The Greatest Game

“You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete”

– Buckminster Fuller

Breakthroughs, that step change our lives for the better, invariably come from something that most people couldn’t see. Our belief of how the world should exist and operate is shaped from looking backwards, not forward, so it makes sense that new paradigms that change everything – face resistance in our minds. Because most people don’t see them, breaking through an existing paradigm needs to provide enough compelling value for users to disrupt an old paradigm. Apple’s iphone for instance, didn’t copy the market leader, Research in Motion’s Blackberry design of needing a keyboard or selling to businesses who required RIM’s security. It created a digital interface when that wasn’t ‘needed’ and created an entirely new platform that changed the industry as a result. Along the way, the Blackberry died, unable to compete with the value for users that was now increasing exponentially on Apple’s platform.

That process describes “Creative Destruction” a paradoxical term first coined by Joseph Schumpeter in 1942 to describe how Capitalism works in a “free market.” Entrepreneurs innovate and “create” value for society – and that value gained by society also often “destroys” the former monopoly power. That process and its importance is at the center of how all modern economies have evolved and given rise to most of the benefits to society we take for granted today. New winners become so valuable that they disrupt existing market power or structures. It is all driven from a near constant flow of innovative entrepreneurs with bold ideas and the capital backing them that go up against the status quo and are only successful, “if” they create value for society.

For the process to work, failure is critical! Both for entrepreneurs and the capital in them whose business doesn’t work, and for legacy businesses that get disrupted by them if their innovation brings better value to society. And while failure is hard, preventing failure is much worse.

Why? – because by preventing failure, market incentives become warped, and in doing so, eventually put a small number of people (government/central banks) in charge of choosing who gets what, instead of the free market.

Unfortunately, preventing failure has been the policy makers tool for the last 20 years, and It has enormous consequences. By socializing losses and preventing failure in our economies, central banks and governments have all but ensured that the existing monetary system of the world collapses – and is replaced by something new. In other words, by preventing failure in economies in the short term, Creative destruction has only moved – now to the level of our international economic system.

I believe with what is to come, Bitcoin has a higher than average probability of overcoming all barriers and becoming a global reserve currency. More importantly, I believe it gives humanity its best chance for a peaceful transition to the future. A world where the abundance gained from our technological progress is more widely distributed. It is not hyperbole to say that almost everything changes as a result of this innovation.

A 10x strategy – Be a big fish in a small pond first.

When creating new technology companies, a framework I use to understand if something has an ability to win is ‘the 10x advantage’. Meaning that, unless a new company (the challenger) can deliver a 10x advantage to the market, it has no chance of creating escape velocity and becoming a new category leader. While a 10x advantage does not guarantee the success of a challenger, it greatly enhances its probability.

There are a number of reasons for this. For a company to create a new category, it has to first convince a market that its product or service is far superior to the one it is trying to replace. (ie – that people need to change). If the challenger doesn’t have a 10x type of advantage, it becomes difficult to even be “found” through the noise of an existing market. Harder still, it has to do this while battling two major forces:

- If successful, the existing monopoly will attempt to beat the innovation – either by changing their own offering, or using their existing market power to kill it, and

- With success comes many new entrants (copycats or slight innovations) that enter the market to compete. (confusing the market as to benefits)

For a challenger to continue to advance then, it must continue to offer more advantage than the copycats while staying under the radar from the monopoly for enough time to gain enough scale or gain “network effects” before the monopoly takes notice. The best way to do this – is not by competing on everything that a monopoly competes on, but instead, picking a very small part of a market that goes relatively unnoticed by the monopoly and providing the 10x advantage to only that.

Google, starting at only search as their first market (when there was no money in providing search) as a start-up versus all of its competitors at the time provides a good example. First competing narrowly (only free search) against every other search website, who were selling advertising at the time was something that was underappreciated by the monopolies. With the market (individuals) moving quickly to Google for all things search, it was easier to add functionality (because the users were already there) to compete with broader platforms like Microsoft.

Therefore, winning a narrow part of the market first (10x advantage) created a path to do everything else. From Amazon’s start in only books, to Tesla starting at the Roadster, if you examine the path of almost every new company who breaks through monopoly power, they follow a similar path. The reason this path goes unnoticed, is that by the time the innovation and path is “recognized” by the broader community, it is too late. It has successfully disrupted the monopoly, and people forget what it looked like in the beginning.

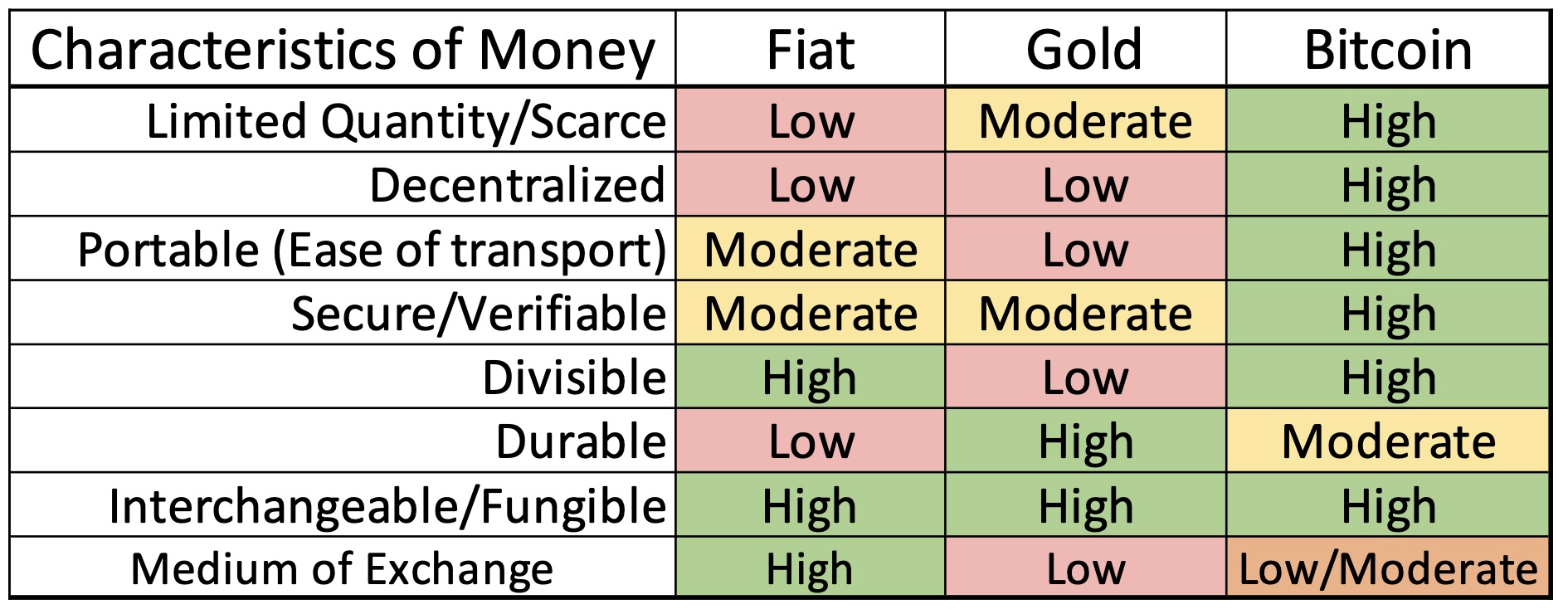

This is a useful analogue when looking at Bitcoin’s evolution from where it was when Satoshi launched the genesis block to where Bitcoin might go in the future. By designing Bitcoin as the first “decentralized, non-trust-based” system and designing fixed scarcity of 21 million Bitcoins into the protocol, Bitcoin removed the need for a trusted intermediary, and at the same time created “digital” scarcity.

Bitcoins first use case could then be viewed more of a store of value, than a currency since for it to compete as a currency, it would need to be able to be used widely in society. In other words, Bitcoin’s narrow 10x advantage could be compared to Gold first, rather than as a competitor to money.

I will attempt to use this framework to describe why I believe Bitcoin (the Challenger) is poised (over time) to replace the existing economic system. (the Monopoly)

Before I do though, it is worth exploring why an innovation like Bitcoin is required in the first place.

Technology has changed the rules

Exponentially advancing technological gains bring efficiency. That efficiency is deflationary. Moving exponentially and into all industries which means prices should be falling on almost everything.

The reason prices are not falling is that advancing technological progress is incompatible with the existing monetary system which requires inflation to remain viable. That existing system is being manipulated so it appears viable and pushes prices up as a result.

Which sets up a conflict to be resolved at a system level.

- Exponentially increasing efficiency driven by technological progress requires a currency that allows for Deflation. (the challenger)

- The existing fiat monetary system (the Monopoly) requires inflation and consequently, it needs manipulation to remain viable.

The reason that many people don’t see it or truly understand its implications is similar to any breakthrough in technology. They are trapped within an existing framework (the Monopoly) and use that framework to measure all interactions.

Let’s explore what happens to policy as the two forces of an inflationary monetary policy competing against exponentially advancing technology come together. Remember, they are opposing forces – entrepreneurs using technology are trying to deliver more value for less, whilst inflation is moving in the opposite direction.

Also note that I have attempted to look at the structural change through a ‘system lens’ rather than a ‘people lens’. Although any system has bad actors, the predominant force driving decisions are not because of willful neglect or bad intent, but instead, to protect the status quo (and Monopoly) because it’s very hard to imagine what the future could look like without it.

In other words, changing actors in the system would produce more of the same results and very little real change. Worse still, when much of society believes that changing actors can fix the system, society becomes more divided while only serving to perpetuate the status quo.

Additionally, for those hoping that a change to Bitcoin (or challenger system) happens all at once, be careful what you wish for. While the existing system is producing profoundly negative effects, it is important to remember, that all of our other institutions currently sit on top of the existing system (the Monopoly) and a sudden change would spell disaster for your way of life.

In my opinion, the best way for people to understand how important Bitcoin (the challenger) is for the future, is to first understand how the existing system (and not people) amplifies insecurity and how a change to a different monetary policy (the Challenger) would produce infinitely better results.

So, let’s first consider what the sequence of events would look like from the existing fiat system: (the Monopoly)

1) Must create inflation. Without it, deflation takes hold and wipes out credit, and because the system is based on credit, wealth is destroyed. The chance for policy change that could have prevented a complete reset to the existing fiat system was about 20 years ago and would have required an understanding of how fast technology was moving and what it meant for the inflationary fiat monetary system. Instead policy makers made the same mistake most people do when looking at technology. They underestimated its exponential impact. This quote by Nobel Laureate Economist Paul Krugman in 1998 sums up the thinking at the time – “By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.”

So instead of allowing nature to take its course:

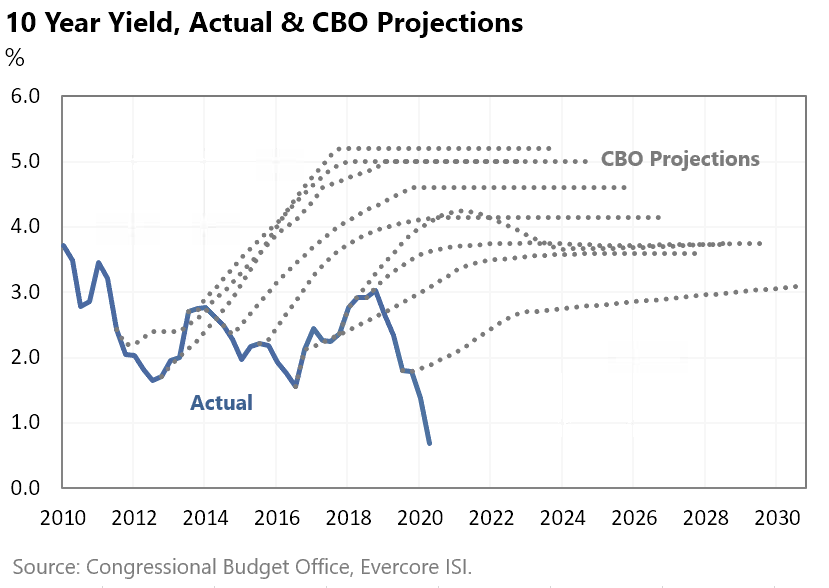

2) Interest rates were manipulated lower to increase growth – and almost every year, taken lower again as predictions of growth came up short against the reality of technological progress on the market. Although the chart below references the United States, this was a global phenomenon.

The lower rates and additional debt created produced limited growth which is to say deflation (prices going down) would have taken hold without it and made the debt un-repayable – causing a larger deflationary depression than would have happened in step 1.

Now trapped though, the system required ever lower rates, and the lower rates caused debt binges, misallocated capital and asset bubbles. Designing more fragility in the system as the severity of the reset for society only grew. Global debt rose to over $250 Trillion in 2019, with $185 trillion of that new “stimulus” coming over the last 20 years.

*Note* because technology is continuing to advance exponentially, it will take exponentially more debt and easing to keep the existing system intact.

It was impossible to see how a system operates by only looking at its individual elements so politicians, policy makers, citizens and businesses were caught along for the ride. For example – believing that housing, and education expenses always go up without asking whether they would have gone up without $185 trillion of additional stimulus, leads logically leads to #3

3) A breaking of the rules of capitalism and distortion of free markets when it is realized that the debt cannot be repaid.

It is not debt itself that acts to undermine capitalism and the free market.

It is the act of stabilizing an economy through socializing the losses when faced with a collapse that undermines the free market and capitalism’s own institutional framework.

Preventing Creative Destruction therefore codifies bad behaviour into capitalism itself, since market participants now realize that the system will always bail them out for fear of a catastrophic collapse – which is exactly what would have happened – and would happen today without bailouts.

Goodbye to free markets.

From the policy makers (the Monopoly) perspective, at this point in the cycle, it would be hard to allow the entire economic system to collapse – so the proverbial can is always kicked down the road without full consideration of the unintended consequences.

This predictably leads to unnatural inequality, social unrest and a loss of faith in “the system” (the Monopoly)

This breakdown phase (which can last longer than people realize) is analogous to a business fighting a structural change AND because of that structural change, having a shorter runway to make the change – which causes chaos throughout the business as it deals with urgent issues and no way of fixing the underlying structure.

It should also be reinforced that by the existing fiat system (the Monopoly) I am not referring to any one country but the overall fiat monetary system. This is important because it will be easy to be fooled in the shorter term by only looking at individual elements of the system. (in this case the individual element being a country currency within that overall framework) As each government acting in its own national interests plays their own game, there could be periods of calm, chaos, uprisings and war as the overall system swings violently back and forth and accelerates its breakdown.

The breakdown phase has a couple of important aspects for how we should view the likely response by the system (the monopoly) versus the challenger (Bitcoin)

The Breakdown Phase:

- Because the system, as it is designed today, creates unnatural inequality, social unrest and loss of faith, a rise in the merits of socialism and centrally planned economies will predictably emerge and become more popular with citizens. They will gladly transfer control to more government and policy makers to fix the problem. Ironically, they will do so without the knowledge that the problem was created by the policymakers on both sides of the political aisle in the first place; all by ignoring free markets.

- The new policy makers will change the rules, effectively transferring the independence of the FED and other Central Banks, to Treasury and politicians to allow for a redistribution of wealth in an attempt to save the system.

This will first come in the way of Modern Monetary Theory, helicopter drops of money and other fiscal programs designed to get newly printed money to citizens and businesses in an attempt to avoid unrest, and to spur inflation. (most people won’t realize that inflation actually means their real wages and value of money going down and will gladly accept the “free money”) - As this happens, and prices are continually manipulated higher through printing money and artificially low interest rates, businesses will be forced to remove labour faster with technology to remain competitive. If they do not, they risk becoming permanent wards of the state (Zombie companies that require money from the government to function).

Removal of labour with technology naturally accelerates the cycle of government intervention and manipulation of currencies to “save jobs.” Because inflation is equal to “real” wages going down, it can work to delay the job loss process by paying less to workers. In other words, the “real” labour component of work falls by making the labour component lower as a percentage of work. Few will realize this sleight of hand, and that inflation is a tax on those most unable to pay, so the cycle outlined in B will accelerate. - Along this path, we can expect the existing system (the monopoly) to attempt the introduction of their own digital currencies allowing for more control over wealth distribution in an attempt to “fix” a problem the existing system cannot.

We can also expect that different “currency” regimes will compete with each other to make their currency most widely used. A couple of examples of why this is becomes a requirement for the existing system:- Central banks cannot take their interest rates too far negative without people pulling their money from banks, which subsequently causes bank runs and the system to unwind. With a digital currency, negative interest rates could be applied immediately without those consequences. Picking your pocket with a keystroke.

- For Central Banks wanting to get newly printed money into people’s hands today, it needs to go through a bank or intermediary who determines credit worthiness. Because a bank is a private enterprise with shareholders and the need to remain profitable, a bank will not lend money unless they believe that a business or individual can pay back the loan with interest (which requires an expectation of strong future earnings, ie; economic growth).

A digital currency that could be transferred by the Central Bank or Treasury into hands of citizens without this transfer mechanism of a Bank.

From the perspective of the system, (the Monopoly) these new digital currencies could slow Bitcoin (the challenger) by compelling people to use (the Monopoly) currency to gain the benefit and interact with the rest of the economy.

As they bring in their own digital currencies though, they bring much more attention, network effects, and accelerated innovation to the challenger because more of the public becomes aware of the manipulation and what it means to them. Additionally, these digital currencies put Central Banks and Treasury in direct competition with the private banking sector, who up until now, have been the largest beneficiaries of the Monopoly System.

- Along this path we can also expect certain governments to make it more difficult for Bitcoin (or other Challengers) to compete by closing onramps/offramps or making their own digital currencies appear more attractive. While the existing Monopoly may not provide the same security as a store of value, (the Challenger’s first 10x advantage) it does currently provide a far simpler way to transact with the greater economy. Certain governments will use that advantage to slow or stop the Challengers’ advance into a wider medium of exchange.

Fortunately, by doing so, it also creates an incentive for other governments, economies and businesses to accept Bitcoin (the Challenger) either as a currency itself or as a unit of account backing their own currency. While these actions are likely to have short-term implications on Bitcoin (the Challenger), they likely also serve to reinforce the Challengers position.

Many people will not take the time to understand that every step along this path to digital currencies, they will have slowly (at first) and then suddenly transferred complete control of their monetary affairs to Government institutions and away from the free market. And, in doing so transferred their natural rights to a ruling class who determines who gets what.

Furthermore, since a small number of people in government could never match the efficiency of a free market, and government tax revenues to pay for the services that its citizens demand come as a result of a vibrant economy, living standards must decline. What can be given away so freely, can just as easily be taken.

It’s along this path, that you had better hope for benevolent dictators, because it’s along this path you have given up your freedom.

Hopefully, you will see by now that just like a company trying to protect itself from being destroyed by a new competitor, the actions and reactions of Central Banks, and Policy Makers to protect the system that they know, are quite predictable. That the existing system that has people trying harder to keep up and “save” enough money, while the same system is designed to inflate those savings away is a feature of the system – not a bug. It has much of the population trading their most valuable asset – their time – for jobs with declining “real” pay – and not able to step off the wheel of insanity for fear of falling into the abyss. What the system (the monopoly) cannot see, is that by protecting itself, it is the harbinger of the real crisis – as the nature of society itself is torn apart as each person and family is forced down a path of destructive self-interest and survival.

The challenger (bitcoin) perspective.

A system design that allows humanity to move from scarcity to abundance.

Like most breakthroughs that make our lives better, one of the most interesting things in the battle between the Monopoly system and the Challenger is that the challenger (Bitcoin) has structural advantages that allow it to get stronger as the existing Monopoly system weakens. Said another way, many of the reactions described above protect the existing system, strengthen the challenger’s status as a store of value whilst the “network effects” of more users bring more trust and constantly enhance the value of the system. As this network effect continues, eventually each country in the existing system (monopoly) will face an important choice.

The existing system can either:

- Start to embrace the challenger (Bitcoin) and start accumulating it on their own for an eventual peg to their own currency. Which will only serve to increase the velocity of the challenger’s “network effect” and cause others to do so as well. This means early adopting countries, like the people, and the companies before them, have a larger benefit as the price moves higher because of increased trust and competition for its utility as a store of value. If this were to happen, Bitcoin’s 10x advantage as a store of value would be cemented but its innovation and advancement to the rest of the economy would probably stop there. The onramps and offramps to individual currencies would continue to function within governments which would be pegged to Bitcoin. Or

- Attempt to stop it. (To do so, it would require a coordinated fashion since individual countries trying to stop Bitcoin’s advance would lead back to #1 by creating an additional incentive for early adopting countries).

Should it happen in a coordinated fashion, the technological innovation will move beyond Bitcoin’s utility as a store of value (its’ first 10x) rapidly. In addition to being accepted as a better store of value, it will quickly become a better medium of exchange (easier to use) as a swarm of “cyber-hornets” (H/T – Michael Saylor) rush in to drive the technology forward.

When dealing with technology, most people fall into the trap of projecting their current experience with technology forward, instead of thinking about how fast the underlying technology and user experience is advancing. By projecting a current experience forward they fail to grasp the magnitude of what will happen. To illustrate this important point, look no further than the internet itself which benefits from a similar network effect and growth rate as Bitcoin. The internet in 1995 had approximately 16 million users versus about 5 billion users today. In 1995, use cases for the internet were very narrow, leading many to discount what would come next. But entrepreneurs and investors looking to what the future could hold, built some of the largest companies today – on top of that new paradigm. Amazon, Google, Facebook, Alibaba, and many others.

In my opinion, with either of these two outcomes, Bitcoin (the Challenger) is likely to become the foundation of a new monetary system. One that is congruent with where human innovation and technological progress is taking us.

With technology, there is an exponential effect in its output or power relative to its price. In other words, we get far greater benefit, and the price continues to fall. This should come as no surprise. It is all around us.

Your phone provides just one example. Twenty years ago, it was only a phone. Today, it is a phone, email + text device, social network, camera, AI assistant, map, and music player, and thousands of other things combined for a fraction of the cost previously available. That, is by definition – deflationary, which is a great thing if you understand how a new system could work to benefit humanity.

In my book, The Price of Tomorrow, Why Deflation is Key to an Abundant Future, I detail how that technology is moving into every industry at an exponential pace.

And while it is easy to get fooled looking backwards, most of the technological gains are in front of us which means getting more for less (deflation) is a completely natural process that embraces human innovation.

A new monetary system like (Bitcoin) that prevented manipulation, would embrace that natural process. And it would mean that our innovation and technological advances would translate into freeing our time, while concurrently enjoying higher living standards.

When re-framed that way, it’s hard to imagine anyone wanting to stop it.

Yes, prices would fall and keep falling as technology and a free market did away a false construct – of needing more growth to pay for prices that were only manipulated higher through money printing in the first place. With prices falling to their natural level, and on a path to free, the entire infrastructure required to support price inflation, that was only caused by ignoring the free market, will fall away.

It is not logic that makes this difficult to see. Instead, it’s because of the attempt to fit a current world view – which dominates your attention – into a new one – that is incongruent with that system. That incongruence of two systems competing in one’s mind results in a conflict. We have an inability to see how much of the existing system of cost falls away under a new system and how much cheaper it becomes to live – so we hold onto our past framework that we know manipulates prices higher for fear of loss.

We fail to comprehend that many of our biggest societal issues today might solve themselves under a new standard like Bitcoin. For instance, the manipulation of money is, by an order of magnitude, the greatest contribution to environmental destruction that no one talks about. Again, most of humanity’s attention is focused on the independent variables of the system instead of the system itself. One of the independent variables in this case being fossil fuel energy to keep with the growth. We miss that that manipulation of money is artificially driving higher prices and growth, along with the need for more of everything to pay for those higher prices. And as entrepreneurs innovate and bring lower prices to market, ever more manipulation is required to offset this benefit. More energy, more jobs, more consumption, more production, more transportation, on an ever-increasing feedback loop, just to keep it going.

And that is the truly revolutionary power of Bitcoin over the long term. As it continues its advance and eventually becomes a global reserve currency, it shatters the societal patterns we currently call reality. As more people start to realize what that means for society (after the transition) more people will also realize that many current “realities” were really only self-imposed prisons.

I’ll attempt to show this by way of another example in education.

Today, with an internet connection and browser, we already have access to many of the world’s best minds, research papers, and content – for free.

Khanacademy.org provides just one example offering a completely free education anywhere in the world in math, physics, science and computing. The courses and UX are designed to make learning engaging and ensure mastery of subjects. Those opportunities are everywhere. A staggering amount of detail, on any subject – all there for us to learn. For the curious – with enough willpower and perseverance then, a great education is already free. Why, given this inescapable fact, do we choose to spend our time in school for 12 years, to compete to get into the best college – when it is both more time consuming and costly?

We do so because historical societal patterns (our perceived reality) tell us that it is the best way to get a good paying job. That may have been true, especially looking back to a time before technology brought that abundance of information to us. It may even be somewhat true for some jobs today, but it also is likely to be less true in the future.

For some – the future is already here. From my own experience in hiring thousands of employees over the years, I would take the curious, self-driven, learner every time.

The “perception” of scarcity 1) that education from the best schools is required to have a great career, and 2) there are only a limited of spaces available in those schools, 3) means the cost and competition for those spaces is constantly rising, which the system reinforces without us even questioning it (our self-imposed prison). That same “perceived scarcity” creates an education system that increases inequality because access to education – and along with it, the best jobs – becomes more about an ability to pay, than curiosity and drive.

Ironically, at the same time abundance of free or almost free education is already all around us – with the change in hiring that will soon follow suit.

It forces us to realize that economics is not about value, but scarcity – real or perceived. It is difficult to charge money for abundance for the same reason it is difficult to charge for the oxygen we breathe. As something becomes abundant, the ability to monetize it drops.

Where does economic value come from?

We can look at the overall economy in a free market as a sum total of trillions of continuing experiments competing to create value for us. An endless swarm of innovation and experimentation by entrepreneurs driven to succeed – with money as a measurement of that success.

That experimentation comes in all forms and sizes – from a new local restaurant, carrying the hopes and dreams of a family with it, to an idea like Amazon that emerges quickly as a new dominant platform. Transportation, space travel, health, education – each playing field is dynamic – constantly changing and evolving. Past success doesn’t guarantee the future. Ask any entrepreneur, it is not a journey for the faint of heart. The competition is brutal and in a free market, it is not only the entrepreneur and their early employees who are at risk of losing everything in a new venture. The capital that bets on those entrepreneurs, either wins along with success or loses with its failure.

Which is another way of saying, businesses are always on the hunt for ways to improve, because if they don’t, they die. We determine their value, by the value they bring to us. A free market, that allows Creative Destruction to work then, results in more experiments and more value created in our lives. Technology amplifies this entire process – and with it, will bring breakthroughs to our lives that were previously inconceivable and open the doors for almost anyone to create them.

This becomes a feature of a new monetary system backed by Bitcoin because it forces out manipulation and as a result – distributes broad society gains as a natural consequence.

Because, unmanipulated, the result of all of that free market competition – must give us more for less – or we wouldn’t use it. Which is to say, a monetary standard like Bitcoin would ensure the exponentially improving value created by a combination of technology and competition, would fall in price to match the new realities of supply and demand in a digital world. That seemingly small change, unnoticed by most of society, changes everything else. In time, society will realize that it also allows for an expansion of the very meaning of success.

In the great game of business, a monopoly rarely dies overnight. They have too much market power for that. What often happens is that they miss a key technological change that would have allowed them to offer value differently, and then set out on a series of actions to protect their existing business. Because the change delivers better value to society, those actions to protect what was – all but guarantee failure in the end.

It is exactly the same thing, playing out before our eyes in the greatest game of all – the international monetary game and the rise of Bitcoin – which is connected to everything else.

For the first time in history though, the unique characteristics of Bitcoin gives everyone a choice on how they play the game. I suspect that as more people come to understand how remarkable this breakthrough is for money and what it means – that things will never be the same.

Learn about Bitcoin. Learn why its importance is so much greater than wealth it might create for you and your family. When you do, teach others. Their futures may depend on it.

It is bound to be an epic battle.

A battle between the free market and entrepreneurs competing to create more value on one side, and manipulation and power concentrated in the hands of a few – eventually leading to totalitarian control on the other.

My hope for humanity is that we’re on the winning side.

Jeff Booth,

Nov, 2020