Stop Calling Bitcoin Deflationary

Bitcoiners reject inflation. We believe it represents a regressive, silent tax — slowly siphoning wealth from the average person to the politically well-connected.¹

In response, Bitcoin critics claim that while inflation may be frustrating, the alternative is much worse, a stagnant deflationary economy.

This article will: (1) begin by laying a conceptual foundation for what deflation is, (2) move on to address critics’ concerns with falling prices, and (3) conclude by showing how Bitcoin’s monetary supply actually guards against deflationary spirals.

Part One: Bitcoin is not deflationary — its money supply is relatively constant.

First, we need to establish what “deflation” refers to. While decreasing prices are colloquially referred to as deflation, deflation is formally a decrease in the supply of money or money substitutes. This is an important distinction. Deflation is not a decrease in prices itself, but a monetary phenomenon that sometimes causes decreasing prices.

In this sense, Bitcoin is not truly deflationary. Bitcoin’s supply will not decrease but will instead continue to increase until the block rewards run out sometime around 2140. At that point, Bitcoin will reach a hard cap of 21 million coins.

Below you can see a graph of Bitcoin’s emission rate, starting with a relatively high inflation rate and slowly leveling off over time to a hard cap of 21 million coins.

The Bitcoin protocol is not inflationary or deflationary in the long run. It is instead programmed to be disinflationary, culminating in a constant monetary base without changes to the supply.

Some may argue the following: “despite this projected constant base, lost coins create deflation as they are functionally removed from the circulating supply.”

This should not be a concern. Coin losses will decrease over time as coin custody becomes more professional and user-friendly. As a result, the highest rates of lost coins were in the earliest days of Bitcoin and this will continue to decrease over time. Thus, as expansion of Bitcoin’s supply approaches zero, so will decreases in supply from lost coins, culminating in a nice middle ground.

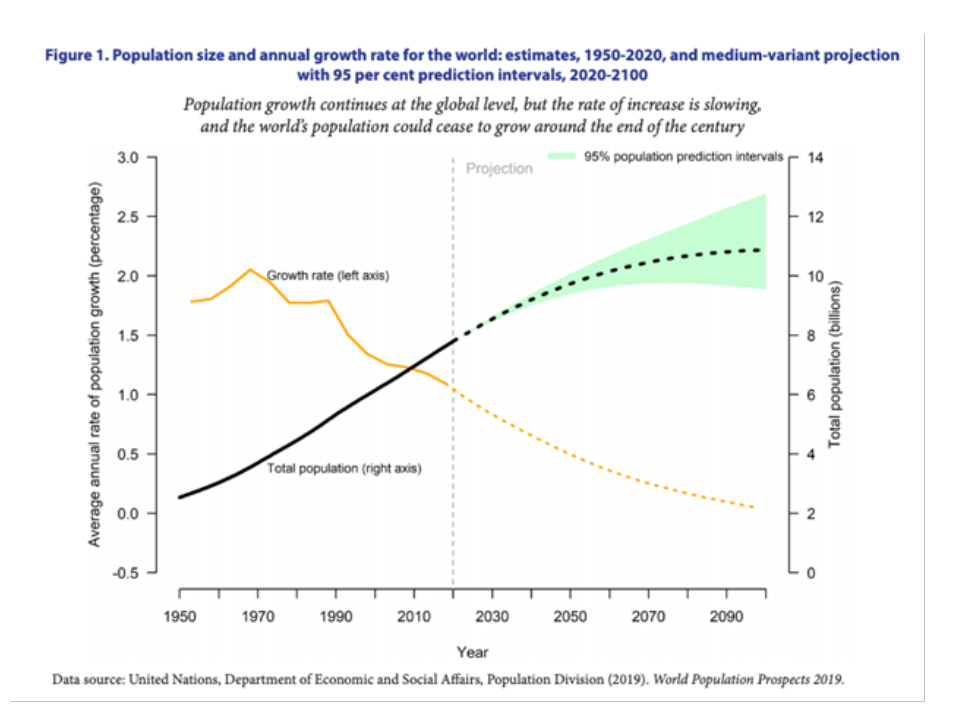

Another argument from critics is: “while Bitcoin’s supply may be constant, populations are growing. Therefore, a rigid monetary supply will lead to deflationary pressure as a growing number of people chase a fixed monetary pie.”

This is also a dubious claim. Across a variety of cultures, population growth declines as societies experience urbanization and higher levels of education. This downward pressure will continue into the future as regions with the highest levels of population growth continue to industrialize.

Above are the latest estimates for population growth from the United Nations.² These figures predict population equilibrium by 2100. It’s quite ideal really — a leveling of the world population that coincides with the Bitcoin emission rate approaching zero. Could we have asked for a better match?

Bitcoin is not deflationary in the formal sense of the term. Its supply will continue to increase on a curve that should account for lost coins and a growing population over the next century. With a constant monetary base, Bitcoin will not have any inherent pressures towards higher or lower prices, it will function as a pure foundation where prices will fluctuate solely based on signals from market participants.

While this is a tidy way of showing Bitcoin is not deflationary, it still doesn’t address the crux of the critics’ arguments: concerns about decreasing prices. So with this understanding of Bitcoin’s constant monetary base in mind, let’s debunk them!

Part Two: Addressing Concerns About Falling Prices.

So, when critics are concerned about bitcoin being “deflationary”, they actually mean “bitcoin will make prices go down!” Generally, critics have three main concerns about these “deflationary” prices under a Bitcoin standard:

● Workers being outraged at nominal bitcoin wages falling.

● Ever-increasing real debt burdens on bitcoin denominated loans.

● Lack of growth from savers hoarding appreciating bitcoins instead of investing or consuming.

But before addressing those specific cases, let’s establish a basic understanding of how prices function.

Price Basics: Falling Prices Are Natural

Imagine a simple item in a competitive marketplace — let’s say a toothbrush. Now assume every year this toothbrush gets a little bit easier to produce. Perhaps machines get a little bit better at manufacturing, or supply chains get slightly more efficient, etc. If our consumer demand doesn’t change, what should happen to the price? It should decrease.

This should not come as a surprise. Free markets cause product prices to fall as industry becomes more productive and competitors fight for consumers with the lowest possible prices. This is a process that has been happening for thousands of years as humans apply their ingenuity to fulfilling the wants and needs of others.

Do prices always decrease? Certainly not! Plenty of common occurrences that hamper production or spike demand can cause price increases. My point is simply that on long time-frames, as humans invest their labor into becoming more productive, items that were once difficult and expensive become cheap and easy to produce. Thus decreasing prices are natural and intuitive.

Despite this understanding, for decades prices for basic consumer goods have increased and quality decreased. This is because increased productivity requires a constant monetary base to be felt through prices. Money is the unit that measures this process. In a monetary measuring system with a constant base (i.e. Bitcoin), increased productivity will translate to decreased prices.

However, if the monetary measuring stick is tampered with (i.e. printing presses), then prices will increase year after year despite massive increases in productivity.

With this theoretical understanding, let’s turn to the specific instances critics are concerned about.

Concern 1: Decreasing Nominal Wages

Critics are concerned that falling consumer prices under a Bitcoin standard will spill over to workers wages, leaving workers frustrated and demoralized. The problem is critics forget what wages represent — human time. With a toothbrush, it’s natural that technological advances make them easier to produce each day, but human time is different. It is truly scarce and irreplaceable. While one type of work may be automated, a new role opens up from other advances. Jobs are not finite.

Thus, while the price of a toothbrush should be expected to fall with a constant monetary supply, there is no reason to think the same with the price of human time.

Let’s look at data points on this. Below is a chart for prices in America over the 1800s.³

As you can see, this was an era with rapidly falling prices. So, what happened to wages? They went up. The Bureau of Labor Statistics noted:

“overall the trend of money wages were upward, and the movement of the cost of living was downward. These divergent movements of wages and retail prices combined to produce a substantial rise in real wages.”

This dramatic rise is all despite a labor supply that multiplied almost 10x from the beginning of the century and a brutal civil war, devastating economies and killing hundreds of thousands.

Now, you may be tempted to argue that prices fell so dramatically because America was young and being developed for the first time, but we can see the same action occurring in the technology sector today. Prices for electronics have been falling for decades, yet companies still manage to pay employees competitive wages. So, it’s certainly possible that even when prices are naturally falling from increased productivity that the cost of labor could stay the same or even go up.

But if the critics fears come true and wages do go down nominally, what matters is purchasing power. To say workers will get upset despite being able to purchase larger amounts of higher quality goods treats them like children unable to do basic arithmetic.

In comparison, inflationary money loses its value every year, leaving the average person without a safe place to store their savings while the wealthy profit off financial assets. This is especially painful given the phenomenon of “sticky wages”. Below is a chart demonstrating a complete decoupling of productivity and compensation that cleanly lines up with leaving the last remnants of a sound money.

For many many more charts on this, I highly recommend visiting this amazing site: www.wtfhappendedin1971.com

The trends shown above lead to predictably dire outcomes — serious and increasing levels of income inequality, populism and social unrest. If critics were truly concerned about workers, they would support Bitcoin as a savings technology for the average citizen to protect their savings from involuntary silent dilution.

Concern 2: Increasing Real Debt Burdens

Critics also claim that as bitcoin appreciates, real debt burdens from bitcoin denominated loans would increase. They fear this will create debtors who are unable to pay and lending rendered impossible. This take is naive at best — it assumes that Bitcoin will appreciate forever.

Here, it’s helpful to recognize the evolution of Bitcoin as money. A new superior money cannot simply come into the world perfectly formed — it requires time. The early stages involve Bitcoin slowly absorbing value from traditional stores of value on its ascent to global reserve status. This initial phase of price discovery may take decades as Bitcoin gains liquidity and market capitalization against other traditional reserve assets due to its superior monetary attributes.

As Bitcoin slowly wins this monetary competition, it will transition to a reliable standard for accounting and exchanging value as well. At these later stages, Bitcoin will become a reliable unit of account as it stabilizes against other assets.

Those concerned about pricing debts in Bitcoin are confusing the timeline. Debts should certainly not be priced in Bitcoin now during the early stages! But the good news is no one is suggesting that. However later in Bitcoin’s adoption, once value has slowly stabilized, debts will be easy to price and their real value will remain stable as the asset itself will have matured into a reliable unit of account.

Concern 3: Stagnant growth from decreased investment or spending

Finally, critics worry that Bitcoin will create a stagnant economy as people hoard appreciating money rather than invest in businesses. This is another case of confusing Bitcoin’s evolutionary trajectory. As mentioned above, once Bitcoin’s price discovery phase comes to an end, it will slowly stabilize relative to other assets. At that point, it will function as a global value constant for communicating prices and making investment decisions. At these later stages investors would certainly still be motivated to invest bitcoin for bitcoin returns while simply HODLing would be akin to a low risk-free rate.

This shift will actually promote better investments! Due to inflation, high net worth individuals and financial institutions are forced to harbor their money into speculative ventures just to protect themselves from inflation’s decay. With bitcoin functioning as a storage vehicle that cannot be diluted, the manic hunt for a “risk-free” safety from inflation will be a thing of the past, leading to more accurate and measured investment decisions.

But what about spending when prices are decreasing? Will people spend less and slow growth? Let’s look at the research. Even the Federal Reserve concluded:

“what is striking is that nearly 90% of the episodes with [deflationary prices] did not have depression. In a broad historical context, beyond the Great Depression, the notion that [deflationary prices] and depression are linked virtually disappears.”

This makes intuitive sense as well. Decreasing prices do not mean people are suddenly going to stop spending! People still have needs and will spend their money to meet those needs. This holds for non-essential goods as well. The technology industry has experienced a profound deflationary trend in prices for decades, but consumers keep lining up for new releases.

In fact, we should expect people to spend more as prices drop due to the wealth effect of feeling their purchasing power increase — consumers love seeing prices go down. There’s a reason everything in Target is perpetually “on sale”.

Part Three: How Bitcoin Prevents Systemic Deflation.

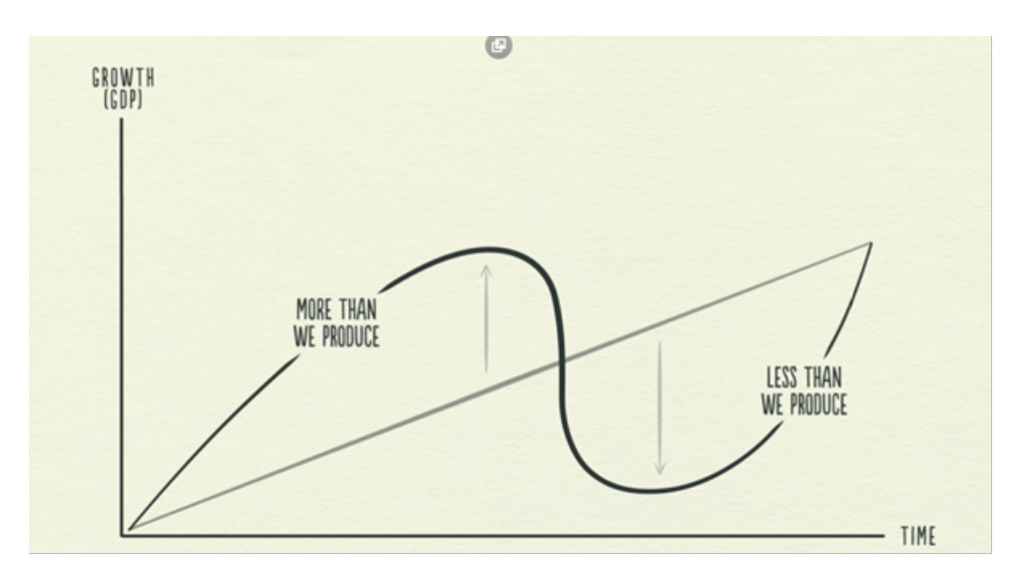

The “deflationary spirals” that keep mainstream economists awake at night will be much less common and severe under a Bitcoin standard. Again, money is the measuring system that market participants use to convey prices. When a money can be manipulated through central banks printing money out of thin air, altering reserve ratio requirements, and raising and lowering interest rates, this measurement system is distorted.

By creating a series of artificial market signals and manipulating the price of credit, inflationary monetary supply leads to over-leveraged and mismanaged investment. Risk is mispriced. People can consume more than they produce and market excess (a la WeWork) can continue for longer than would have happened absent intervention.

The black line represents debt, the gray line represents productivity.

Taken from Ray Dalio’s “How the Economic Machine Works”. Watch it!

Unfortunately what goes up must come down. Artificially stimulating an economy leads to poor investments and a bubble that must eventually burst with more painful and pronounced swings.

Some notable examples:

● The roaring 20’s, sparked by central banks creating artificially low interest rates and an immense foreign bond binge. This intervention prompted unsustainable credit creation which eventually culminated in the great depression.

● Japan witnessed this in the early 1990’s where years of expansive monetary policy primed a massive uptick in asset prices before their markets eventually cratered. Equities fell over 63% in a few short years and many real estate markets were cut in half. Continued intervention has led to decades of slow growth and zombification of many firms.

● The Great Financial Crisis of 2008 also was a deflationary crisis where a massive liquidity crunch completely froze credit markets and pricing mechanisms. This was exacerbated by easy money policy and artificially low interest rates, along with highly leveraged eurodollar deposits breaking down.

The truly terrifying deflation, bubbles of overconfidence suddenly bursting in the markets, is made much worse when currency can be manipulated at will by large financial institutions. The short term interests of elected officials causes central banks and politicians to routinely engage in expansive monetary supply for temporary gains, despite disastrous long term consequences.

As Ray Dalio noted in his book of case studies on big debt crises,

“ In many cases, monetary policy helps inflate the bubble rather than constrain it. This is especially true when inflation and growth are both good and investment returns are great. . . . In such cases, central banks, focusing on inflation and growth, are often reluctant to adequately tighten money. This is what happened in Japan in the late 1980s, and in much of the world in the late 1920s and mid-2000s.”

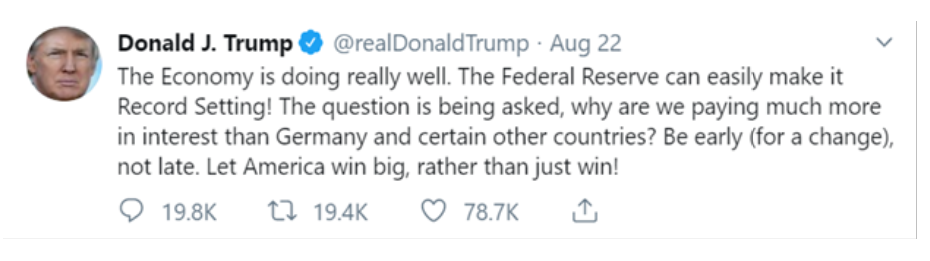

Don’t believe me?

To make matters worse, inflationary money supplies also make recovery harder after the fall. Despite engineering the collapses, authorities often then immediately intervene to bail out firms. Once again providing short term aid and devastating long term prospects. As a result, zombie firms with chronic mismanagement linger in the economy for decades.

Will Bitcoin end these credit cycles? Not entirely. But a steadfast monetary foundation would prevent authorities from artificially large credit bubbles and the horrible deflationary consequences they bring. Instead of violent swings, Bitcoin will smooth out credit cycles to their natural rates and form an economic backbone for consumption in line with productivity.

Conclusion

Bitcoin’s supply is not deflationary. It’s monetary supply is programmed to be one thing — constant. As the world coalesces around a Bitcoin standard, our new monetary base will facilitate economic signaling in profound ways, bringing sustainable healthy growth like never before. As a side effect, prices will naturally fall as humans are more productive while avoiding the truly horrifying deflationary spirals caused by artificial monetary injections.

Footnotes:

1. This phenomena of those closest to money creation reaping unfair benefits is known as the Cantillion Effect. An introductory article can be found here: https://fee.org/articles/the-cantillon-effect-because-of-inflation-we-re-financing-the-financiers/

2. You can read more about this data and its implications here: https://www.pewresearch.org/fact-tank/2019/06/17/worlds-population-is-projected-to-nearly-stop-growing-by-the-end-of-the-century/

3. McCusker, John J. “How Much Is That in Real Money?: A Historical Price Index for Use as a Deflator of Money Values in the Economy of the United States.” Proceedings of the American Antiquarian Society, Volume 101, Part 2, October 1991, pp. 297–373.

4. Douty, H. M. “Nineteenth Century Wage Trends.” BLS Staff Paper #2, Jan. 1970, p. 25.

5. Atkeson, Andrew, and Patrick Kehoe. “Deflation and Depression: Is There and Empirical Link?” Federal Reserve Bank of Minneapolis Research Department Staff Report 331, 2004, doi:10.3386/w10268.

6. Dalio, Ray. Principles for Navigating Big Debt Crises. Bridgewater, 2018.

7. Caballero, et al., Zombie Lending and Depressed Restructuring in Japan.American Economic Review, Vol. 98, №5, 2008.