Bitcoin Behind the Veil

I. Introduction

In which kind of world would you prefer to live, a world with bitcoin, like our own, or a world without bitcoin, one like ours but where bitcoin had never been invented?

Although a responsible answer doesn’t come as easily as most would think, I prefer the bitcoin world. Strongly. But what I’ll explain here is not so much why I prefer the bitcoin world but how I’m led to prefer it. So instead of listing reasons for being pro-bitcoin, I outline a method for deciding whether one would prefer to live in a world with or without bitcoin. The method is designed to help us overcome biases that might otherwise skew our judgments. In my view, those who use the method will likely discover that they, too, prefer to live in the bitcoin world, as long as they are suitably informed, honest, and reasonably self-interested.

Before I outline the method, let me first explain why we might need it. Many seem to believe that bitcoin lacks serious tradeoffs. Critics often deny that bitcoin benefits the world in any substantial way. Meanwhile, proponents often seem to deny that bitcoin’s benefits come at any substantial cost, including some costs we might not now comprehend. The critics often miss the potential benefits, and the proponents often miss their costs. Any serious progress on the question about bitcoin requires that we adopt an open attitude for weighing its potential costs and benefits, even if doing so makes us uncomfortable.

Second, after we adopt an openness to bitcoin’s potential tradeoffs, we must begin to identify them. Here, we quickly face some daunting challenges. For one, bitcoin’s consequences are best evaluated across several different disciplines and likely reach both around the globe and far into the future. So we need an interdisciplinary, global, and somewhat speculative perspective to weigh these potential consequences. But most of us are experts in at most one or two fields, know little beyond our small pockets of experience, and have too narrow an imagination to survey the relevant possible futures. So we must hold our conclusions tentatively, ready to accept further evidence that could tilt the scales the other way.

Finally, having identified the tradeoffs, we need to weigh them properly. This weighing requires some familiarity with a range of academic disciplines. Philosophy, in particular, houses various frameworks for evaluating things as good or bad, as well as methods for choosing one of these frameworks over the others. Yet — and here’s another problem — philosophers themselves disagree on these matters. Given what we know about human cognition, discussants will gravitate towards the frameworks that confirm their prior opinions.

So, to review, we must overcome three challenges to evaluate bitcoin fairly. We must adopt

(i) an openness about bitcoin’s tradeoffs,

(ii) a humble, interdisciplinary, and global perspective to identify them, and

iii) a fair framework to assess them.

Soon, I’ll outline a framework that encourages openness towards any kind of evidence and so disposes one to welcome evidence no matter its source or content.

The main challenge to assessing bitcoin, in my view, owes to biases stemming from self-interest. Bitcoin’s critics and proponents alike seem to assess bitcoin not against the truth but against their own desires. How can we fairly evaluate bitcoin if money and power lure us away from a sober-minded assessment of reality?

In what follows, I show how we can protect against the biases of self-interest in deciding whether we’d prefer to live in a world with or without bitcoin. I outline a method which helps people shed their biases. The method doesn’t import my values, political beliefs, or opinions about the just distribution of goods. It simply offers a fair procedure for deciding whether you would prefer to live in a world with or without bitcoin.. Although the framework doesn’t expand our individual areas of expertise, a wider community of inquirers might use the method collectively and so update the method’s conclusions as new and varied pieces of evidence roll in.

Before I present the framework itself, let’s cover in more detail the problem it’s designed to overcome. In the next section, I describe the bias of self-interest and explain why bitcoin’s critics and proponents likely fall under its spell.

II. Self-Interested Biases

People tend to favor proposals that would benefit themselves and reject proposals that, at their own expense, would benefit others. If you were wealthy, you’d probably reject calls for higher taxes and more welfare programs. If you were poor, you’d probably call for higher taxes and more welfare programs. I don’t just mean that the currently wealthy tend to endorse proposals thought to benefit the wealthy and that the currently poor tend to endorse proposals thought to benefit the poor. I mean something stronger — even the actual, presently poor would likely endorse proposals thought to benefit the wealthy if they had been wealthy. And even the wealthy would likely endorse proposals thought to benefit the poor if they had been poor.

Research suggests that our self-interest affects not only which policies we prefer but also how strongly we prefer them, given our beliefs about how the policy would affect us. We’re drawn like magnets to policies that seem to benefit us. If you’re tempted to say otherwise, consider what the world would be like had the currently poor been rich and had the currently rich been poor. Would the wealthy of such a world mostly favor much higher taxes on themselves? Would the poor mostly reject welfare programs? Lotteries provide a glimpse into such a world since lottery winners often transform from rich to poor overnight. And their attitudes about taxes change predictably. Our judgments about policy proposals often reflect our individual stations in society — or, at the very least, what we want others to believe about ourselves

Our biases don’t suddenly deactivate when we discuss bitcoin. And both critics and proponents bear the tale-tell signs of biased self-interest. To no one’s surprise, many bitcoin proponents hold bitcoin or work for bitcoin companies. Granted, several proponents assessed bitcoin positively first and then later bought and chose to work for its success. Even so, these proponents have now bet their finances and their reputations on bitcoin’s success, myself included. Given this “skin in the game,” proponents surely have some pro-bitcoin bias that doesn’t necessarily track the truth. This is how bias works — and few elude its grip

But the point goes both ways — bitcoin critics also stand to gain from its failure, and they rarely if ever acknowledge it. So let’s review a few different ways that different kinds of critics stand to gain from bitcoin’s failure.

First, bitcoin threatens powerful nodes in the traditional financial system. Would you like to hyperinflate your currency to profit from seigniorage at your citizens’ expense? Bitcoin’s non-discretionary, disinflationary monetary policy provides a more fair alternative.

Or would you like to leverage your reserve currency for meaningful economic threats to other countries and corporations? Bitcoin’s censorship-resistance offers an escape route.

Perhaps you would like to leverage your piece of the financial railway and track whose money goes where so that you can sell this information to the highest bidder and block financial activity that you dislike. Bitcoin’s network offers a more private detour.

From Bitcoin’s design alone, we could have predicted the sources of bitcoin’s most influential criticisms. That is, the very people we’d predict to criticize bitcoin are the very people whose power it threatens — the old-school financial elite and those who benefit from being close to them. (Not every critic falls in these two camps, but many of the rest fall in a third camp: those who either naively trust the first two camps or else want to be liked by them.) We have good reason to suspect that the bias of self-interest underlies some prominent public denunciations of bitcoin.

Second, we generally fall prey to powerful self-enhancing biases that paint a rosier picture of ourselves than the total evidence warrants. Since so many critics have been so wrong about bitcoin’s trajectory, we would expect that this self-enhancing bias has a bigger effect on critics than on proponents when it comes to debating bitcoin overall.

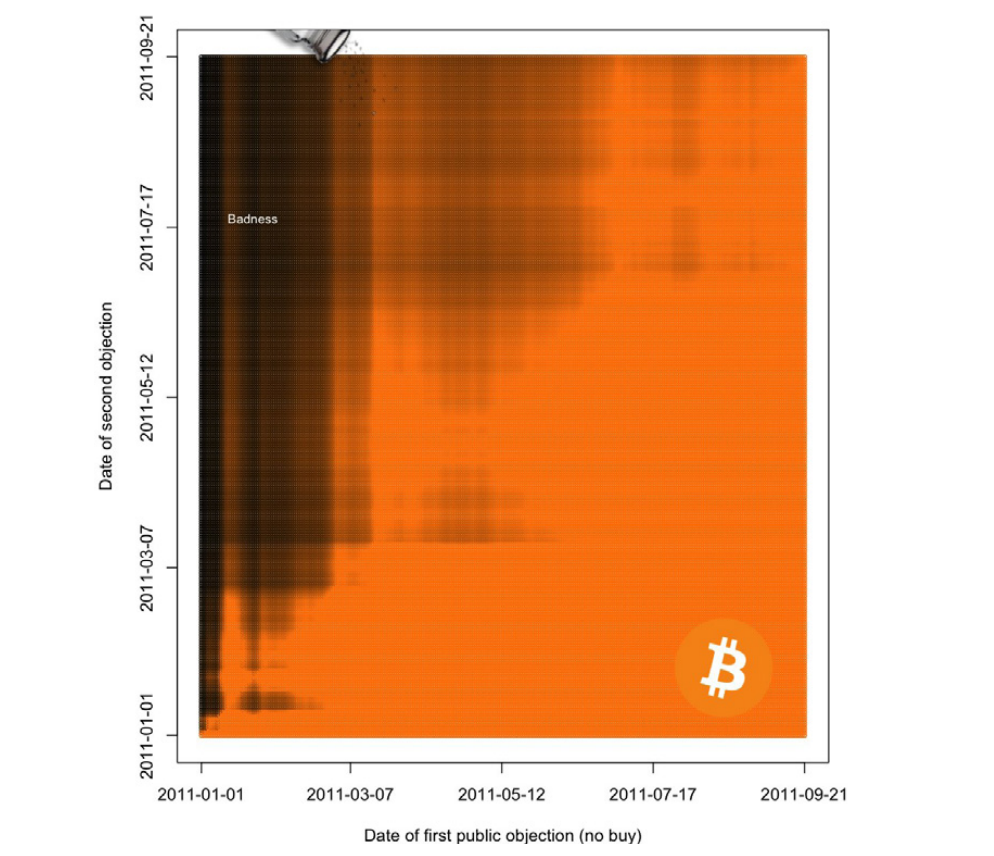

Many had the chance to buy bitcoin early but chose not to, even though their areas of expertise should have enabled them to see bitcoin’s early potential. Given the enormous returns of early bitcoin investors, we’d expect many early critics to double down as critics after seeing that being a critic early on cost them millions. As someone who has lost some money on options-trading, I know first-hand how painful it is to admit such mistakes. So I can’t imagine how painful it must be to admit publicly that, despite being in the right place and the right time, with all the requisite background knowledge, you cost your family generational wealth by being wrong not just once but continuously over several years. Before these critics could address bitcoin without bias, they’d need one or two rounds of industrial-grade desalination. (@takenstheorem and I once collaborated on a salinity coefficient to measure how salty–and, therefore, how biased–a critic might be given bitcoin’s price at their first public condemnation.)

Figure 1. A visual representation of the Salinity Coefficient. For explanation, see https://twitter.com/takenstheorem/status/1359896102141591555.

So, to be fair, let’s admit that each side in the debate likely harbors some powerful biases. The desire to increase or retain one’s wealth and power fuels the bias of self-interest. And, like ramparts, self-enhancing biases block counterevidence that might undermine a positive self-image. As cognitive science teaches us, the effects of our biases aren’t transparent to us. So we can’t overcome them as easily or as nonchalantly as we might decline a post-dinner espresso. Biases don’t work that way.

We need a tool that helps neutralize bias, one that provides a fresh perspective on bitcoin. I aim to provide that here and show how it works. It’s a thought experiment. And if we fleshed it out adequately, I suspect that most people who used it would decide that they, too, prefer to live in a world with rather than without bitcoin–if only they were suitably informed, self-interested, and honest. And this holds even for elites like Elizabeth Warren and Steve Hanke who have made themselves public enemies of bitcoin.

Let’s get to the thought experiment, then.

III. The Veil

You awake in darkness as a calm voice reassures you:

“… You might feel disoriented, but everything will be okay. You signed a waiver to take a pill that temporarily erases all personal memories. You signed the waiver because you believed, as we do, that each of us would evaluate policies more reliably were we unaware about their effects on us individually.”

The pill you’ve taken has temporarily erased any memories of personal experiences, including memories about your family, your ethnicity, wealth, citizenship, gender, etc. These memories will return in five hours. Until then, you will evaluate the following question:

Would you rather live in a world with or without x-money?

X-money isn’t a particular money, like the dollar, but a category of money defined by a particular set of features. Those features split into two. The first features include those more familiar features of durability, divisibility, portability, fungibility, etc. These features make x-money an apt form of money. The remaining features distinguish it from traditional forms of money. X-money is:

Non-discretionary. No politicians or central bankers control its supply at a time or over time. The monetary policy is automated and disinflationary.

Accessible. Sending and receiving x-money is possible worldwide with nothing but a basic device connected to the internet.

Permissionless. Anyone can send or receive x-money without relying on the implicit or explicit permission of any state, corporation, or authority.

Private. Under best practices, using x-money does not reveal your identity or past transaction history to anyone.

You now must decide whether you’d prefer to live as an arbitrary person in a world either with or without x-money. To assist you, you’ll have access to our experts and exhaustive data sets on human psychology and economics, as well as various truths about wealth distribution, financial access, central banking, payment networks, and the range of personal freedoms around the globe.

IV. Two Worlds

Let’s pause the veil experiment momentarily to say something about the two worlds you’ll examine from behind the veil. Each is what philosophers call a possible world, a complete way the world could have been. The 16th century philosopher Gottfried Leibniz was the first to develop a philosophically interesting theory of possible worlds. For Leibniz, possible worlds were ideas in God’s mind. The actual world exists because God actualized, or brought into reality, the best among all possible worlds. Ever since Leibniz’s time, philosophers have proposed a range of theories about both the nature of possible worlds and the nature of our knowledge about them. But neither of those issues concern us here. Behind the veil, we simply assume you compare two possible worlds, in particular. I’ll say more about these two worlds shortly.

Possible worlds can also be more or less similar to each other. The possible world which differs from ours in nothing except the trajectory of a single particle in deep space is more similar to our possible world than the possible world in which a nuclear catastrophe devastates the earth in 1991. In the 20th century, the great metaphysician David Lewis offered a useful framework for ranking the overall similarity each possible world has to all others. The framework doesn’t hold up in all its details. But we don’t need a perfect method for evaluating the similarity relations among worlds to accept that some possible worlds are much more similar to each other than they are to some other possible worlds. We’ll ignore the details and difficulties in proposing such a method for ranking and simply take it for granted that there is at least one such ranking, perhaps yet to be discovered, which would suit our purpose.

And our purpose is this: the veil’s architect has chosen two worlds much like our own. One is so much like the actual world that it is the actual world. Complete similarity is one kind of similarity. And since bitcoin meets the criteria for being x-money, our actual world is a world with x-money.

The other world you’ll evaluate is very similar to what the world would have been like had no form of x-money ever been invented. Presumably, there are infinitely many possible worlds where the timeline goes this way. Which one has the architect chosen for you to compare with the previous world? This is where something like Lewis’s similarity metric comes to the fore. We choose a world that’s qualitatively identical to ours up through the time that Satoshi discovers how to implement x-money. But then it diverges ever so slightly so that the world is much like it is today in the actual world but no form of x-money ever exists. We needn’t think that there’s just one such possible world. Likely, there are infinitely many such possibilities. As long as the world is similar enough to ours, the architect can simply pick one from a range of sufficiently similar worlds.

In the thought experiment, then, you’re presented with these two worlds: (1) the world with x-money, bitcoin-world, and (2) a world much like ours but without x-money, which we’ll call y-world.

Importantly, behind the veil, you don’t know that bitcoin-world is the actual world. You just have these two worlds before you, and all that happens within them. Your job is to compare them and decide which one you’d prefer to live in as an arbitrary person. If you were going to be an arbitrary person in one or the other, which world would you rather inhabit?

V. Risky Business

Your preference to live in one world or the other, behind the veil, would amount to preferring to be some arbitrary person in one world rather than the other. But, since you don’t know which person you’d be in either world, you have to assess the risks of being a random person in one world against the risks of being a random person in the other. So you need to calculate, as best you can, the expected utility of either choice. This puts us squarely within the realm of decision theory.

According to orthodox decision theory, when we decide between multiple options, we should choose the option with the greatest expected utility. An option’s expected utility is the result of multiplying its utility (or value) with its associated probability. Consider, for example, a decision with two choices, A and B:

| Option | Utility | Probability | Expected Utility |

| A | 7 utils | .7 | 4.9 |

| B | 9 utils | .3 | 2.9 |

Although Option B would have more utility than Option A, B has a lower probability of success than does Option A. Given orthodox decision theory, one should prefer the option with the greatest expected utility — Option A.

Now, you might think that we could use the expected utility calculus to make our decision about bitcoin-world and y-world. Here’s how this might go. For bitcoin-world, calculate the utility of being each person, add all these values together, then divide by the total number of people in the world. This provides the average expected utility of being a person in bitcoin-world. Then, do the same for y-world. Finally, choose whichever world has the greater average expected utility. But this decision-making process behind the veil is incomplete, as Lara Buchak has convincingly argued.

Suppose that one world has relatively few people with super high amounts of utility but many, many more people with very low amounts of utility. Would you risk being a random person in such a world, given such a significant chance of having a low-utility life? Or would you rather live in a world with a little less overall expected utility, but where the utility is more evenly spread across people? I know how I’d answer: I’d rather not play Russian Roulette with the overall course of my life. So I’d choose the second world. I’m relatively risk-averse. That’s why I don’t do hard drugs, ride motorcycles, free solo steep cliffs, or vacation in Afghanistan — no matter how fun these might be. The risks trump the rewards.

We can model anyone’s appetite for risk with a personalised risk function. A risk function represents a person’s willingness to accept the risk of something worse in exchange for the possibility of something better. Risk functions can model risk-averse attitudes, risk-seeking attitudes, and anything in between. Since the decision behind the veil involves perceived risk — you don’t know which person you’d be in either world — you should apply your own particular risk function to calculate your preference rather than rely on the expected utility of being a random person within each world.

We needn’t wade into the mathematical intricacies to understand how risk functions work. For our purposes, three facts about risk functions will suffice.

First, someone with a neutral risk function simply maximizes expected utility, no matter how risky the choice is.

Second, risk-seekers weigh outcomes better than the minimum more heavily than we would expect from the expected utilities alone. That is, a risk-seeking person places a premium on better outcomes and is more willing to face the chance of a bad outcome in exchange for the possibility of a better outcome.

Third, the risk-averse weigh outcomes better than the minimum less heavily than we would expect from the expected utilities alone. A risk-averse person discounts better outcomes and is less willing to face the chance of a bad outcome in exchange for the possibility of a better one.

Behind the veil, you calculate the utility of being each person in each world and then apply your personalized risk function. But we immediately face two difficulties. In the thought experiment, you have access to the utilities of each person in each world and you know, roughly, the shape of your own risk function. We have access to neither of these things, not with any sort of precision anyway. So we will do the best we can with a bit of guesswork.

VI. Calculation in Progress

To help us compare the utilities of people in both worlds, we will look at two data points. We’d need to look at several more to approach any kind of exhaustive search for evidence. So the point here isn’t to settle the debate once and for all, but to model how one should make the decision behind the veil.

The first data point: according to a 2017 World Bank report, around 31% of adults globally lack a traditional bank account. 26% of the unbanked blame the cost of banking. 21% blame distance.

16% distrust traditional banks.[1] For the sake of argument, let’s assume that the group that blames the cost of banking contains those who cite distance and distrust as reasons for not having a bank account. This is likely not true, but it simplifies the evidence in favor of those dispositionally against bitcoin because it shrinks the number of people with bad outcomes.

A. Banking

Even with our simplification, however, about 1/12th of the world population attributes their lack of a bank account to some combination of its cost, distance, and distrust. We will take these people for their word and suppose that this is true of both bitcoin-world and y-world. But, given bitcoin’s presence in bitcoin-world, any of its denizens can access its network and become his or her own bank with little more than a cheap phone and internet access. Because of bitcoin’s accessibility and its lack of traditional intermediaries, the vast majority of the unbanked don’t have to travel anywhere or pay much of anything to use it.

The unbanked fare less well in y-world. Traditional banks in y-world charge transaction fees and levy costly and unavoidable penalties. Thieves can attack the vulnerable as they travel to conduct business at their far away banks. And, of course, the intermediaries in traditional finance can profit in ways that make several of their customers distrust them.

Now, if you had a 1/12th chance of being unbanked due to distance, cost, or distrust, which world would you prefer to be in? Would you be willing to risk being unbanked without recourse to bitcoin in exchange for the possible utility bump of being a banker or thief in y-world? Let’s suppose the utility bump is quite large, say, about a million dollars for about 1% of the world’s population. Would you risk a one in twelve chance of being completely unbanked due to distance, cost, or distrust — and with no recourse to bitcoin — for a 1% chance of getting an extra million dollars? Or would you rather not have that extra 1% chance of getting a million dollars to ensure that, even if you’re among the unbanked, you still have the ability to bank yourself cheaply, accessibly, and without exploitative intermediaries?

I suspect that, when we focus solely on issues about banking, anyone with a reasonable risk function would prefer to live as a random person in bitcoin-world rather than as a random person in y-world. Your risk function may not even have to be risk-averse since, over time, the utility hit of being unbanked and without bitcoin may exceed the benefit of being in the 1% and having an extra million dollars. Consider not only how many people are worse off in y-world but also the diminishing marginal utility of those in y-world who benefit from bitcoin’s absence. Those better off from its absence are already in the financial elite. And, at a certain point, an extra dollar provides little utility.

And, remember, for all you know, your preference behind the veil has momentous consequences. You’re actualizing a world not just for yourself but for everyone else, too. Would you ensure that 1/12th of the world’s population has no banking alternative just so you could have an extra 1% chance of being someone who profits from the absence of the alternative? All else being equal, if you care for your potential world-mates, you’re likely bound to prefer bitcoin-world even if you yourself have a relatively high appetite for risk.

B. Inflation

Now consider inflation in both worlds. In both worlds, about 1 billion people live in countries with at least a double digit rate of inflation.[1] Citizens of such countries lose their purchasing power quickly and few have access to the traditional investments typical among the global elite: equity, real estate, bonds, etc. No matter which world you choose, you have a worse than one in eight chance of being a citizen in such a country.

In y-world, most of those subject to runaway inflation have restricted access to investments that might otherwise preserve their purchasing power. But anyone with internet access in bitcoin-world can buy an asset with an inflation rate lower than the U.S. dollar. And this asset has an automated and disinflationary supply schedule that resists central bank manipulation. So nearly anyone subject to runaway inflation has an alternative vehicle to store wealth that the counterparts in y-world lack. In the medium term, bitcoin might also serve as a competitive check on central banks that would otherwise flood the system with money. If a government prints too much money then citizens will swap their currency for more bitcoin, causing the national currency to decline in value even further. But we needn’t factor in this more speculative point into our calculation.

Would you risk a one in eight chance of being subject to runaway inflation so that you might potentially be one of the few beneficiaries closer to the monetary spigot? Again, I suspect most would rather live in bitcoin-world. The extra benefits that accrue to Cantillon insiders likely wouldn’t outweigh the benefit of having a monetary life-raft that would keep almost anyone afloat amidst relentless waves of central bank liquidity. Even if the reward of being near the monetary spigot is enormous, both the reasonably risk-averse and those who care for others’ risk-aversion will discount these rewards and favor the benefits that accrue to the masses on account of having access to bitcoin.

We could continue this assessment, looking at statistics about privacy and identity theft, capital controls, and remittances. In every case, the reasoning will follow the same route. We’d only have to supply freely available statistics and the decision calculus would favor bitcoin-world.

Now, the bitcoin critic may respond that we haven’t yet mentioned anything about bitcoin’s energy consumption. This, too, is an important factor that someone must assess from behind the veil. But every argument I’ve ever seen from critics about bitcoin’s energy suffers from a failure to grasp fundamental features of the bitcoin network, the kinds and amount of energy used, how bitcoin can be as green as we like, and how it is already helping to stabilize power grids which rely on renewable but intermittent energy sources like wind and solar.

For all this, I don’t pretend to know bitcoin’s second-, third-, and n-order consequences. There are tradeoffs no one knows about. Here are some that may deserve some attention. If you don’t see your favorite criticism below, that’s likely because I think it’s confused or misinformed.

1. To what extent would the core properties of bitcoin erode state power to provide a level of welfare that a society might otherwise not be willing to provide?

2. Would a disinflationary currency, if adopted globally, slow economic growth?

3. Would a censorship-resistant money for international trade make economic sanctions a thing of the past and, as a result, lead to bad international actors gaining substantial amounts of global power and influence?

4. Would bitcoin holders, vindicated and emboldened by their newfound riches, wreak havoc on the world with their fanatical theories about how the world works?

Although each of these concerns me, I don’t have near enough evidence to think that they would tilt the scales against someone’s preference behind the veil.. Every one of these is highly speculative, and we already have real-world data on how bitcoin would improve, and is improving, the lives of millions. Humility suggests that we factor more heavily the data we have rather than possible consequences about which we can only guess.

But please remember, I’m not offering an argument here. I’ve only outlined a method. The method allows for anyone to apply their own risk profile to help decide whether or not they’d like to be an arbitrary person in a world with or without bitcoin. Whatever your attitude to risk, the method helps us evaluate bitcoin not against what it can do for you or me but through the lens of the less well-off globally. For that reason, it blunts the force of self-centeredness on our judgment.

VII. Conclusion

What do I say to the bitcoin critic? Imagine yourself behind the veil and run through the exercise. Be mindful of statistics on banking, inflation, remittances, data leaks, refugees, and severe capital controls. I can’t survey all the data points here, but they each push the reasonably risk-averse towards preferring to live in a world with bitcoin over a world without. That’s how it seems to me, anyway. Anyone is welcome to model the thought experiment with sophisticated data sets. I’ve provided little more than a promissory note.

Given the method above, I believe that the more data we gather, the more readily we must admit that bitcoin is hope for many hopeless. And, for their sake, we should not wish it away. This doesn’t put bitcoin’s loudest critics in the best light, though, since we have quite a bit of data already on how an open monetary network would benefit humanity. Already, critics would mostly seem to fall in one of three groups, then:

The dumb, for criticizing bitcoin without knowing how it works or what it does.

The detached, for not knowing or caring about the plight of the less well-off.

The dishonest, for preferring points with the in-group over admitting more complexity.