and increase resilience of the grid. In exchange, miners receive cheap energy and gain powerful allies in the form of local governments. Over time, the energy utilities who partner with Bitcoin miners will outcompete those who do not.

Small change in incentives, big impact.

What Niches Do Bitcoin Miners Satisfy?

Bitcoin miners satisfy two primary niches.

First, we have existing energy assets with excess capacity. This ecompasses the vast majority of our existing infrastructure including energy grids, upstream oil and gas, nuclear, seasonal energy sources like hydro, intermittent energy sources like solar and wind, and many more.

Bitcoin miners collocate with existing energy producers and buy up all the cheap energy supply that would otherwise go to waste. West Texas is a great example of this symbiosis in action. Energy producers are more profitable, energy costs decline, and the grid becomes more reliable for everyone.

In ecology, this is an example of “secondary succession,” in which plants and animals recolonize a habitat after a disturbance – such as a flood or wildfire. The disturbance injects new incentives which lead to a restructuring of the entire ecosystem. In this analogy, Bitcoin miners are the disturbance which restructures the incentives of the entire energy ecosystem.

Second, we have untapped energy assets that haven’t yet been harnessed (energy deserts). This includes geothermal energy from volcanoes, mountainous regions with wild rivers, sunny regions, windy regions, and any number of potential energy assets that aren’t currently developed due to economic reasons or otherwise.

Bitcoin uses simple economic incentives to unlock this latent energy supply. From the energy producer perspective, Bitcoin miners are captive customers with stable, predictable, demand. They serve as a subsidy to bootstrap new energy investments by reducing risk, accelerating return on investment, and lowering the cost of capital. This will result in net new energy investments that previously weren’t possible without symbiosis with Bitcoin miners.

Back to ecology, bootstrapping net new energy projects is an example of “primary succession,” in which organisms colonize a new habitat for the first time. Effectively turning a desolate wasteland into a complex ecosystem. In this analogy, Bitcoin miners are “pioneer species” uniquely qualified to colonize new territory (bootstrap latent energy sources).

Much ink has been spilled demonstrating how Bitcoin miners are symbiotic with existing energy assets (secondary succession).

Let’s focus on primary succession and how Bitcoin will help bootstrap net new energy assets that will pave the way to prosperity.

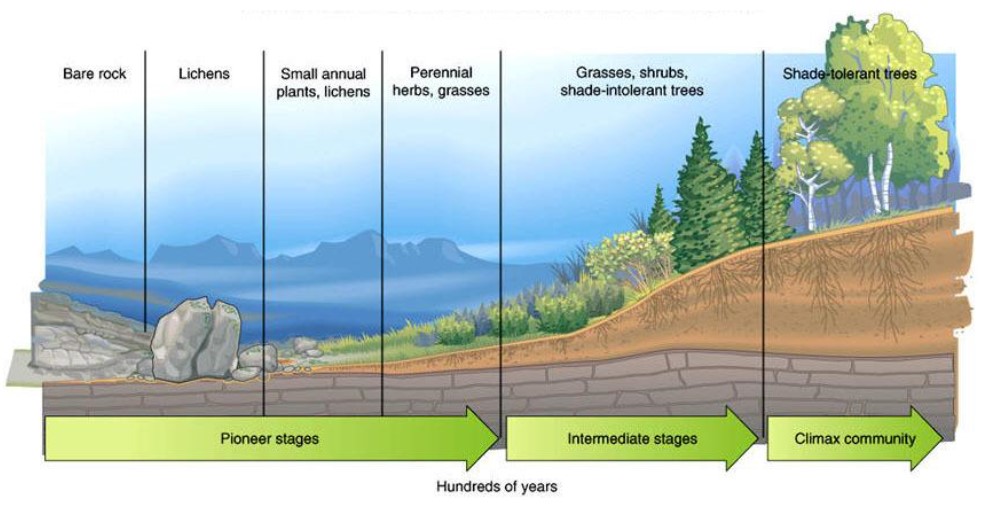

Ecological Succession: From Pioneer Species to Climax Community

Pioneer species first colonize a new hostile niche. Fungi, lichens, and primitive plants are good examples. They take the most risk and fail often. Yet they play a crucial role. Without pioneer species, complex ecosystems could never get off the ground.

Eventually pioneer species are displaced by “intermediate species” which are more suitable to the changes in the environment made by the pioneer species. Intermediate species include grasses, shrugs, and shade-intolerant trees.

This process of ecological succession continues for hundreds of years until the ecosystem becomes a “climax community.” Climax communities are relatively antifragile, support large trees, and can sustain a rich diversity of predators and prey.

Bitcoin is a pioneer species that colonizes energy deserts.

Surtsey, an island off the southern coast of Iceland, is an iconic example of a place where primary succession has been studied for decades and where human disturbance has been minimised due to significant geographic isolation and early protection efforts.

In 1965 a volcano erupted destroying all life on Surtsey. A year later scientists found some hardy plants had already colonized the island which jump-started the process of primary succession. Fast forward a few decades and it’s a thriving ecosystem where the original plants have been displaced by more suitable intermediate creatures. After being displaced, the pioneer species reproduce and attempt to colonize a new barren wasteland.

Bitcoin acts like one of the pioneer species on the island of Surtsey. It incentives investors to bootstrap energy sources that aren’t currently being harnessed. In the early stages, Bitcoin miners serve as captive demand, reducing the risk and the time to value of the energy asset.

Over time this leads to an increase in energy production and a decrease in cost. Abundant energy also attracts higher value use cases for energy such as industry, the intermediate species of this example.

Industry creates jobs, then people move nearby who subsequently need houses and basic services. Before long you have a little boom town, similar to what we saw in the Gold Rush of the mid 1800’s or on the Bakken oil field in North Dakota today. This boom town is now an “intermediate community” and the new industrial consumers eventually outcompete Bitcoin miners for energy supply (they’re willing to pay more). The ecosystem is thriving due to energy abundance and wealthy shareholders from mining Bitcoin.

The boom town is now able to outcompete nearby ecosystems who have less energy and wealth. This creates a positive feedback loop leading to more jobs, more people, more abundance, and a more complex culture. Rational companies and politicians will now defend Bitcoin because it’s crucial to the success of their city. Eventually this former energy desert will become a climax community.

Climax communities are vibrant human civilizations with access to large amounts of low cost, reliable energy. They’re full of cool neighborhoods (microclimates), successful corporations (apex predators), and become culturally rich with music, food, and people (biodiversity). This isn’t a fragile gold mining boom town anymore. As complexity (biodiversity) of the community increases the system becomes increasingly more prosperous and antifragile.

These climax communities will owe their success to a subtle shift in incentives created by Bitcoin’s Proof of Work mechanism.

What happens to the displaced Bitcoin miners (pioneer species)?

A few Bitcoin miners stay around and continue soaking up any excess energy capacity. These would most likely be older generation miners which are less efficient (hashes per unit of energy) and thus come with a lower opportunity cost. They can handle intermittent load and serve as a background player stabilizing the new grid and ensuring maximum efficiency of all energy produced.

Most Bitcoin miners, however, are displaced by consumers who are willing to pay a higher price for energy. Just like the pioneer plants on Surtsey, they traverse to new areas by releasing airborne seeds carried by the wind and birds. Eventually these “citadel seeds” find a suitable niche (energy desert) and once again serve as a pioneer species in the new location, bootstrapping the entire process again with the benefit of genetic wisdom passed down from the previous generation.

Over time, the selective pressures weed out the weakest miners and select for those who can manage capital well and form symbiosis with energy producers best. Individual miners are self-interested, and yet the miner ecosystem as a whole is effectively competing for “who can benefit humanity the most.”

Let’s examine a few more real world examples

Located in the Democratic Republic of Congo lies Virunga, Africa’s oldest National Park. It serves as both an ambitious wildlife conservation project and a crucial economic hub for over five million people living nearby.

According to the Virunga Alliance, which aims to foster peace and prosperity through responsible economic development of natural resources:

“Virunga National Park’s resources have enormous economic value. When these resources are poorly managed, they can lead to extreme cycles of violence. Cultivating peace and stability in the region is tied to the Park’s ability to harness the wealth of the Park to help build new jobs and opportunities for the local population.”

Less than 10% of the Congolese have access to power which, understandably so, leads to citizens cutting down trees to stay warm and cook their food. Cooking with biofuels is a leading cause of indoor air pollution and results in millions of deaths annually, usually young children.

Hope is not lost. The Virunga Alliance has partnered with the EU and Bitcoin miners to harness latent hydro power found in the vast mountainous regions in Virunga. Bitcoin miners effectively subsidize existing energy hydro (secondary succession) and incentive development of new hydro coming online (primary succession).

This symbiosis will promote economic development, help stop deforestation, create jobs, attract industry which will reduce reliance on imports, preserve endangered species, prevent unnecessary deaths caused by cooking with biomass, and reduce violence caused by systemic poverty in the region.

Energy abundance created in part due to Bitcoin miners gives hope for the future of the region. There will undoubtedly be challenges along the way, but the foundational conditions are met to encourage an underdeveloped region to one day become a climax community.

Next time you hear some privileged journalist claiming “bitcoin wastes energy” – point them to Virunga as an example of Bitcoin providing humanitarian, economic, and environmental aid to a neglected region on a neglected continent.

Other examples of Bitcoin miners serving as pioneer species around the globe:

Volcano mining in El Salvador – their Bitcoin profits are being used to build 20 new schools and a veterinarian hospital.

Hydro mining in Laos – One of the poorest countries in the region and an abundance of excess hydro power on the Mekong River. Laos expects to earn $190M in 2022 from Bitcoin mining alone.

Geothermal in Kenya – vast untapped geothermal is just waiting to be harnessed. Kenya lacks the capital needed to develop this energy and Bitcoin Miners can help.

Hydroelectric in Ethiopia – 90% of their power comes from hydro and much of it is stranded. Bitcoin miners serve as a revenue source for utilities until infrastructure to distribute energy can catch up.

Harnessing energy anywhere can now be monetized

Existing energy assets are more economical due to symbiosis with Bitcoin miners

Cost of capital for net new energy assets has decreased

Looking forward: How Human Civilization Becomes a Climax Community

Human civilization in 2021 is at best an “intermediate society.” We’re no longer a pioneer society struggling to get by, yet we have a long way to go before claiming to be a “climax community.”

Bitcoin miners shake up society by introducing new incentives. While it’s impossible to predict exactly how a complex system (civilization) will respond, we can use ecology and systems thinking to make predictions.

First, a quick recap of the new incentives

Now that we understand the incentives at play, let’s speculate on where these incentives might take us in the next 10, 100, or 1,000 years…

Bitcoin Mining leads to Energy Mastery

Bitcoin mining is a species-level incentive leading to energy mastery. It acts like a free market subsidy for the entire energy industry. Just imagine what humans can accomplish after 100 years of emergent, free-market, energy bounties?

Similar to how demand for online streaming services drove investment into broadband infrastructure, Bitcoin creates demand for energy which will drive investment into energy infrastructure.

Expect total energy production to grow dramatically, new energy sources becoming economical for the first time, declining energy costs globally, and futuristic new energy assets that will only be made possible due to increased incentives for R&D.

Rather than relying on government subsidies which distort the market, the invisible hand of Satoshi can guide us towards a type-1 civilization.

Bitcoin miners and energy producers will likely merge. MBAs will call this vertical integration, Ecologists will call this “co-evolution.” Some say we’ll even price energy in satoshis some day.

What fraction of the world’s electricity will be used to secure the money supply? Dhruv Bansal theorized that we’ll eventually hit a saturation point called the “Nakamoto point” where the marginal revenue from PoW will equal the marginal revenue from selling energy to the grid. Mining above this saturation point would be uneconomical, and mining less would be wasteful.

As our energy constraints decline, new technologies will become economical such as desalination plants, removing CO2 from the atmosphere, producing green hydrogen, molecular weight refineries, space travel, and terraforming Mars.

On a microscale, anything that uses heat as a resource can be made more economical through symbiosis with Bitcoin mining. For example, individuals can heat their home or greenhouse with the waste heat from their ASIC rigs.

More importantly, however, is that energy mastery will do more for humanitarian causes than all the NGOs combined.

Energy mastery will raise the minimum standard of living globally

Energy that is both reliable and abundant is key to food security, shelter, clean water, education, and a prosperous economy. Sub-Saharan Africa needs the most help. According to the IEA, this region is home to 500 million people without electricity and 900 million lack access to clean cooking fuel.

Much of Africa is rich in untapped renewable energy sources such as hydroelectric, solar, and geothermal. Unfortunately, it also lacks the capital investment required to harness this energy. This is a complicated problem but Bitcoin will undoubtedly be part of the solution.

“Instead of relying on altruism or sliding deeper into debt, EM countries can finance renewable energy farms and harness vast natural resources via Bitcoin mining and generate immediate revenue to expand electrification and “close the energy access gap” – Alex Gladstein, Chief Strategy Officer of the Human Rights Foundation

Pakistan produces more energy than it consumes and yet major cities regularly suffer blackouts because they lack the infrastructure to transport the energy to where it’s needed. Building this infrastructure is expensive and so is servicing the debt on these energy assets. This leads to rising energy costs in Pakistan which lower quality of life dramatically.

Bitcoin miners could serve as a steady source of demand to monetize its stranded energy. This would improve the economics of its energy assets, would free up capital, eventually leading to declining energy prices and higher quality of life.

Hopefully one day developing countries can enjoy a similar living standard as the developed world.

Early adopters will leapfrog the laggards

The first companies on the internet were appropriately rewarded for being both right and early to a new technology. The same story is unfolding with Bitcoin and Bitcoin miners.

Developing countries have a unique opportunity to simultaneously harness more energy while generating tremendous wealth by mining Bitcoin.

Norway’s sovereign wealth fund is a nice parallel. They nationalized and monetized their natural resources (mostly oil) providing long term economic stability and a high quality of life for its residents. Developing nations can both mine Bitcoin and buy Bitcoin for their sovereign wealth fund.

Countries such as Ethiopia, Kenya, Laos, and El Salvador (mentioned above) are sitting on abundant geothermal and hydroelectric potential. By monetizing these assets with Bitcoin, they may leapfrog the late adopters and become new climax communities.

The Great Spreading Out

Historically, humans built civilizations alongside rivers which provide transportation, energy, food, water, and defense. These hubs of transport, energy and commerce created new opportunities attracting more and more people. Post industrial revolution, the migration to cities accelerated and has been called “the great urbanization.”

Both China and the World Economic Forum’s vision of the future involves continuing the trend of urbanization. They seek centrally planned mega-cities controlled by sophisticated social credit systems. This techno-fascist few of the future results in citizens “owning nothing and being happy.”

We only have two ways to coordinate society at scale, with cooperation or coercion. The global “elite” choose coercion while the Bitcoiners choose cooperation. Which way western man?

A practical way to opt out of this madness.

Great news for anyone who values market-based economies and individual freedom: there may be another path.

Bitcoin mining provides a key to unlock nascent potential in distant rural areas, rich with latent energy sources. As these new latent energy sources come online, humans will follow the energy sources resulting in “the great spreading out.”

Bitcoin miners will monetize these energy assets, turning them into the nucleus of a new type of human organization. With abundant power and wealth supported by mining Bitcoin, these startup cities will attract ideologically aligned people who diverge from mainstream culture. They will become increasingly self-sufficient, experiment with forms of governance, form special economic zones, and eventually become fully self-sovereign city states (citadels).

Bitcoin mining is necessary, but not sufficient. The 21st century citadel toolkit also includes widespread cryptography, ubiquitous internet access, self-sovereign money, remote work, regenerative agriculture, and more.

These citadels must succeed for they have an important duty. They must preserve the spark of freedom, for I fear it’s more fragile than we know.

In Harmony with Nature

The world is a complex place and lately it feels like things are going off the rails. The central planners underestimate the complexity of the world and make poor decisions in haste. This results in unintended negative consequences affecting everyone. As they say, ‘the road to hell is paved with good intentions.’

Good intentions aren’t good enough. Results are all that matter. If we hope to improve the complex system we call society, we need to carefully fix the incentives.

Through ecology, we can see Bitcoin as a subtle disturbance which changes the incentives around two foundational systems in society – money and energy. This provides digital sound money and eventually mastery over energy. Together these will serve as pillars of progress in the 21st century.

Now go forth and plant citadel seeds all around the universe.